One of "innovations" of neoliberalism was extension known since Ancient Greece concept of debt slavery

to the whole countries.

Donald Trump is the best thing to happen to Wall Street in twenty years. This is because

since the moment he took the oath of office, no one has so much as uttered a word about Wall

Street....

... ... ...

During the 2011/ 2012 Occupy movement, for the first time in years the entire country took a

critical eye to the institution that was running our economy (by "running" I mean "dry

humping"). The nation FINALLY cared that this institution was steadily extracting all of the

wealth and resources and giving it (in an unmarked bag) to a tiny percentage of men and women

(mainly men) who smelled impeccable. Even those citizens who were wrongly disgusted by Occupy

still felt that Wall Street was exploiting the American people at a jaw-dropping pace. And they

got angry. The country got angry. FINALLY – at long last – everyone got ANGRY.

This is when the mainstream media did what they do best – they acted as the white

blood cells attacking the infection in the system. (And I'm sure I'm not the first to use that

analogy.) In this case the "infection" was activists calling attention to the full-blast

destructive tendencies of capitalism.

The media piled on the protesters as if those activists

were the ones sucking every last penny out of the American people. This, along with a healthy

dose of militarized police

and

FBI infiltration

, is how Occupy ended up maligned and imprisoned. The white blood cells

then moved on to step three of Operation Protect Wall Street (step one is ignore the protests,

step two is attack the protesters). Step three is the same as step one – "ignore," which

is akin to silencing. We saw these identical steps with Standing Rock. Most protest movements

don't get past step one; the mainstream media ignores them to see if they'll simply go away,

and it usually works. In fact until social media came along, it almost always worked. But now

the internet has allowed for an alternate path to public awareness (and an alternate path to

AMAZING photos of cats partaking in a variety of very un-catlike tasks). And this is why

crushing net neutrality is something the FCC and Wall Street are drooling over. But I

digress.

Jim A.

