|

|

Home | Switchboard | Unix Administration | Red Hat | TCP/IP Networks | Neoliberalism | Toxic Managers |

| (slightly skeptical) Educational society promoting "Back to basics" movement against IT overcomplexity and bastardization of classic Unix | |||||||

| Jan | Feb | Mar | Apr | May | June | July | Aug | Sep | Oct | Nov | Dec |

|

|

Amazing recovery. S&P 500 hit 1250. Many 401K suckers now think that they can get their money back if they wait until it hit 1400. May be that's true. What they don't understand is that they are in a big and hungry crowd of retiring baby boomers...

|

|

"And once there was no more Soviet Union, those that run the US no longer had to pretend that they were on the side of the common man, that they offered a better alternative than communism."

Maynard Handley:

"The risk--very real in previous decades--that expansionary monetary policy would destabilize expectations and erode confidence in the Federal Reserve's commitment to effective price stability is simply not an issue today. "

Oh Brad, you with your costs and economic language and nonsense about it being five times more worthwhile to fight unemployment today. Why not admit what is REALLY going on? What happened in 1989? Well yes, there was the Exxon Valdez, And Seinfeld premiered. But there was something else that also happened, in Eastern Europe and Russia...

And once there was no more Soviet Union, those that run the US no longer had to pretend that they were on the side of the common man, that they offered a better alternative than communism. A fifteen year run of US unemployment from, say, 1970 to 1985. might have had unfortunate effects on the attempt to convince the world of how great the US was. But with the Soviets gone, the plutocracy can reveal its true colors --- and those true colors are: who gives a damn how long unemployment lasts, and how bad it is? Doesn't affect my life in my penthouse --- and what are those whiners going to do anyway? Shout in the streets, write blogs, complain to their friends? Like I care.

See-Saw Economy or a Series of Shocks? by CalculatedRisk on 10/14/2011 01:25:00 PM

Kelly Evans at the WSJ makes an interesting observation: Economy in Full Swing (Watch Your Head)

So far, incoming September economic reports have been surprisingly firm. Auto sales rebounded to their highest level since April. Chain-store sales posted year-on-year growth of 5.5%. The economy added 103,000 jobs, and manufacturing sentiment improved a bit. [Retail sales increased 1.1% in September] ... If this feels like a 180-degree turn from August, that's because it basically is. It would be one thing if this were a special case, or a broad turning point in the economy. But, in fact, this kind of volatility, these jerky swings in growth, have become the norm. Consider what has happened so far this year: Real gross domestic product shrank in January and February, according to tracking firm Macroeconomic Advisers. Then it surged by more than 1% in March. It contracted again in May and June—only to jump by more than 1% again in July.

This isn't typical. Since 1992, monthly GDP has fallen about a third of the time when the economy hasn't been in recession. This year, even assuming a small gain in August, monthly GDP has fallen about half the time. Monthly GDP isn't released by the Bureau of Economic Analysis (BEA). Evans is using an estimate from Macroeconomic Advisers.

Bob Dobbs:

"Yes, the economy is very sluggish - 103,000 jobs was a weak report, just better than low expectations - but I think the economic volatility is related to events and hopefully not some new normal. "

I wonder if the economy is so weak and fragile -- based on a financial system on life support -- that every shock is simply more noticeable and more injurious than it might have been otherwise. The inertial dampers are offline.

Critical Update Notificat...: Shocktoberfest !!

Outsider:

they are forcing me to

External locus of control.

Locus of control - Wikipedia, the free encyclopedia

Work on it. Or not. The choice is, of course, yours alone to make. or is it?

fy:

Auto Sales are increasing because of Sub Prime auto loans by Government Motors. It worked out so well for houses - why not cars.

Next thing you some Wall Street boy wonder will be bundling and securitizing them.

EvilHenryPaulson:

Although growth is sluggish - due to the significant slack in the system (excess capacity, lack of demand) and also high levels of household debt, I think the volatility this year can be blamed on a series of events including extreme weather (significant snow storms, flooding, hurricane Irene), the oil price increase related to the "Arab Spring", the tsunami in Japan, and the debt ceiling debate in D.C. during late July and early August.

Also the ongoing European financial crisis keeps flaring up and impacting the U.S. economy.

I disagree.

First of all, such shocks have always been there. It's that we don't have the capacity to absorb and ignore them. Even for the Arab spring, if it weren't for high commodity prices and weak exports the governments could have remained in power by cutting the price of fuel and food or boosting incomes just enough to keep the crowds below the threshold their police or military could squelch.

Second of all, given the inability to increase total effective money supply (cash + credit outstanding) as I predicted the prospect for growth becomes a zero sum game which invites very different behaviours and outcomes in the economy. Don't mistake the one-time gain of smoothing down supply chains or credit spreads for growth. The best that can hoped for is to keep total effective money supply flat, replacing corporate or household debt with government ones. There is no possible credit bubble or ponzi scheme left that is large enough, but even if there theoretically were the amount of leverage would mean increased sensitivity to these random shocks

If you disagree with me, I believe I started blabbing about this back when auto sales were over 15mn SAAR in 2008 and it could be my own selective bias, but I feel like I did accurately describe the macro economy up until now. I've been wrong about other things like the stock market, timing, and even the reappointment of Bernanke -- but not this.

Bad Dawg Bobby:

greenchutes,

" Only with years of learning about economics can the clarity and depth of this depression not seem incredibly obvious. "

That could explain the action out of the Fed and DC. I have no doubt, when it comes to economics they are smarter than I am, but maybe they are to smart to see what they are doing to the average person. If they are right, the economy will correct itself, if not hold on to your socks we are going for a ride.

Wean yourself from the bankers. Don't sweat the other stuff.

my sewer rate went up 33% in 2009 because of a faulty interest rate swap. my water rate went up to meet revenue-to-debt bond covenants.

FIRE is embedded in almost everything we use.

LoserBeachBum:

About Asia: The most dynamic is South Korea, they got their faces collectively lost in 1997 with IMF loan of over 50 billion. Since then LG and Samsung, they are very innovative companies and also hiring foreigners. Malaysia and Singapore is also good ones but the rest is still stuck in feudalism. Big boss is always right even if he is wrong Cambodia and Laos could be next "tiger" ones, Koreans are investing heavily both of them. Thailand...maybe someday. India...the same.

ResistanceIsFeudal :

greenchutes wrote:

FIRE - via zirp (enabled by nitwit acolytes like and the Gramm/Rubin axis of evil) struck a gentlemans' agreement with MiC - free money, endless war.

It seemed foolproof... so much planet left to plunder, so little time...

Pellice:

pavel.chichikov wrote:

There are people here so bitter and angry that they're willing to hurt anyone, tear anything down. They don't want to fix anything, they want to smash everything.

The economic welfare of the majority of Americans cannot be fixed without addressing the grotesquely unequal distribution of wealth. That is simply the truth. National single payer health care would help. Investing in infrastructure would help (doesn't have to be high speed rail, there are millions of bridges waiting for repair). Bringing tax codes on the wealth back into some semblance of historical norms would help. Closing corporate loopholes would help.

What won't help is telling people not to be angry.

Rickkk:

Soaring Suburban Poverty Catches Communities Unprepared

10/13/11

EDGEWATER, Colo. -- "Before the unraveling, Selena Blanco and her family felt secure in their hold on middle class life in this bedroom community just west of Denver. She and her husband both held professional jobs in industries that seemed sheltered from trouble, his in technology, hers in health care. Together they brought home $100,000 a year, enough to allay concerns about paying the bills, let alone having to ask for help.

But over the last two years, both have lost their jobs. Her unemployment check ran out in the spring, leaving them to subsist on his jobless benefits alone, about $1,500 a month.

The Blanco's shattered fortunes have supplied them an unwanted new status, one they share with millions of suburban households in a nation previously accustomed to thinking of suburbia in upwardly mobile terms: They are poor.