,

July 11, 2017 at 8:10 am

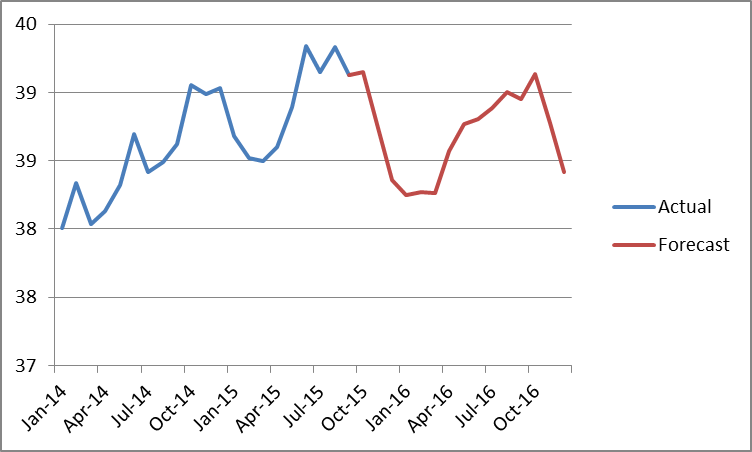

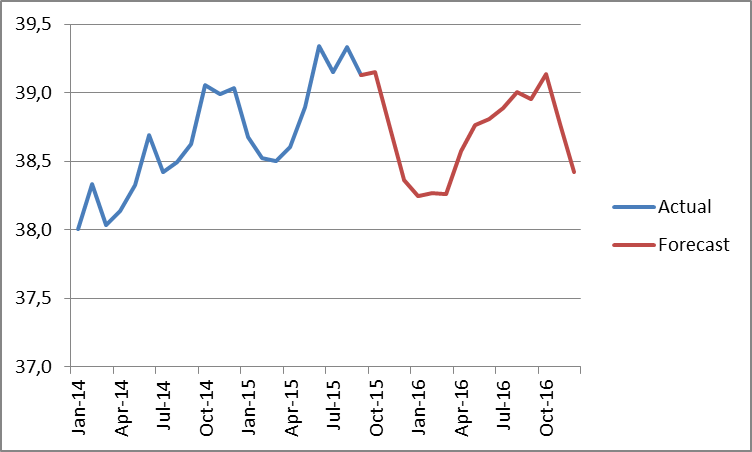

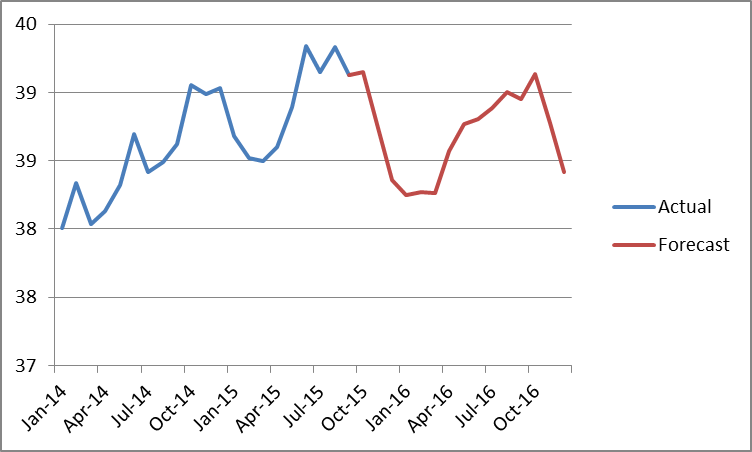

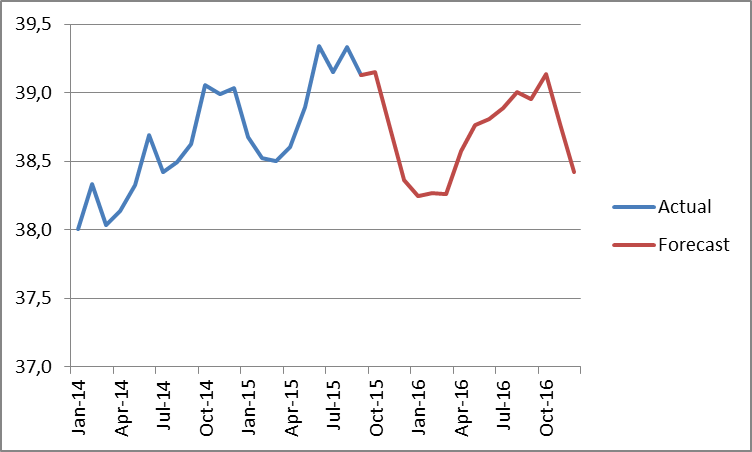

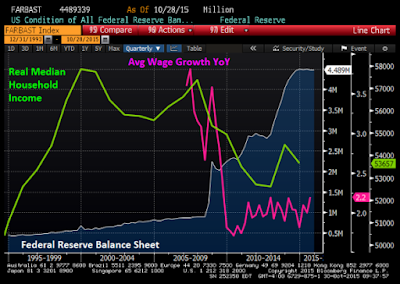

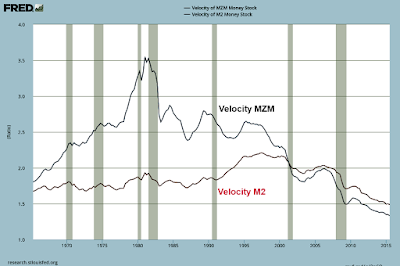

At some level, we need Wall Street, just like we need a liver. But a swollen, bloated and

inflamed liver is NOT a sign of health, and is indeed a dangerous. Wall Street has become a

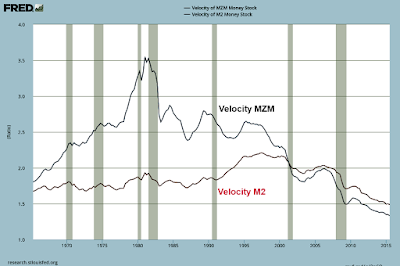

huge drag on the economy rather than an aid to it. Our economy is now structured to give Wall

Street far more money than it can find actual, productive uses for. Instead of being used to

build new plants and research new products, most of that money just goes into "financial

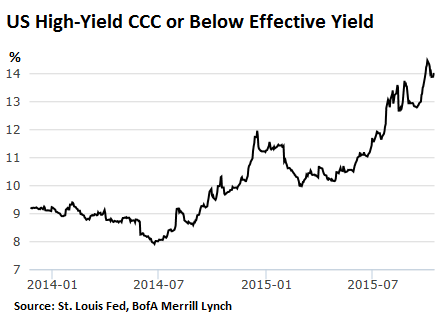

products," that blow asset bubbles or stock repurchases, or leveraged buyouts, Low rates have

fueled large levels of inflation in the monetary supply, but because little of that has been

seen in wages, it hasn't had much effect on the prices of consumer products, Instead, it has

pushed up asset prices, which in turn concentrates wealth every more. Which the wealthy, and

their sycophants confuse with actual "growth" in the economy.

A small tax on all financial transactions would be a start in slowing down the crazy

money-go-round that is strangling our real economy.

PKMKII

,

July 11, 2017 at 9:05 am

More like a tumorous liver, one that's come to see the other organs as superfluous. Heart,

brain, digestive system, they're nice, but if sacrificing them means more for the liver, well

TINA! We don't help the body perform, we

are

the body.

bdy

,

July 11, 2017 at 9:40 am

At some point we need Wall Street

Anyone care to elaborate? Cause me and mine do just fine down at the credit union. If Santa

Monica wants to tunnel under downtown for the new Bio-Luminescent Fungus Park do they really

have to borrow the funds from the vampire squids? Isn't Bank of Santa Monica just as capable

of hitting the discount window after the fact to shore up reserves? What am I missing that

makes an NYC clearing house for lottery tickets that profit the .1% so vital?

Vatch

,

July 11, 2017 at 11:08 am

The credit union won't be able to fund the construction of a new school or sewer system.

They won't be able to fund a business that wants to expand. If you want to sell some of your

stock to pay for your child's college education, you don't call your friends and neighbors

and ask them to buy your stock. You sell it through a broker, who is part of the Wall Street

network.

What we don't need is a lot of fancy options, elaborate asset backed securities like

collateralized debt obligations, and credit default swaps. We certainly don't need high

frequency trading. Wall Street is infested with those.

alex morfesis

,

July 11, 2017 at 11:47 am

the american credit union system is not much different than the german financial

cooperatives and landesbank system except the germans get to use it to build a stable

economic model, where here in the us, the credit union system is attacked as some form of

"fidelismo"

http://www.abfjournal.com/articles/brave-new-world-community-banks-credit-unions-enter-syndication-market/

"in my hand I have a list of" .

https://www.bvr.de/About_us/Cooperative_Financial_Network

somehow, the whole euro thingee system only cheerleads for german use of its system and

does not seem to encourage (other than perhaps the WIR in switzerland) anyone else being

"european" enough to enjoy the "german advantage"

http://www.reuters.com/article/us-banking-germany-landesbanken-idUSBRE98G06720130917

there have been fannie/freddie type of conduits previously for credit unions to recycle

capital lending capacities but those were the first to be shut down to eliminate competition

with wall street

http://www.business.unr.edu/faculty/liuc/files/fin415/WSJ_01292009.pdf

http://news.cuna.org/articles/print/36683

credit unions can do all types of big projects

directly or via some form of syndication

they can also be formed for and by businesses to provide local capital they do not have to

be just "consumer" deposit cycling organizations there are technically no restrictions on

their growth

there is the acela vanity press which goes in a circle in respects to what a credit union

is and what it does and how large a parcel of the citizenry in fact are members and have

funds deposited and cycled through said credit unions

Vatch

,

July 11, 2017 at 12:38 pm

credit unions can do all types of big projects

directly or via some form of syndication

Wouldn't that syndication be something resembling Wall Street? (without all of the

ridiculous derivatives, high frequency trading, and outlandish bonuses, of course)

alex morfesis

,

July 11, 2017 at 1:15 pm

just as truckers and pilots need to pass random drug and alcohol tests, congress kriters

and strategic wall street participants should also be required to subject themselves to such

monitoring and testing

can easily make a strong argument "for" derivatives, cds, cdo, squareds rectangulars and

octoganals too even high frequency churning

the technical word is prudence within reason and for a small percentage beyond the market

needs to keep market flows available and ready for moments of capital drying up

currency markets at trillions of dollars per day are perhaps just a convenient vehicle to

"make bribery great again"

would argue there is now and has been for quite some time a very massive substance abuse

problem in the capital markets which feed into the myopia of "allowable excesses"

more funds are given away to charities in this great american enterprise than is "thrown

away/invested" in enterprise start ups

300 billion per year to charity vs less than 100 billion per year in start ups

the systems are all in place in this vast imperium for the small shmoes to do many things

perhaps not enough transactional attorneys in the right places to make it work and happen in

a consistent and sustainable manner, but the tools are all there however

we have our capital allocations all [family blogged] up

Hiho

,

July 11, 2017 at 1:06 pm

God, and why on the earth would someone agree with wall street funding schools or sewer

systems. That is the duty of the government. Not even bondholders or private creditors are

really needed once you understand that banks also create money from thin air.

Anon

,

July 11, 2017 at 1:37 pm

And the Wall Street route (selling Bonds), instead of using taxation, usually costs the

locals a premium of 40% over the actual cost of the project. And the beneficiaries are the 1%

who can afford to purchase those Bonds.

sgt_doom

,

July 11, 2017 at 1:50 pm

You need to have a serious question with the Clinton/Rodham family about this, since it

really exploded under their watch.

Reagan did establish the Office for Privatization within the OMB, but he didn't do enough

to suit the Heritage Foundation, which evidently loves their Clintons!

Vatch

,

July 11, 2017 at 2:00 pm

Hiho: City, county, and state/provincial governments can't create money, and sometimes

there are necessary projects which require a lot more money than can be raise by taxes in

just one year. Whether the money comes from bond sales or from bank loans, the governments

will use taxes to pay the money back over a period of 20, 30, or 40 years. Since the local

savings banks may not have the resources to make a lot of those loans, a bond market is

needed.

Anon: It's not just the one percenters who benefit from buying bonds. There are also

plenty of pension funds and mutual funds, and those benefit more than just the one

percenters.

A vast amount of abusive behavior has occurred in the financial industry, but that doesn't

change the fact that the industry does provide some value.