They are officially so according to the federal government's definition, which sets the poverty line for a family of five at an annual income of $26,023 or less. It is viscerally true when one sees how Blanco, 28, now spends her day. She takes her four-year-old son to a county-operated Headstart program, free preschool for the poor. She forages for clothes at thrift stores. She scrounges for coupons to keep her family fed."

This story has resonance for me, I remember as a child, foraging for clothes with my mother at thrift stores. I marvelled how quickly my mother's hands picked through the piles of used clothes.

All of our bedrooms were rented out to boarders, and we slept downstairs in the dinning room, till the mortgage was paid off.

October 14th, 2011 | The Big Picture

I am no conspiracy theorist, and my assumption is this has been an oversold rally. However, I love that Bill King (of M. Ramsey King Securities) asks the questions that others gloss over:

SPZ s rallied 13.75% from the pre-NYSE open low on October 4 to October 12 high. Normal markets do not rally almost 14% in 6 sessions. Normal buyers do not behave this way. Volume was lacking on the rally; there was little real buying. The compelling question is: Who forced SPZs higher and why?

14% in 6 sessions? That some serious shite!

Selected Comments

rd:

The market hasn’t been “normal” since 1998.

Greenspan, Bernanke, Rubin, Trichet, Paulsen, Geithner, Dodd, Frank, etc. have worked hard to de-regulate, obfuscate, and manipulate the system so that it would become prone to fraud and high-frequency booms and crashes.

The astonishing thing is that they are all scratching their heads wondering why people are losing confidence in them and the system. They can’t even dream of connecting the dots between a 14% rise in six low-volume sessions and “Occupy Wall Street” outside their windows.

Patrick Neid :

October 14th, 2011 at 3:00 pm I think China just pulled a 20% move in the same time frame.

bobbyd:

HFT algos, pushing up ETF algos, which rebalance, pushing up prices. Not much human sellers left in the markets. Mostly algos running around out there.

Same effect for down days, that lead into down spirals.

Frwip:

Equities have been behaving super-double-plus-spooky since the second week of August. Just look at SP500 on a one-year scale and it’s striking. It’s just buzzing about 1150 and spitting random signals. I could see the HFT leeches / ETF whinnies producing something like that. I’m ready to bet that correlation within SP500 is extremely high right now.

I call that a Tourette market.

bear_in_mind:

Just more evidence that the market is rigged and HFT is calling the shots. Let’s see if the algos can pierce through and hold the 300-day SMA in the INDU and SPX. Looks very possible now, but this could very well be a head-fake at the top of this trading range.

Frwip:

@tsk tsk

No one is saying that HFT are rigging the markets. At least, I’m not. The problem with HFT and algo trading in general is that they introduce a lot of noise. Normally HFTs are operating on extremely short periods and, in theory, they have no net effect day-to-day. Their noise is filtered out, dampened by the overall market.

But I’m wondering if we haven’t reached the point where algos are simply talking to each other. It could look like what we’re seeing : algos generating high frequency noise with essentially no damping, feeding back in each other and the whole system starts to resonate at much lower frequency though non-linear coupling. Here, I would guess that the coupling term is humans tweaking the models on a scale of a few days.

If you ever played with self-resonating VCFs on a old style modular synthesizer, you’ll grok right away what I’m talking about.

Mr. Wonderful:

The world isn´t ending by a long shot.

There is no planet x and no elusive meteorites will threaten us in the foreseeable future. No flesh eating alines hungry for gold to save their atmosphere will appear. All these fairy tales originate with forces that have an interest in people chasing rising prices for overabundant stuff. These forces run a hoard and sell business. Look it up. Warehousing? It isn´t just about overabundant physical stuff but also more or less less worthless shares of major stock watering scams. There is a reason that these scams are still down 60-80% from their 2000 highs. IMO about a third of the Dow Jones Industrial Average should have a one for ten reverse split to write off worthless stock.

Ted Kavadas:

I agree that the stock market isn’t acting in a “normal” fashion; the volatility, both up and down, as well as intraday and interday, has been large.

I have created a chart that illustrates this volatility and comments on it; it can be found at a post at my blog here:

http://economicgreenfield.blogspot.com/2011/10/chart-of-recent-s-price-volatility_13.html

AlexM:

Regardless of who or what was doing the buying, or on what volume, the negativity was so thick on every blog, twitter feed, and media outlet that there and everyone thought we were repeating 2008 that the market rallied.

We were seriously oversold and now everyone is surprised by the rally or blaming HFT fraud?

So many internal measures were pointing to a rally that it is really not that surprising. What is surprising is the speed of the rally.

In the end we have not broken out of this to month bear flag so until that happens we could just be consolidating these August losses.

dead hobo:

BR wondered:

I am no conspiracy theorist, and my assumption is this has been an oversold rally.

reply: ———- Yup, you got it. A bunch of grizzled and young Turk traders sat around their individual walls of LCD screens and spent the past week or so trying to outsmart each other, resulting in a group exasperation that is known as an oversold rally. Just like the advanced investment texts say, circa 1980. Golly, the big money sure works in mysterious ways. Any other explanation is just paranoia or stupid ideas from people who don’t understand anything except junk investing and simpletonism. Really. You nailed it. BullsEye!!!

Petey Wheatstraw:

Ted Kavadas:

Visited your site and agree with your conclusion (caution). What’s causing it? Don’t know, but I also don’t think the instability is a good sign, and that the system has changed, fundamentally, in a way that only those running the scam can fully understand (I suspect we’ll someday learn that we’ve ben robbed — again).

I also agree with rd’s observation that the link between such market behavior and OWS is lost on TPTB (I’d also include Saint Ronnie and his push for deregulation, generally and as a long-term goal, in the list of those responsible).

nofoulsontheplayground:

My eyes are on the .618 re-trace of the move from the 2011 highs to the recent 1074 SPX lows. That’s at about 1257 SPX.

The Big Picture

Outlier

The bulk of those billionaires did the bulk of their billion building in eras of higher taxes and lower executive compensation. People have nothing against billionaires when the set up seems fair and it’s clear they worked hard to get there. Case to point Steve Jobs.

It’s really the wannabees that cause the problems, the millionaires trying to squeeze their way up the ladder and who need to cheat by dodging tax codes, hiring armies of lobbyists to change the rules and rigging corporate boards to turn corporations from job creating machines to dollar squeezing machines.

Very few people hate the ones who look like they play it square. They hate the ones that look like they juking the system, exporting US jobs and placing short term profits over long term economic stability.

MikeNYC Says:

Seriously? You can’t imagine the world without CABLEVISION???!!! Millions of us are dreaming of the day, and not just Knicks fans.

Some of the shining stars you name are responsible for a litany abuses and rank among the near-monopolists who have treated their employees and customers like utter shit in the pursuit of CEO bonus-inducing short term cost-cutting. Or nose-cutting, as it sometimes turns out.

Remember when Home Depot fired all their full time professional store employees and replaced them with know-nothing temps, while the CEO scored a huge bonus? Remember how HD went from a decent place to shop to abysmal, directly as a result?

Remember how Wal-mart employed battalions of people advising on how to move production overseas to save a few cents per trinket? I said advising, but if you wanted to get on the Wal-mart shelves it was more like “forcing.” You can bet plenty to the protesters know exactly how that worked, and faced or had parents who faced the fallout of the wholesale shipment of jobs out of the US. They know who greased the skids for that and who benefited. And it’s not simply a case of labor-arbitrage, as the right wants us to believe.

The real faces behind these billionaires are the millions of customers and employees who have been collectively treated abhorrently, while providing those often undeserving and seemingly ungrateful few with the means to become ridiculously wealthy.

“I don’t want to get political in this note”

Your passive-aggressive disingenuousness is quite remarkable.

Big swings, both up and down, such as seen this summer and fall often indicate the stock market isn't healthy and more trouble is in store.