No Way Out

,

July 11, 2017 at 1:09 pm

At some point we need Wall Street

We need Wall Street to recycle back into the economy the huge sums of money that rise to the

top of the human chain like crap rises to the top of a cesspool.

Either that, or we could reinstate the 90% marginal rate, properly tax capital gains in

inheritances, and institute a wealth tax with a hard cap on how much a person could possess.

We could also disallow the ownership of corporations by other corporations (since they are

after all human beings), and make corporate officers indictable for any felonies their

corporations committed which they did not report. And we could stop pretending that an

economy needed more than 300 million people to function efficiently, and that human beings

can pull themselves up by the bootstraps on $8/hour.

sgt_doom

,

July 11, 2017 at 1:53 pm

Recently read

Survival of the Richest

by Donald Jeffries, and he has a

wonderful chapter there on the great American populist, Huey Long.

Long's tax reform program in his Share The Wealth project was most intelligent.

John Wright

,

July 11, 2017 at 10:04 am

While the country does need Wall Street to help allocate resources, a link I've posted

before to NC has one observer (Paul Woolley) suggesting the US/UK financial industry is 2 to

3 times larger than optimum.

Essentially, the USA could downsize its financial industry by 50-66% and be better off

see:

http://www.newyorker.com/magazine/2010/11/29/what-good-is-wall-street

See "I asked Woolley how big he thought the financial sector should be. "About a half or a

third of its current size," he replied.""

But as we watch the Bush-Obama-Trump financial industry friendly administrations operate,

the likelihood of "right sizing" the financial industry seems very remote.

In my view, only another financial massive crisis can precipitate any reform/resizing, it

will not arise in the current financial industry fed political process otherwise.

justanotherprogressive

,

July 11, 2017 at 10:09 am

"to help allocate resources"????

Yea, they are good at that, aren't they? Oddly enough, that allocation seems to be to only a

select few ..is that what allocation means?

Then bank robbers are also good at allocating resources

John Wright

,

July 11, 2017 at 11:15 am

It's a stretch, bu imagine you subtract the portion of Wall Street responsible for the

Housing Bubble, Auto Bubble, Student loan bubble, Commercial property bubble, Internet

bubble, LBO/Private Equity funding, and stock buyback funding, the remaining subset of Wall

Street could be providing some societal value.

One could argue that crowd funding could lessen the size of even this residue.

So a portion of Wall Street may be useful for funding infrastructure and

research/development in the future.

But rightsizing never seems to be appropriate for Wall Street.

Jim A.

,

July 11, 2017 at 10:58 am

Oh at this point I suspect that it is far larger than 2-3 times optimum size. I'd wager

that the reason for that 2-3 estimate isn't so much that they get the optimum size wrong as

that they underestimate the current size of Wall Street.

justanotherprogressive

,

July 11, 2017 at 10:07 am

"At some level, we need Wall Street"?

The biggest employer in my town is privately owned – it doesn't need Wall Street (and

oddly enough, that company didn't suffer during the "recession", go figure .). There are many

many small businesses in this country – they don't need Wall Street

I don't need Wall Street

Wall Street has been putting out its propaganda for so long that people are buying into it

without thinking. Actually Wall Street needs us to keep buying and going into debt to survive

but they've somehow convinced us that they are doing us a favor by keeping us in debt .

Hiho

,

July 11, 2017 at 1:10 pm

Exactly.

On top of that and contrary on what many people think, wall street does not fund industry.

Industry funds wall street.

Thor's Hammer

,

July 11, 2017 at 10:14 am

"At some level we need Wall Street–" like we need a metastatic cancer. A neutron

bomb that destroyed its core and sought out all its tentacles would be more appropriate.

What we need is an actual marketplace that evaluates asset allocation from the standpoint

of how well it serves the citizens of the world and how well it supports the biosphere and

ecosphere within which they live. Capitalist markets serve or evolve into casinos for the

ultra-rich who control them. Central planned economies without the guiding hand of markets

become calcified skeletons that are every bit as dysfunctional as capitalist markets.

in order for a market system to be sustainable it would have to be based upon a generally

accepted wisdom about the human role in the ecosphere. And it would have to reflect a

systemic decentralization of power that prevents the drive to domination that characterizes

all of human social history.

Are humans smarter than yeast?

Thor's Hammer

,

July 11, 2017 at 2:49 pm

When this post was submitted there were only three posts before it. Why is is now 2/3 of

the way down the list of 48?

Outis Philalithopoulos

,

July 11, 2017 at 3:19 pm

Look at the time stamps. The post order is a tree order (node, then branches), with posts

on the same tree level ordered by time stamp. That means that if originally there are two

posts, and then twenty people respond later to the first post, the second post will become

the twenty-first.