Why so? Lehman Brothers’ failure has brought home to emerging market central banks that economic and financial links between nations have become far stronger in recent decades. The idea held by many before 2008 that their economies could “de-couple” in the event of a severe slowdown in the advanced economies is no longer credible. Here’s one of the main conclusions of the meeting:

Financial globalisation has multiplied the number of transmission channels and associated risks through which external factors influence domestic economic and financial conditions in emerging market economies. This complicates the assessment of the outlook for inflation and growth. It also introduces an additional dimension – the evaluation of financial stability risks – to the objectives of central banks. Monetary policy in emerging market economies has become much more complex as a result.

If that is the case, then emerging central banks will pay less attention to domestic price pressures, and attach more weight to what is happening in global financial markets, than in the past.

Are "Wall Street’s Masters of the Universe" feeling some heat?:Economist's View

Panic of the Plutocrats, by Paul Krugman, Commentary, NY Times: It remains to be seen whether the Occupy Wall Street protests will change America’s direction. Yet the protests have already elicited a remarkably hysterical reaction from Wall Street, the super-rich in general, and politicians and pundits who reliably serve the interests of the wealthiest hundredth of a percent. ...

Consider first how Republican politicians have portrayed the modest-sized if growing demonstrations... Eric Cantor, the House majority leader, has denounced “mobs” and “the pitting of Americans against Americans.” The G.O.P. presidential candidates have weighed in, with Mitt Romney accusing the protesters of waging “class warfare,” while Herman Cain calls them “anti-American.” ... And if you were listening to talking heads on CNBC, you learned that the protesters “let their freak flags fly,” and are “aligned with Lenin.”The way to understand all of this is to realize that it’s part of a broader syndrome, in which wealthy Americans who benefit hugely from a system rigged in their favor react with hysteria to anyone who points out just how rigged the system is.Last year, you may recall, a number of financial-industry barons went wild over very mild criticism from President Obama. ... And then there’s the campaign of character assassination against Elizabeth Warren, the financial reformer now running for the Senate in Massachusetts. ...What’s going on here? The answer, surely, is that Wall Street’s Masters of the Universe realize, deep down, how morally indefensible their position is. They’re not John Galt; they’re not even Steve Jobs. They’re people who got rich by peddling complex financial schemes that, far from delivering clear benefits to the American people, helped push us into a crisis whose aftereffects continue to blight the lives of tens of millions of their fellow citizens.Yet they have paid no price. Their institutions were bailed out by taxpayers, with few strings attached. They continue to benefit from explicit and implicit federal guarantees — basically, they’re still in a game of heads they win, tails taxpayers lose. And they benefit from tax loopholes that in many cases have people with multimillion-dollar incomes paying lower rates than middle-class families.This special treatment can’t bear close scrutiny — and therefore, as they see it, there must be no close scrutiny. Anyone who points out the obvious, no matter how calmly and moderately, must be demonized and driven from the stage. ...So who’s really being un-American here? Not the protesters, who are simply trying to get their voices heard. No, the real extremists here are America’s oligarchs, who want to suppress any criticism of the sources of their wealth.Richard H. Serlin"They’re not John Galt; they’re not even Steve Jobs. They’re people who got rich by peddling complex financial schemes that, far from delivering clear benefits to the American people, helped push us into a crisis whose aftereffects continue to blight the lives of tens of millions of their fellow citizens."mmckinlA key thing to realize is that making money on Wall Street is very different from making money producing things.

If you make money growing strawberries, and then you sell them to a consumer, that's a pretty Pareto optimal transaction: The consumer gives you money in exchange for strawberries. The consumer gets more personal value from the strawberries than from the money or else he wouldn't make the exchange. The strawberry producer gets more personal value from the money than from the strawberries or else he wouldn't make the exchange. And with strawberries you can safely assume that both parties are pretty accurate in their calculations of value, as there's not that much asymmetric information about strawberries.

But with financial transactions there is often tremendous asymmetric information. A layperson sells his stock in March of 2009 wrongly thinking it will only plunge further. A very expert finance person buys it knowing it's substantially underpriced given its expected earnings. This was not a Pareto optimal transaction at all. The layperson seller did not sell because the stock was worth less to him than the money. He only sold because he very mistakenly thought it was, and the savvy finance expert took advantage of his ignorance. Now, there was an external effect that was good for society in that that pushed the price closer to an accurate efficient one, helping allocate capital better. But in many cases any external effect is a lot less than the gain to the finance expert, and in the case of some financial transactions the external effect is actually a negative one, a huge negative one.

The bottom line is that finance billionaires don't always create more wealth than they earn, sometimes far from it. Asymmetric information is huge here and so are externalities, often huge negative ones, not just positive.

Disclosure: I've myself made a lot of money buying stocks when they're undervalued. There's a positive value here in pushing prices in an efficient direction, but maybe a lot less than what I've made. My solution is that I plan to eventually give this money to charity. Another is steeper taxes on financial speculation, at least of certain types whose positive externalities are not large, or especially where the externalities are negative.

"But with financial transactions there is often tremendous asymmetric information."Edward LambertAnd, an asymmetric playing field. Computer trading now accounts for 70% of all trading.

The average investor portfolio is being "whipped sawed" day after day.

For those of you who think that inequality of wealth is not affecting the economy and therefore isn't an urgent issue for healing the sick economy, I would think that you are rethinking your views...Richard H. SerlinI should add that in that March 2009 example, if you hadn't of bought, the price might have gone even lower and the layperson might have sold at an even lower price. There's a lot to it, and financial transactions have to be looked at case by case. But the key point is that there's a huge amount of asymmetric information and externalities here which makes the finance market very different from the average market, and this is a reason why good financial regulation can tremendously increase total societal utils.William of OckhamBrother Krugman's message is quite clear, understandable and to the point. However, it can be viewed another way;IrishRedDaddy Warbucks and friends have all of the apples in the bushel except for three and the rest of us have to divide those three amongst ourselves.

With so many apples, Daddy Warbucks can afford to give a few apples here and there to buy influence, change law and control the government in a way that greatly benefits himself and his friends and not the rest of us.

Daddy Warbucks doesn't like it when those of the 'three apples' make noise about fair distribution. Those to whom he has given apples, rush to support Daddy Warbucks' views even though they know how morally and ethically bankrupt they are.

Please review the Seven Deadly Sins and the compare and contrast them with the Seven Heavenly Virtues. Your assignment is to pick the political party that best alligns itself with Heavenly Virtues and vote accordingly.

Amen

I suspect the Occupiers' refusal to identify themselves with any established party or organization is based on their assumption that there is NO "political party that aligns itself with Heavenly Virtues."rjsGiven that nothing has changed for us in the 99% despite elections in 2006, 2008 and 2010 that overturned ruling party majorities, I firmly believe they're correct.

GOP Rep Peter King: "We Can’t Allow More Coverage Of Occupy Wall Street, Or They Will Win" - Home - The Daily Bail: Video - Congressman Peter King (R-NY) with Laura Ingraham - Oct. 7, 2011Ignacio

Runs 1 minute. The establishment protectors of corporate America and the Wall Street Kleptocracy are growing scared.“It’s really important for us not to give any legitimacy to these people in the streets,” said King on Laura Ingraham’s radio show Friday evening. “I remember what happened in the 1960s when the left-wing took to the streets and somehow the media glorified them and it ended up shaping policy. We can’t allow that to happen.”

http://dailybail.com/home/gop-rep-peter-king-we-cant-allow-more-coverage-of-occupy-wal.html

From what I read, I realize that this "occupy W St." movement is similar to the so called "indignados" ("the angry") that took place in Spain with special strength during the municipal elections. The most important difference is that while in New York, the movements focuses rightly against the W.St financial lobby, in Spain, the movement identified, also correctly, municipal corruption as their main objective.LafayetteI don't know If Wall Street Masters of the Universe are really feeling some heat. I don't think so. They have sent their wolves to cry against the movement in TV and they have the money to do so for a long time. W. St. protesters need to build an potent internet tool to thwart the new campaign and to establish themselves as a permanent protest until there comes, some day, when they are prepared to transform their protests and ideas in a political move.