Alex Morfesis

,

July 11, 2017 at 12:58 pm

The new york state stock transfer/transaction tax exists & has existed but has been

handed back as a 100% tax refund since felix the Cheshire car crushed the municipal govt

unions in the late 70's

TSB-M-82-(6)M

Depending on who you ask, the amount not collected each year is ten to twenty billion (yes

with a B)

10 to 20 billion per year rebated to wall street for 25 years

well be reasonable

Times square is still a mrss and the abandoned piers on the west side of Manhattan and all

those empty factory buildings that faith hope consolo just can't seem to get any retail

enterprises into

Half a trillion bux

you can't have nice things

Because because

just because

RickM

,

July 11, 2017 at 8:43 am

Why a small tax on financial transactions? How about a flat 1%, instead of the 0.1% I read

about in the usual sources? That sounds about right. Besides, I hear flat taxes are the

best!

Vatch

,

July 11, 2017 at 10:56 am

I believe the thinking behind a small transaction tax is that it will not impede

legitimate securities transactions, such as the purchase of some shares of stock for

retirement. If the transaction tax is too large, it affects people on main street. But even a

small transaction tax will have an effect on the

high frequency trading

that hedge

funds and giant banks indulge in thousands or even millions of times per day. Ordinary

investors have no possibility of beating the algorithmic high frequency traders, so to make

things a little more fair, the high frequency traders should pay a tax on every transaction.

This tax should not be large enough to harm the ordinary investors.

Jim A.

,

July 11, 2017 at 11:01 am

And if that HFT was just dueling algorithms in a cage match, it would be a zero-sum game.

But the reason that it is profitable is that much of it constitutes automated "front

running."

Anon

,

July 11, 2017 at 1:50 pm

This tax should not be large enough to harm the ordinary investors.

Who are these ordinary investors? What percent of transactions do they make? How do their

transactions fare when their trades only have to be made within 48 hours of placement.

(Arbitrage anyone?!)

sgt_doom

,

July 11, 2017 at 2:00 pm

Bulltwacky!

Gary Gensler's study, when he headed the CFTC, found that over 90% of so-called hedge

trades were pure speculation.

From 1914 to 1966, there was a transaction tax, begun with the Revenue Act of 1914, ended

during the Johnson Administration.

Vatch

,

July 11, 2017 at 2:07 pm

Right. So a small transaction tax will either inhibit the speculation, or raise money for

the government. Either way it's a good thing.

José

,

July 11, 2017 at 4:55 pm

There's this interesting proposal on transaction taxes to stabilize the financial system

– by Professor Marc Chesney from the University of Zürich (I translated from the

original German):

"Micro taxes on electronic payments – This would also be a technically simple

solution to stabilize the system. In Switzerland, there are about one hundred thousand

billions of Swiss francs in electronic payments per year. That is, one plus 14 zeros. This is

about 160 times the Swiss GDP. Taking 0.2 percent of this, one would have had in tax receipts

two hundred billion francs a year, more than all present-day taxes in Switzerland, that do

not exceed 170 billion Swiss francs per year.

That is, theoretically one could, in place of all other taxes, of almost all other taxes,

just pay this micro tax every time that you get a bill electronically paid. Like, every time

you go to the restaurant, to the hairdresser. Every time you go to the ATM, for example, to

get 100 francs, you could pay 20 Rappen (cents) in taxes. It would be a simple measure and we

would have much less of a headache with the annual tax declaration. In fact, we could also,

in theory, use this micro tax for – quite simply – abolishing the annual tax

declaration. So, it would be a simple, and cheap, measure. And yet we do not talk about this

possibility."

Carolinian

,

July 11, 2017 at 8:51 am

The media don't like Trump and they didn't much like Occupy either. So one should be clear

about who is doing the distracting. While Trump certainly is a boorish person who rubs women

in particular the wrong way, it's likely that's not what is motivating the rabid opposition.

Commonsensical pronouncements about getting along with Russia or rolling back globalism

strike at the heart of a plutocracy that seems to have the country in a death grip. Trump may

not have been a very sincere or motivated reformer but clearly Sanders would have met with

the same circus of distraction (the stories about his wife a shot across the bow).

It's really the power of the media that is Fight Club, the thing nobody is allowed to talk

about. Camp himself has come under attack from the NYT. Doubtless Trump understands this

which is why he still clings, however ineptly, to Twitter. One can only wonder how long

before the web itself comes under assault.

neo-realist

,

July 11, 2017 at 10:03 am

The mud heaping on Sanders wife, I suspect, is about destroying his credibility for 2020.

With all their influential capability, TPTB still believe themselves very threatened by

Sanders.

perpetualWAR

,

July 11, 2017 at 12:49 pm

It's actually enfuriating me the FBI has enough time to investigate Jane, but couldn't

find the time to investigate the bank crimes causing 18.2 million unlawful foreclosures.