CARPE DIEM!The moment is ripe for this grassroots movement to coalesce around a Progressive Agenda that will serve as a litmus-test for candidates in next year's elections.

Without that agenda, the movement will lose focus and dissipate. We will not elect a Progressive Congress. We will not implement Reformational Change so necessary to the future well-being of Americans today or their children tomorrow.

Towards producing such an agenda - which is clear, focused and limited to key objectives - I submit this version for consideration and debate here: https://docs.google.com/viewer?a=v&pid=explorer&chrome=true&srcid=0BxDaVjkRehhSMWZiMjFiMDAtMTcyNC00MDEyLWE2NGItMjE1MGE4ZWE3ZjQ3

October 9, 2011 | naked capitalism

Mark P.:

" … a policy of devaluation of the US dollar may trigger trade and currency wars."

"May trigger currency wars?" It WILL trigger more currency wars, which in fact have already begun. And it’s not just the U.S.

We are witnessing a global, massively n-player Prisoner’s Dilemma, where each of the players, by rationally making those choices that maximize their own chance of surviving and retaining their assets, inevitably acts to produce outcomes that are ultimately worse — in almost every case — for themselves and for everybody else than if they had cooperated and taken their losses at the beginning.

This inevitability of things is the most essential feature of the catastrophe.

In the case of Greece, whether or not it’s true that the Europeans and whomever else have learned nothing from Lehmann in 2008 is secondary. (Though it certainly seems that European policymakers and big institutions are sleepwalking towards the abyss.)

The central point is that everybody — the German pols and people, the Greeks, the French and German banks, Morgan Chase and the other U.S. TBTFs which hold 85 percent of each others’ counterparty risk, and every other player — is rationally attempting to take the best course of action for themselves in the circumstances.

And thereby down and down we go.

psychohistorian:

You expect THESE pilots to land THIS plane under CURRENT conditions. Just a magic printing party and all will be well. Just a bit more FAITH and prosperity is just around the corner……..BALDERDASH!!!

Bend over and prepare for a crash.

Damian:

i dont think the planned end game is war or starvation but neglect via reduction in SS and medicare which will kill millions prematurely and then they will introduce your last event — disease- they will set up a virus – which has limited availability vaccine for the 1% plus protection and utilities workers

the balance of the population will be at risk: they want 160 million eliminated – they have no use

R Foreman:

Is this where we guess what’s going to happen in the next 12 months ? Here’s my guess. The OccupyWallStreet crowd is willfully ignored, and things continue getting worse for the unfortunate 99%, until such time as the enablers, the gatekeeper police and military authorities figure out that to save the entire structure they have to do the unthinkable, they have to turn on their masters.

Then we get lots of targeted killings, which may actually escalate into complete anarchy, or it may culminate with control being reestablished just in time for the shooting war to start. After that, well, there really is no place to hide in a war like that. You either die in the fighting, or by starvation and disease. Everybody have a nice day, especially you 1% whose greed caused all this, and you know who you are.

LucyLulu:

Das says that US debt can not and will not be repaid, at 93% of GDP, as is often heard in mainstream political discourse. However, at the end of WWII the public debt was 160% of GDP yet it was mostly paid down before it started climbing again. How can it be possible to pay down higher debts in one era and impossible in another? The limiting factor, as I see it, is lack of economic production (and excessive military spending), not the amount of current debt the government holds. The growth in production is affected by lack of demand which, in turn, is being affected by the levels of household debt which significantly exceed the level of public debt.

Also, the $5T increase in federal debt after the GFC has been matched by a close to similar reduction in state and local government debts in the U.S.

Diego Méndez:

Does the US really control its currency?

As I see it, the US is in a eurozone-like construct with China, in which the US is Southern Europe and China is Germany.

If the Chinese government decided to sell their T-bills, interest rates would soar and the US would have a full-fledged currency and sovereign debt crisis, with its own banks betting on US bankruptcy.

Both the level of the US dollar and the sustainability of its sovereign debt are controlled in Beijing.

Mmtfan:

The key difference is the the US controls its own central bank so it could launch another round of QE to absorb any Chinese selling. The PIIGS don’t control the ECB.

Diego Méndez:

Mmtfan,

your name explains a lot. If China so wants, it can create global inflation and then sell T-bills and buy US corporate assets instead.

The Fed would not be able to finance US sovereign debt via the printing press, since that would make a hyperinflation problem out of an imported inflation problem. So US interest rates would soar.

The US would not be able to finance its deficit nor cut it without sending the country into a depression and political upheaval.

Devaluation is not an option, since the US has no capital controls and, in this example, China would not sell dollars, only T-bills. Moreover, devaluation would be dangerous in an already inflating environment.

In this context, the US would be exactly in the same position as Southern Europe is today.

jake chase:

This post is errant nonsense. The idea of growth as a solution has always been bogus. Growth of what? Does growth in drug traffic, prostitution, war, child pornography help? It does to economists. For thirty years we have lived the fiction that corporate growth equals prosperity. That is bunk.

Government must begin cutting down the superrich to life size. There is plenty of money there, it is just held by 1/10% of the population.

Corporate wealth may be accessed by franchise taxes based upon total assets. Corporate income taxes produce nothing but evasion. We need a tax holiday for the non rich. Let the rich pay for the government they have bought. All these problems can be solved, but not by the strategies which have created the problems. Das should stick to writing about trading fiascos. His devotion to free market mumbo jumbo disqualifies him as a serious commentator on the world economic situation.

Psychoanalystus:

Brilliant. Thank you, Yves!

Satyajit Das also appeared on Max Keiser last week. Here’s the link to the clip (if begins in the second half of the show):

http://rt.com/programs/keiser-report/episode-193-max-keiser/

As for me, at the moment I am hunkered down at the Ground Zero of the GFM (Global Financial Meltdown) — you guessed it, that would be Greece… Life is really tough down here these days. The frappes and the souvlakis are no longer of the quality I had gotten used to in past years, and everybody is stressed out and out to rip you off.

So I guess it’s time for this old boy to kiss this third world nation good bye (yes, that’s Greece again), and move on to greener pastures… once I figure out where those greener pastures might be…

Crazy Horse:

Beard writes: “It is impossible to borrow real goods and services from the future”

Really? I would categorize oil as the most real source of the most vital service (concentrated energy) necessary for the continuation of industrial civilization. What do you consider pumping Texas dry in a mere half century if it isn’t borrowing from the future?

“If the money had not run out would not the boom still be going?” Tautological questions like this have no meaning, and only serve to obfuscate the way systems operate.

- In a fractional reserve banking system money can only be created as debt and loaned into existence. No amount of “printing” increases the amount of money in circulation if its velocity is zero (i.e. no new loans are made).

- If Helicopter Ben were true to his nickname and flew over the City dropping Federal Reserve Notes it would increase the amount of money in existence, but then we would have a Potlatch system rather than a fractional reserve banking system.

- Loans are only issued in the expectation of earning a return in the form of interest.

- If debt grows at a rate faster than the rate of growth in ability of borrowers to pay both the loan amount and its associated interest, it eventually reaches a point where it cannot be repaid and becomes valueless.

- Because of the necessity to cover interest costs, a debt-based money system depends upon continued exponential growth of debt, growth in the exploitation of natural capital, and growth of consumption (demand).

- Permanent exponential growth (of anything) is a mathematical impossibility in a finite world.

The US tried to sustain exponential growth of debt to mask stagnant real wages and massive redistribution of wealth, and it only took 30 years for Peak Debt to push the housing market over the cliff and render the banking system fundamentally insolvent.

“Money” will always run out because it is the product of debt, and debt is not cost free or infinite as you seem to believe. “Printing” money simply lowers the total debt burden of the borrower and thus the effective interest rate. If expected return on capital falls below zero because of inflation or fear of default, no new loans are initiated, and that money heads for the nearest financial casino in search of speculative yield.

Is it possible to structure a financial system that allows a sustainable economy to function? Perhaps, but there are no examples beyond hunter-gatherer societies that I am aware of.