Audit the REMIC mortgage loan lists for multiply-pledged notes! Then, go after the

uncollected billions in tax implications and give the houses back!

Thor's Hammer

,

July 11, 2017 at 10:37 am

We irrelevant posters in the blogsphere seem to have trouble learning from even the most

recent past.

Consider the fate of Muammar Gadiffi. Ruler of the wealthiest an most socially progressive

country in Africa. Liked to wear weird clothes and hang out in a tent in the desert with his

harem. Made the mistake of meddling in regional power politics, and the fatal mistake of

trying to organized a gold-based currency for trade in oil. His fate was to have his country

torn apart with the active support of the CIA, NSA and other US spook agencies. And to die

with a bayonet up his ass while Secretary of State Hillary Clinton watched on a live spy

satellite camera and chortled madly.

https://www.youtube.com/watch?v=dR45C6Vw8uM

If that is the response of the Deep State to a perceived threat from a small African

country, imagine the measures it would take toward an out-or-control US president who

threatens to make peace with the best and most profitable enemy they have ever been able to

create.

Disturbed Voter

,

July 11, 2017 at 12:43 pm

Correct not only is politics war by other means, but finance is war by other means. The

banking business is part of the WMD of the Anglo-American Empire. This is what happens when

you unleash a predatory species of unparalleled capability on the planet.

jo6pac

,

July 11, 2017 at 1:09 pm

LOL and sadly so true.

polecat

,

July 11, 2017 at 2:01 pm

It' not really a laughing matter especially where the Russians & Chinese are uh

'concerned' --

At the ever-increasing rate of establishment insanity, I see a nuclear war in our future,

perhaps not too far out, either.

Thor's Hammer

,

July 11, 2017 at 3:15 pm

I wouldn't exactly call the sounds that come out of the Hildabeast's mouth laughing!-.

https://www.youtube.com/watch?v=dR45C6Vw8uM

Lord Koos

,

July 11, 2017 at 4:21 pm

Iraq was a similar deal. Any country that attempts to operate outside of the western

banking system must be destroyed.

RenoDino

,

July 11, 2017 at 10:48 am

I'll say again, Trump was elected to break things and he is doing his job perfectly. He is

breaking the MSM and all three branches of government. He is destroying the global order and

undermining the "democratic" process. Such is the hatred for these institutions, he is only

marginally less popular than when he was elected. People may find fault with the way he

breaks things, but he is not going for style points. Rather he is the perfect person for the

job. He is totally dismissive of his critics, not open to suggestion and completely and

utterly unpredictable. He is one of the few people who manages to live life on their own

terms. This is an extreme rarity and its importance cannot be stressed enough. It drives his

critics completely mad because they reflect on everything they say and do and try to gauge

the response to every action.

The last forty years have wrought a society with a glass jaw that Trump intends to break.

His antics expose the vulnerabilities inherent in the West's corrupt and hypocritical

institutions who are desperately trying to cling to a unreal state of affairs that have

become a bigger joke than Trump.

... ... ...

edr

,

July 11, 2017 at 11:44 am

The country didn't need "Occupy Wallstreet" to focus on Wall Street Corruption.

The loss of people's homes already had the entire country aware and fuming about Wall

Street corruption, writing and calling Congress. Occupy's purpose was to convince

Legislators, not the public, of the country's existing concerns and get them to break up the

Wall Street MegaBanks. And what happened with the whole country fuming???? Nothing!!! 8 years

of nothing.

Wall street Derivatives bets are about 2-3x the total of World's cumulative assets!!

That's been staring the Fed and Congress in the face since 2008, and they can't figure out

there is anything to fix. Worse than the housing crises, which they ALSO REFUSED to see or

prevent. 40years of losses in real wages, also purposefully ignored by Congress and the white

house.

(And, deciphering the facts behind Media reporting is a full time job.)

Therefore, Trump . why get all in a froth to resolve nothing? Enjoy the show, because

nothing else was on offer.

Bill H.

,

July 11, 2017 at 11:52 am

Wall Street does not create the money that sloshes into it. That money pours into Wall

Street from Pharma with its 50%+ profit margins, from "sharing economy" capitalists with 80%

profit margins, from health care corporations with 50% profit margins, from IPO's that net

the "creators" obscene amounts of money for trivial adventures and from the Federal Reserve

for "quantitative easing."

Wall Street is not the problem, it is a symptom of the problem, it feeds on the problem,

and it is a distraction from the problem. The problem is corporatism and its control of

governance. That is why "Occupy" was such a farce.

sharonsj

,

July 11, 2017 at 12:05 pm

You're forgetting free credit from the Fed. They have given billions worldwide.

Lord Koos

,

July 11, 2017 at 4:25 pm

I disagree, Wall Street is an actor that is complicit with big capital and it is

definitely a problem. I don't see how you can separate corporatism from Wall St. since they

enable each other.