Econbrowser

I emphasize that a U.S. recession is certainly possible, given that a Eurozone recession looks very likely. It is entirely conceivable that European policymakers will fail to gather the necessary resources in time to prevent financial-market contagion to peripheral countries, such as Italy and Spain, or to recapitalize their banks sufficiently quickly in the face of or, better yet, in advance of a Greek default. Such a financial shock, if it occurs, could be transmitted to the United States with sufficient severity to lead to recession here. This would be a new negative shock, however, and does not appear to be built into current early-warning financial indicators in the United States to a sufficient degree to make a U.S. recession the base case at this time. My current reading of the financial market indicators of the U.S. business cycle is that investors are more concerned about Japan-style economic stagnation right now than about a traditional recession.

Economist's View

Tim Duy:Don't Let Monetary Policy Off The Hook, by Tim Duy: Re-reading Federal Reserve Chairman Ben Bernanke’s latest testimony to Congress left me increasingly puzzled by his conclusion:

Monetary policy can be a powerful tool, but it is not a panacea for the problems currently faced by the U.S. economy. Fostering healthy growth and job creation is a shared responsibility of all economic policymakers, in close cooperation with the private sector. Fiscal policy is of critical importance, as I have noted today, but a wide range of other policies--pertaining to labor markets, housing, trade, taxation, and regulation, for example--also have important roles to play. For our part, we at the Federal Reserve will continue to work to help create an environment that provides the greatest possible economic opportunity for all Americans.

This is a clear effort to shift the focus away from monetary policy onto the fiscal side of the equation. But I think there is a significant flaw in that position. Fiscal policymakers will be completely unable to address medium- or long-term budget issues as long as there exists a sizable output gap and high levels of unemployment. Persistently low levels of output will necessitate deficit spending, and low interest rates will justify that spending. That is the lesson of Japan. Nor will the economy naturally gravitate toward such any other outcome – we are stuck in a liquidity trap. That is also the lesson of Japan.

Assuming the proximate cause of the current US economic environment is indeed a liquidity trap, then a solution to that problem lays solely in the hands of monetary policymakers. In short, the primary economic challenge is to lift the US from the zero bound floor; until that happens fiscal policy will limp along like that of Japan, with ever-growing debt that does little than serve as a partial stopgap. The deficit spending becomes a long-run outcome rather than a short-run solution.

Simply put, the Federal Reserve needs to take responsibility for ending the liquidity trap. Instead, as Scott Sumner summarizes:

The Fed has plenty of credibility, that’s not the problem. The problem is that they are using the credibility to assure investors that low inflation is here to stay. With the right target, there would probably be no need for massive quantitative easing, or other extraordinary policies.

First and foremost, low inflation is the primary objective of Fed policy. They have repeatedly set expectations that the increase in the balance sheet is only temporary, and will be reversed as soon as possible. On not one but two occasions this cycle they prematurely shifted gears to setting expectations for tighter policy, which is effectively the same thing as engaging in tighter policy. They have offered a half-hearted attempt to remedy this situation by announcing a commitment to low rates, but have made it remarkably clear it is not a real commitment. From the Fed minutes:

Most members, however, agreed that stating a conditional expectation for the level of the federal funds rate through mid-2013 provided useful guidance to the public, with some noting that such an indication did not remove the Committee's flexibility to adjust the policy rate earlier or later if economic conditions do not evolve as the Committee currently expects.

Fear of inflation prevents the Federal Reserve from making an unconditional commitment. And therein lies the stumbling block to real policy change. It is virtually impossible to imagine reestablishing the pre-recession nominal GDP trend, and entirely impossible to regain the pre-recession price trend, without accepting a temporary acceleration of inflation along the way.

More succinctly, we will not lift the economy off the zero-bound without accepting higher than 2% inflation. Since the Federal Reserve has made it clear they will not accept inflation greater than 2%, the economy will not clear the zero-bound. And if the economy does not clear the zero-bound, we will be faced with perpetual and unavoidable deficit spending.

Deficit spending is not accommodated by the Federal Reserve via low interest rates; it is made necessary because the Federal Reserve sees no urgency ending the lower bound challenge. Which means it is ridiculous to believe that the Fed can dump off this problem on fiscal policymakers. How can the state of monetary policy have deteriorated so much that now even Bernanke claims “regulation” is holding back the economy? Yet here we are.

Where should the Fed go from here? First and foremost, they need to make a commitment to pull away from the zero-bound. As Sumner suggests, they need this commitment clearly defined by a target such as reestablishing nominal GDP or price level. The need to implement open-ended action to achieve this target. My suggestion is to announce they will make permanent additions to their balance sheet by purchasing on the secondary market $5 billion of US Treasury securities every week until the target is reached. I think they need to make permanent additions to be credible – they have clearly expressed that previous balance sheet expansions should be viewed only as temporary.

Won’t this amount to monetization of deficit spending? Yes, but if Sumner is correct, less than might be feared, as the commitment is more important than the size of the purchases. And I already arrived at the conclusion, aided by Bernanke’s 2003 speech, that the situation requires a greater coordination of monetary and fiscal policy. Moreover, even if sizable purchases are required, there is no reason this needs to be a problem. As Bernanke has already explained, the Fed simply needs to make clear its target and once that target has been reached, they will adjust policy appropriately to maintain the nominal GDP or price level trend. In other words, purchases will be suspended and policy will by that point revert to traditional interest rate management, with the possible reduction of the portion of the balance-sheet expansion that to-date has been viewed as temporary.

Once the Fed achieves normal monetary conditions, the ball will be back in the hands of fiscal policymakers, who may then soon understand that policy is a lot different when interest rates create real constraints on spending and taxes. But that is a battle for another day.

Bottom Line: It is ludicrous for the Fed to declare the primary economic responsibility is now on fiscal policy. As long as we are in a liquidity trap, fiscal policy is stuck in a never-ending cycle of deficit spending. Absent that spending, the economy will simply slip backwards into recession again and again. The exit from the liquidity trap can only come from the monetary side of the equation. Try as he might Federal Reserve Chairman Ben Bernanke cannot escape his policy responsibilities. And we shouldn’t let him.

FT Alphaville

Posted by Joseph Cotterill on Oct 05 12:34.

This looks a bit like how 2012 will turn out, doesn’t it?European countries are at present locked into a severe recession. As things stand, particularly as the economies of the USA and Japan are also faltering, it is very unclear when any significant recovery will take place. The political implications of this are becoming frightening. Yet the interdependence of the European economies is already so great that no individual country, with the theoretical exception of Germany, feels able to pursue expansionary policies on its own, because any country that did try to expand on its own would soon encounter a balance-of-payments constraint. The present situation is screaming aloud for co-ordinated reflation, but there exist neither the institutions nor an agreed framework of thought which will bring about this obviously desirable result. It should be frankly recognised that if the depression really were to take a serious turn for the worse – for instance, if the unemployment rate went back permanently to the 20-25 per cent characteristic of the Thirties – individual countries would sooner or later exercise their sovereign right to declare the entire movement towards integration a disaster and resort to exchange controls and protection – a siege economy if you will. This would amount to a re-run of the inter-war period.

If there were an economic and monetary union, in which the power to act independently had actually been abolished, ‘co-ordinated’ reflation of the kind which is so urgently needed now could only be undertaken by a federal European government. Without such an institution, EMU would prevent effective action by individual countries and put nothing in its place.

It was written in 1992.

From an essay penned at the birth of European Monetary Union, by the late Wynne Godley in the London Review of Books. They’ve now released it from the pay-walled archives. Worth a read. Godley was wrong about how 1992 would turn out but it makes for uncomfortable reading in 2011.