I wouldn't call an authentic grass-roots protest against inequality a farce.

jsn

,

July 11, 2017 at 7:43 pm

Occupy was a "farce" because bank security colluded with corporate press and the

enforcement arms of the surveillance state to present you that image. Hook, line and sinker

appears to be your take.

Marbles

,

July 11, 2017 at 11:55 am

More sky is blue commentary, with no discussion of what to do next.

Re occupy Wall Street?

Stop paying all of your loans and watch the banks implode?

Pin one's hopes on some snowball's chance to elect officials in every office that would

use the force of the state to clawback ill gotten gains?

Pray for a computer hacker to create some debt jubilee and reset the clock?

agkaiser

,

July 11, 2017 at 12:17 pm

Look what happened to Mr. Robot! Yeah, that was all a dream too, wasn't it?

Marbles

,

July 11, 2017 at 12:47 pm

After the revolution is a topic that needs to be discussed more, not to bring Slavoj Zizek

into the discussion.

diptherio

,

July 11, 2017 at 3:13 pm

Here's one:

https://nextcity.org/daily/entry/directory-worker-cooperatives-worker-owned-businesses

And another:

https://cooperativeeconomy.info/every-commune-is-a-cooperative-self-organisation-and-self-sufficiency-are-progressing-in-rojava/

agkaiser

,

July 11, 2017 at 12:12 pm

Everybody knows the rich and their banks and corporations pay lower percentages of taxes

than the rest of us. Everybody knows many of them pay no taxes at all.

Many of us and our governments borrow money from the rich. We borrow to live a decent

life. The governments borrow and do the things like build and repair roads, defense and other

things we need in common. Some say we don't have to borrow. Is that really true?

Q: Why do the rich have excess money that they can loan to us and our government?

A: The rich don't pay taxes.

If the governments taxed the excess instead of borrowing it, maybe we could pay lower

taxes and have more of our earnings so we wouldn't have to borrow so much either. What do you

think?

Jcast23

,

July 11, 2017 at 12:13 pm

Jello Biafra made the same point about Trump's tweets a couple of months back:

https://youtu.be/BPwdK9cBhK8

templar555510

,

July 11, 2017 at 2:13 pm

Goldman Sachs = Vampire Squid . What more needs to be said ?

Norb

,

July 11, 2017 at 3:44 pm

Governments colluding with wealthy elites in order to rule the world is what human society

is all about at the present time. It has been the driving force for millennia. Wealthy elites

and Government are interchangeable terms- thus the problem for poor people.

Getting people into debt is the whole point. If not willingly, by force if necessary. Debt

keeps the mopes working. Debt works better than abject slavery because the oppressive nature

of the practice is more easily rationalized by the perpetrators. Christianity once objected

to usury for good reason.

This dual arrangement, private elite money and Government need works so well for both

parties because all the upside goes to the wealthy. The wealthy are shielded form the horrors

of dishing out violence to achieve ones goals -- that task is relegated to the Government,

while the Government is free from accountability- they can always get more "money" from the

elite because they control all the wealth.

That is the extreme tragedy of Privatization. The real wealth of the nation and potential

of its people are squandered in a financial shell game.

There is a bigger picture that is obfuscated by necessity. Limits to private ownership are

essential to a fair and just society. Some form of common good must be defined.

As for taxes. Taxes are the main tool for social engineering. You either have the

opportunity to create a middle class or cement an oligarchy in power. Take your pick on which

to support.

Russia! Russia! Down with Socialism and Communism!

Repeat above phrase until your are unconscious.

Crazy Horse

,

July 11, 2017 at 5:56 pm

If we adopt the perspective of all the other millions of species that have evolved to find

a home on this planet, homo sapiens can only be seen as a toxic weed that if left unchecked

will destroy their home. Perhaps the bacteria will succeed where saber toothed tigers and

grizzly bears failed and save the planet from humans. There certainly is little evidence that

the Sapiens will evolve into an intelligent species that can live in harmony with all the

other inhabitants.

Mal Warwickon July 21, 2014

They shaped US foreign policy for decades to come

One of them was the most powerful US Secretary of State in modern times. The other built the

CIA into a fearsome engine of covert war. Together, they shaped US foreign policy in the 1950s,

with tragic consequences that came to light in the decades that followed. These were the Dulles

brothers, Foster and Allen, born and reared in privilege, nephews of one Secretary of State and

grandsons of another.

What they did in office

Allen Dulles masterminded the coup that turned Iranian prime minister Mohammad Mossadegh

out of office and installed the Shah on the Peacock Throne. Less than a year later he presided

over the operation that ousted Guatemalan president Jacobo Arbenz. He set in motion plots to assassinate

Gamal Abdel Nasser in Egypt, Sukarno in Indonesia, Ho Chi Minh in Vietnam, Patrice Lumumba in

the Congo, and Fidel Castro in Cuba. He delegated to his deputy, Richard Bissell, leadership of

the Bay of Pigs invasion of Cuba. Later, out of office, he chaired the Warren Commission

on the assassination of John F. Kennedy. "'From the start, before any evidence was reviewed, he

pressed for the final verdict that Oswald had been a crazed gunman, not the agent of a national

and international conspiracy.'"