But talk about reflation or nominal GDP as the things the eurozone (and in particular Italy) are crying out for today, and you get funny looks. It may not be the answer, but few now even ask the question.

naked capitalism

Just a few moments ago I posted on the fact that the US is officially in bear market territory. On Twitter, I said that “in Fall 2008, 10-year yields went to extreme lows and then the liquidity train went into overdrive. Stocks rallied, bonds fell.” I wonder if we will have a repeat now. Felix Zulauf believes so:

Once the S&P 500 falls to 1000 or below in the first half of 2012, the Fed will come in and try to support the system. Eventually the ECB [European Central Bank] will try to do the same thing in Europe. The damage in Europe will be greater, as Europe’s financial system is even weaker than the U.S.

-Zulauf: "I expect the market to go below the latest lows in September"

We should focus on the ECB this time since the crisis has now moved to Europe. My question on Twitter was “If we get on the liquidity train, what assets will central banks buy?” More specifically, what would the ECB buy? Marshall and Warren Mosler suggest that they provide a full backstop to Greece as a quid pro quo for austerity. This is not a politically feasible plan as they point out; it would work neither for those at the ECB against monetising debts nor for Greece where the economy is being crushed by the contraction that is synonymous with fiscal consolidation.

The reality, however, is that the ECB’s equity capital is €10 billion. If Greece defaults, the ECB will lose a multiple of that amount and then you run into the bankruptcy/seigniorage problem that Willem Buiter explained in a piece I highlighted over the summer:

jerry denim:As long as central banks don’t have significant foreign exchange-denominated liabilities or index-linked liabilities, it will always be possible for the central bank to ensure its solvency though monetary issuance (seigniorage).

However, the scale of the recourse to seigniorage required to safeguard central bank solvency may undermine price stability. In addition, there are limits to the amount of real resources the central bank can appropriate by increasing the issuance of nominal base money. For both these reasons, it may be desirable for the Treasury to recapitalise the central bank should the central bank suffer a major capital loss as a result of its lender of last resort and market maker of last resort activities.

At which point on the chart does Washington run out of excuses for not putting TBTF Zombie banks in receivership?

Please God let this be the crisis to finally break the grip of the TBTFs.

Foreclosure Blues :

not a chance…because the tbtf’s are the agents of the extraction machine funded by the fed…no one has enough power to root them out…

Typing Monkey :

At which point on the chart does Washington run out of excuses for not putting TBTF Zombie banks in receivership?

Please God let this be the crisis to finally break the grip of the TBTFs.

I’m all for this (in fact, I believe it’s inevitable), but I hope you realize that the general economy is going to experience a hell of a lot of problems once this happens? This is not a magic bullet by any stretch of the imagination.

avgJohn:

Yeah, it probably will be painful either way we go. And for sure, to get back on track will require patience and pain on ALL our parts, rich and poor alike.

But I liken it to pulling blood sucking ticks off a pet pup. Sure there will be some discomfort for your pet, but if you leave them on, you run the chance of the blood sucking parasites killing the poor little pup.

And when I refer to Wall Street, I am talking about blood sucking parasites, as disgusting as that might sound.

MyLessThanPrimeBeef :

They don’t teach omelette-making anymore.

Foreclosure Blues:

these “monetesation” ‘solutions’ are simply the continuation of the ongoing wealth transfer via debt control machine of the Federal Reserve. Discussions as if it is anything other is just distraction.

F. Beard:

these “monetesation” ‘solutions’ are simply the continuation of the ongoing wealth transfer via debt control machine of the Federal Reserve. Foreclosure Blues

Bingo!

If liquidity was really the problem then a short term loan of existing money would suffice. Instead, we have a systemic solvency problem caused by the government backed counterfeiting and usury cartel (as usual).

It should be obvious that a money system based on theft (immoral), usury (mathematically unsustainable) AND government privilege (fascist) cannot be a good thing.

Yearning to Learn:

it would seem that there are 2 things that will severely constrain the Fed/ECB

1) commodities and Precious Metals.

The market learned from the post-Lehman drop off. They learned that the Fed will prop up equity valuations by so called “printing” (although obviously it’s not quite the accurate word).

The big winners were those who flocked to oil, commodities and PMs.

there is no doubt that equities are affected by “liquidity” but it seems that commodities are moreso… with devastating effects. therefore it seems to me that efforts to reflate equities will instead flow into commodities again, but this time at a more rapid clip…

2) how to do this politically given what happened last time. The Fed/ECB can shovel all it wants into the banks, where it promptly dies. going into an unfillable hole, into CEO bonus payments, and into the pool where the bank can leverage/gamble.

none of it is transmitted to Main street, and thus the added liquidity lacks any velocity…

Main street noted that the banks got Golden parachutes while Main Street got a golden shower.

thus: politically it will be trickier. Do they honestly think they can say “what’s good for Wall St is good for Main St” again?

Thus, the Fed/ECB will need to come up with a way of propping up equity and the banks, WITHOUT allowing commodity price appreciation, AND HOPEFULLY transmitting the bank/equity improvement through to the average John and Joe.

it’ll be tough.

I agree, it’ll happen, but we’re going to have to see carnage in the equity markets first to scare Joe-6 into agreeing.

and calls for nationalization will be strong.

Nathanael:

It’s proven nearly impossible to ban private credit creation (there’s always some way around it), but it *would* be good if the government *discouraged* it — it would keep a handle on the bubbles.

I agree with you that fiat issued by a democratically controlled government is the only legitimate money to declare “legal tender”. Unfortunately, we don’t even seem to have democratically controlled governments. If we did, we could also have a “post office bank” type operation for conservative savers.

The private banking cartel has completely screwed up and proven dramatically that they should not be allowed to run the economy…. but they’re still in charge.

Oct 03 | alphaville.ft.com

For someone who hasn’t got much to add about the current state of the market, Bob Janjuah still manages to crank out 1,500 words in his latest piece for Nomura.

Bob firmly believes we are in a third stage of a secular bear market, More…

For someone who hasn’t got much to add about the current state of the market, Bob Janjuah still manages to crank out 1,500 words in his latest piece for Nomura.

Bob firmly believes we are in a third stage of a secular bear market, which is about to get nasty.

Basic problems

The key basic problems remain weak trend growth in the DM world, which we think will continue for another three to five years, the policy errors (in our view) of the current set of policymakers, and the existing set of inadequate ‘old world’ policy institutions.Still bearish

In or within a year from now I expect global equities to be 25% to 30% lower. My S&P500 target for the low in 2012 remains 800/900, and I think an ‘undershoot’ into the 700s is entirely possible. For the valuation-focused, assume S&P 500 EPS in 2012 of $90/$100, and P/Es in the 8 to 9 area – I see this kind of P/E as the new norm in the kind of world we are in. In this bearish outcome I would expect 10-year bund yields at 1% to 1.25%, 10 year UST yields at 1.25% to 1.5%, and 10-year gilts below 2%. The USD should do well, credit and commodities should not.

Here I have to insert an important caveat regarding Germany and bunds. My core assumption remains that in the euro zone policymakers do not attempt to fix an excess leverage and low growth problem with more leverage. This type of plan obviously appeals to Tim Geithner, but the core euro zone should be extremely concerned by the suggestion that leveraging the EFSF is a supposed “solution‟

Echoes of Albert Edwards in there. He too thinks the S&P should trade on a single digit PE and expects the yield on US treasuries to fall further.

In the short-term, Bob expects the S&P 500 to bottom in the low 1,000′s later this month, by which time he expects to see 10-year bund yields below 1.5 per cent and US Treasuries under1.75 per cent.

Beyond October 2011, on a two- to three-month basis into year-end/early 2012, I still see a possibility of a decent counter-trend risk rally. Should this materialise, the S&P500 could move from a low in October of around 1000, up to/towards 1200 by end-December 2011/January 2012. I see many possible drivers of this risk squeeze: Greece could be bailed out through to early 2012, which is when I would expect it to default and the restructuring of the euro zone to begin in earnest; Kevin expects a two- to three-month patch of „better‟ data in Q4 2011; QE2 in the UK; ECB rate cuts; positive EFSF headlines or progress; positive PSI headlines or progress. At least part of President Obama’s fiscal ‘boost’ should happen, and something is better than nothing. Additionally, should the S&P 500 hit the low 1000s (over the next month or so, as I expect) and the unemployment rate exceeds 10%, I believe the Fed will be unable to resist another dose of QE, whereby QE3 will be a rehash of QE2. Finally, I think positioning and sentiment by late October 2011 will be such that markets are ripe for a decent squeeze.

Bob reckons QE3 would be an even bigger policy mistake and won’t hold his breath waiting for a solution to the Eurozone debt crisis.

I expect the next year to be about capital and job preservation. Any counter-trend rally should be tradable but short lived – it should be viewed opportunistically. My core message is bearish. Over the past month Kevin and I have looked closely for anything that could change our view and have come up with nothing. Even the hope that EM or China can go on a multi-trillion USD investment binge to re-ignite global growth seems pretty forlorn, as China’s last fiscal and credit binge in 2008 is proving very costly to clean up. The euro zone may positively surprise us with a clear and credible plan for the region, involving major debt and economic restructuring for Greece, Portugal and Ireland, a major recapitalisation of the euro zone financial system, and the formation of a „neue-eurozone” with a hard-money ECB at the core. We can but hope. The only alternatives are immediate full fiscal union, or full on unlimited unsterilised monetisation by the ECB. Both “options” are I think extremely unlikely.

Economist's View

Sachs: Corporatocracy is Replacing Democracy

Jeff Sachs:

Paul Ryan, American Values and Corporatocracy, by Jeff Sachs: My new book, The Price of Civilization, describes why America needs a "mixed economy," one where a more effective federal government regulates business and invests alongside the business sector. In his review of my book, Congressman Paul Ryan, an avowed libertarian, describes my book as anti-American in its values. ...

Ryan ignores the extensive evidence in the book showing that Americans support the values of a mixed economy, not of Ryan's free-market libertarianism. Americans today by large majorities support public education, Medicare, Social Security, help for the indigent, stronger regulation of the banks, and higher taxation of the rich. ...

On issue after issue, Washington is presently bucking the public's values, rather than respecting them. A majority of the public wants to preserve social programs, but they are being cut anyway. A majority wants higher taxes on the rich, but they are being cut rather than raised. A majority wants to end the wars, but they continue anyway.

The reason is the following. America is losing its democracy as our politicians trade their votes for campaign contributions from the corporate lobbies. We have a corporatocracy rather than a democracy, and Ryan stands at the center of it. The Wall Street Journal, which commissioned Ryan's review of my book, is the leading print mouthpiece for the corporatocracy.

Since entering Congress in 1999, Ryan has helped to prevent effective oversight and regulation of the banking sector. ... Ryan's re-elections have been consistently funded by the insurance, banking, and homebuilding industries. Banks such as the Bank of America and Citigroup, two of the largest bailout recipients, have been high on Ryan's contribution list; so too have major lobbying groups for the financial industry, such as the American Bankers Association and the Securities Industry & Financial Market Association.

America's corporatocracy is governed by vested interests rather than moral or economic principles. After financial deregulation led to the 2008 collapse, Ryan's enthusiasm for free enterprise suddenly took a second place to his new enthusiasm to rescue the banks through a giant taxpayer-funded bailout. The "free-market" Wall Street Journal similarly defended the bank bailout, all of a sudden lecturing its readers about market failures and the limits of the free market.

As soon as the banks were saved with public money, Ryan, the Journal, and most of the political class swung back to deregulation. Ryan voted against reforms of Wall Street. He inveighed against taxing or otherwise controlling the bonuses received by the CEOs and senior managers of the bailed-out banks. When it comes to the poor, however, Ryan has a different response: slash Medicaid spending, come what may. ...

My views ... run to the very idea of America: a democracy of the people, by the people, and for the people, not a government of the corporations, by the corporations and for the corporations. ...

me:

The Arab spring is dawning in America, young, educated and jobless. If the police state continues to abuse them, expect the protests to turn violent like the Arab spring. I am sick and tired of Jamie Dimon and David Koch going against the American people.

Jesse:

Has Brad DeLong denounced this concern with morality as a puritanical overreaction and misplaced concerns about moral hazard, as he did with the concerns about the bank bailouts?

My point being that it is not only the Republicans that tend to be tools and fools for the status quo? They are just more obvious.

GeorgeK:

kievite:I really have trouble with Mr. Sachs born-again populism.

For over 30 years his economic policies have served the corporations and oligarchs very well. Even his recent African program pushes corporate farms over helping indigenous small farmers. Stating that displaced farmers will be able to move into urban areas where they will have access to social services. Perhaps he's never seen urban slums in Africa?

Maybe he's trying to make amends to all the people his policies have harmed or maybe he just knows which way the wind is blowing.

GeorgeK,

I agree. He is a very dangerous person, a tool of financial oligarchy, kind of neoliberal Harvard mafiosi (see http://www.softpanorama.org/Skeptics/Pseudoscience/harvard_mafia.shtml). Here is what Wikipedia tells us about his participation in the economic rape of Russia (aka "shock therapy" with its Wiemar level inflation and corrupted "rapid fire privatization" by Yeltsin cronies):

Nancy Holmstrom and Richard Smith pointed out that, in advising implementation of his shock therapy on the collapsing Soviet Union, Sachs "supposed the transition to capitalism would be a natural, virtually automatic economic process: start by abandoning state planning, free up prices, promote private competition with state-owned industry, and sell off state industry as fast as possible…". They go on to cite the drastic decreases in industrial output over the ensuing years, a nearly halving of the country's GDP and of personal incomes, a doubling of the suicide rate, and a skyrocketing unemployment rate.[17] The Lancet [18] has recently reported that rapid privatization of the Soviet Union caused a 12.8% death rate increase among males in just two years,[19] a claim that The Economist attributed to alcoholism, though The Lancet article attributed the rise in alcoholism to changes in the economy.[20]

Moopheus:

"Corporatocracy"--There's a word for that. Mussolini described it, as a good thing. We could use his word. It's certainly a more accurate description of where things are going than "Socialism for the rich." Which is really a euphemism to avoid using the other word.

Edward Lambert:

Everyday, the tide is turning against the economics of the conservatives. But will they jump ship? ... no... because they are still being funded by business, instead of the people.

and the weakening of democracy was made worse by the supreme court decision to allow corporations freedom in funding politicians.

The only way to change the situation is for the people to fight back... with demonstrations and solidarity... imagine that

YouTube

Keith Olbermann pointed out Wednesday night on Countdown that the major newspapers had been ignoring the five-day-long "Occupy Wall Street" protests, but would have scrambled to cover a similar-sized tea party protest.

"Why isn't any major news outlet covering this?" he asked. "If that's a tea party protest in front of Wall Street about Ben Bernanke putting stimulus funds into it, it's the lead story on every network news cast. How is that disconnect possible in this country today with so many different outlets and so many different ways of transmitting news?"

His guest, author Will Bunch, suggested the disconnect was caused in part by the news networks being out of touch with the pain of the 25 million Americans who are unemployed.

Every time they threatened to move our jobs unless we took pay cuts, they declared war, every time they shipped our jobs overseas, they declared war, every time they paid lobbyists to get elected officials to roll back employees rights, they declared war. Workers have stopped turning the other cheek, the war was declared long ago....It's time to fight back!

YouTube

Police in New York have violently dispersed an anti-Wall Street rally, arresting more than seven hundred people after a dramatic showdown on Brooklyn bridge. Thousands joined the movement dubbed 'Occupy Wall Street' - in protest against what they call corporate domination. James Corbett, editor of independent news website http://www.corbettreport.com says the police brutality may provoke an escalation of violence.

Soulfree2008

funny how fraud news was like "GO EGYPT GO" when they were having their revolution but now that america wants a revolution they are like "LOOK AT THIS HIPPIES THAT DONT HAVE ANYTHING BETTER TO DO AND JUST WANT ATTENTION" if that doesnt show that our mainstream media is run by the bankers(same people this guys are protesting) then I dont know what will

YouTube

The Brooklyn Bridge has been shut down in one direction after protesters camped out near Wall Street spilled onto the roadway. Police have made hundreds of arrests and were continuing to stop people from blocking the roadway Saturday evening.

The protesters are railing against corporate greed, global warming and social inequality. The group has been camped near Manhattan's downtown financial district for two weeks and has clashed with police on earlier occasions.

Goldman Sachs is a criminal organisation masquerading as a "bank". Goldman Sachs advised the Greek Government on how to commit fraud by cooking the books and fooling banks to lend money it could never repay.

Former employees included Robert Rubin who spent 26 years there and Henry Paulson. Who was responsible for the abolition of Glass-Steagall under Clinton? Rubin! Who bailed out the banksters with billions of US taxpayer money? Paulson! Who paid for Obama to be elected? Get the picture!

YouTube

And its not only Greeks up in arms about the situation they've been dumped into. The U.S. is also witnessing angry moods - in the nation's financial hub. Hundreds have thrown their weight behind the latest demonstration, named "Occupy Wall Street", to protest against the huge influence and bad behaviour of corporations and billionaires. RT's Anastasia Churkina was there.

YouTube

Demonstrations began on September 17 to show U.S. citizens anger over a financial system that favors the rich over all other American citizens. Chanting, "We are 99 percent," thousands of protesters gathered near Zucotti Park, close to Wall Street and began their march. Around 5 pm, while attempting to enter the financial district at 55 Wall Street, they were met by curious onlookers from the balconies who were leisurely watching the protesters and doing the unthinkable -- drinking champagne.

I became aware of Brecht as a playwright during a course of study while an undergraduate in university while taking a course in modern drama. I do not remember so much now except that my favorite of Brecht was Mutter Courage und ihre Kinder, or simply, Mother Courage.

The Mackie Messers of Wall Street are nothing new. Each generation has the responsibility to rein in its predators. It is just a question of whether anyone will sing a ballad about them after they are gone.

September 30 | FT Alphaville

reviedon

@dodge

the S&P 500 ex financials has a market cap of $10tn. Net Debt is $3tn and trailing EBITDA is $1.6tn. so the market cap weighted net debt to tailing EBITDA ratio is less than 2x which is low. If you stip out GE this ratio falls to 1.7x.

Apple and Microsoft alone have $70bn of net cash. Trailing FCF is $1tn. Private sector fixed capital investment is at an all time low at 12% of GDP...corporates have hoarded cash

the data i see says that corporate financial leverage is low. why do you think it is not? i would like to see the data to help correct my view if i am wrong

October 1 | FT Alphaville

User3232466

if you learn nothing from history, you are bound to repeat the mistakes of the past - the horror story of uncontrolled short selling via an easily manipulated CDS market is creating havoc again.

Basically the rising spreads are nothing else but a concerted effort to create a run on banks and countries.

We warned about this repeatedly during the 2008-09 crash but regulators and politicians have not heeded the warnings, now they reap the whirlwind. Heinz Geyer, Temple Associates, London

29 September 2011 | guardian.co.uk

Keynes was right: only government can get us out of this jobs slump. And only taxing wealth can restore US prosperity

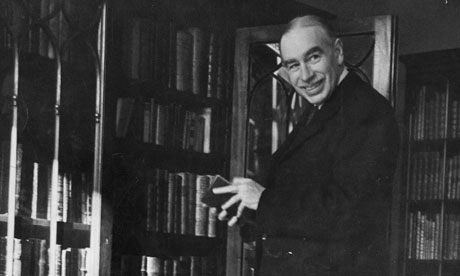

John Maynard Keynes: the government needs to 'prime the pump' to pull the economy out of recession. Photograph: Tim Gidal/Getty Images

The Reverend Al Sharpton and various labor unions announced Wednesday a March for Jobs. But I'm afraid we'll need more than marches to get jobs back.

Since the start of the Great Recession at the end of 2007, the potential labor force of the United States – that is, working-age people who want jobs – has grown by over 7 million. But since then, the number of Americans who actually have jobs has shrunk by more than 300,000.

In other words, we're in a deep hole – and the hole is deepening. In August, the United States created no jobs at all. Zero.

America's ongoing jobs depression – which is what it deserves to be called – is the worst economic calamity to hit this nation since the Great Depression. It's also terrible news for President Obama, whose chances for re-election now depend almost entirely on the Republican party putting up someone so vacuous and extremist that the nation rallies to Obama regardless.

The problem is on the demand side. Consumers (whose spending is 70% of the economy) can't boost the American economy on their own. They're still too burdened by debt, especially on homes that are worth less than their mortgages. In addition, their jobs are disappearing, their pay is dropping, their medical bills are soaring.

Businesses, for their part, won't hire without more sales. So we're in a vicious cycle. The question is what to do about it.

When consumers and businesses can't boost the economy on their own, the responsibility must fall to the purchaser of last resort. As John Maynard Keynes informed us 75 years ago, that purchaser is the government.

Government can hire people directly to maintain the nation's parks and playgrounds and to help in schools and hospitals. It can funnel money to help cash-starved states and local government so they don't have to continue to slash payrolls and public services. And it can hire indirectly – contracting with companies to build schools, revamp public transportation and rebuild the nation's crumbling highways, bridges and ports.

Not only does this create jobs but also puts money in the hands of all the people who get the jobs, so they can turn around and buy the goods and services they need – generating more jobs. Not exactly rocket science.

But congressional Republicans are firmly opposed. Why don't Republicans get it? Either they're knaves – they want the economy to stay awful through next election day so Obama gets the boot. Or they're fools – they've bought the lie that reducing the deficit now creates more jobs.

Republicans claim businesses aren't hiring because they're uncertain about regulatory costs, or their taxes are too high, or they can't find the skilled workers they need. But if these were the reasons businesses weren't hiring – and consumer demand were growing – we'd expect companies to make more use of their current employees. The average number of hours worked per week by the typical employee would be increasing.

In fact, the length of the average workweek has been dropping. In August, it declined for the third month in a row, to 34.2 hours. That's back to where it was at the start of the year – barely longer than what it was at its shortest point two years ago (33.7 hours in June 2009).

Republicans say America can't afford to spend more. In truth, we'll be in worse shape if we don't. If the economy remains dead in the water, the ratio of public debt to the total economy balloons.

Besides, the United States can now borrow money from the rest of the world at fire-sale rates. Interest on the ten-year Treasury bill is now just a notch above 1%. That's an almost unprecedented deal. With so many Americans unemployed and so much of our infrastructure in disrepair, this is the ideal time to get on with the work of rebuilding the nation.

But it won't be enough for government to become the buyer of last resort – in Keynes's words, to prime the pump. If the economy is to continue to grow and create jobs after the government has stopped the priming, there must be enough water in the well. Yet, now and in the foreseeable future, America's vast middle class doesn't have the purchasing power to keep the mechanism going.

For more than 30 years, the median wage in America has barely increased, adjusted for inflation – even though the economy is twice as large as it was three decades ago. Almost all the gains have gone to the top – especially the top 1%, who now receive over 20% of total income (it was just 10% in 1980).

As long as America's vast middle class could continue to borrow on the rising value of their homes, they continued to spend – thereby keeping the economy going. But going deeper into debt is not a sustainable strategy. Now, after the bubble burst, America's middle class doesn't have enough money to maintain the economy at or near full employment.

Any long-term strategy for rescuing the American economy must therefore seek to reverse the widening gap in income and wealth. One place to start is tax reform. The earned income tax credit – a wage subsidy for lower-income workers – should be enlarged and expanded. Taxes on the middle class should be reduced – including social security payroll taxes (80% of Americans pay more in payroll taxes than they do in income taxes).

Taxes on the wealthy, on the other hand, should be increased. The president has proposed closing some tax loopholes that allow the super-rich to reduce their tax liability, and to end the tax cut on the rich put in place by George W Bush in 2001 (thereby increasing the top marginal tax rate to what it was under Bill Clinton – 39%).