Foster Dulles repeatedly replaced US ambassadors who resisted his brother's assassination plots

in countries where they served. Pathologically fearful of Communism, he publicly snubbed Chinese

foreign minister Chou En-Lai, exacerbating the already dangerous tension between our two countries

following the Korean War. The active role he took in preventing Ho Chi Minh's election to lead

a united Vietnam led inexorably to the protracted and costly US war there. He reflexively rejected

peace feelers from the Soviet leaders who succeeded Josef Stalin, intensifying and prolonging

the Cold War. Earlier in life, working as the managing partner of Sullivan & Cromwell, the leading

US corporate law firm, Foster had engineered many of the corporate loans that made possible Adolf

Hitler's rise to power and the growth of his war machine.

What does it mean now?

At half a century's remove from the reign of the formidable Dulles brothers, with critical

documents finally coming into the light of day, we can begin to assess their true impact on US

history and shake our heads in dismay. However, during their time in office that spanned the eight

years of Dwight Eisenhower's presidency and, in Allen's case, extended into Kennedy's, little

was known to the public about about Allen's activities (or the CIA itself, for that matter), and

Foster's unimaginative and belligerent performance at State was simply seen as a fair expression

of the national mood, reflecting the fear that permeated the country during the most dangerous

years of the Cold War.

Diving deeply into recently unclassified documents and other contemporaneous primary sources,

Stephen Kinzer, author of The Brothers, has produced a masterful assessment of the roles played

at the highest levels of world leadership by these two very dissimilar men. Kinzer is respectful

throughout, but, having gained enough information to evaluate the brothers' performance against

even their own stated goals, he can find little good to say other than that they "exemplified

the nation that produced them. A different kind of leader would require a different kind of United

States."

Their unique leadership styles

To understand Foster's style of leadership, consider the assessments offered by his contemporaries:

Winston Churchill said "'Foster Dulles is the only case I know of a bull who carries his own china

shop around with him.'"

Celebrated New York Times columnist James Reston "wrote that [Foster] had become a 'supreme

expert' in the art of diplomatic blundering. 'He doesn't just stumble into booby traps. He digs

them to size, studies them carefully, and then jumps.'"

Senator William Fulbright, chair of the Senate Foreign Relations Committee, said Foster "misleads

public opinion, confuses it, [and] feeds it pap." "A foreign ambassador once asked Foster how

he knew that the Soviets were tied to land reform in Guatemala. He admitted that it was 'impossible

to produce evidence' but said evidence was unnecessary because of 'our deep conviction that such

a tie must exist.'" (Sounds similar to the attitude of a certain 21st-century President, doesn't

it?)

Allen, too, comes up very, very short: "He was not the brilliant spymaster many believed him

to be. In fact, the opposite is true. Nearly every one of his major covert operations failed or

nearly failed . . . [Moreover,] under Allen's lackadaisical leadership, the agency endlessly tolerated

misfits." He left the CIA riddled with "lazy, alcoholic, or simply incompetent" employees.

Stephen Kinzer was for many years a foreign correspondent for the New York Times, reporting

from more than fifty countries. The Brothers is his eighth nonfiction book. It's brilliant.

W. J. Haufon June 27, 2014

Without John Foster Dulles There Would Have Been No Hitler and No Nazi Germany!

After the Treaty of Versailles mandated the imposition of incredibly severe monetary reparations

on Germany, John Foster Dulles in the 1930s, as a partner in his law firm of Sullivan and Cromwell,

assembled a coalition of banks to lend Germany over $1 trillion, (in today's dollars), supposedly

for them to pay these reparations. Had Foster not organized these massive bank loans to Hitler's

Germany and organized the sale of raw materials such as cobalt to fabricate armor plating to build

Germany's war machine, there would have been no Nazi war machine or an Adolf Hitler to kill millions

of Americans, ally troops and civilians in a war that would have never happened.

As a reward our government appointed John Foster Dulles as Secretary of State so he could continue

his war against democracy by orchestrating the overthrow of democratically elected leaders such

as the Prime Minister of Iran to restore the Shah, and then continuing his reign of terror against

other democratically elected governments such the CIA overthrow of the President of Guatemala

in 1954 by his brother Allen, Director of the CIA, and installing a US controlled puppet President

so the United Fruit could continued its monopolistic hold on the banana industry in that country

and eventually throughout Central and South America and the Caribbean.

Oh did I mention that JFD was a stockholder in United Fruit. Corporate greed is not new

but for members of the US Congress and the Administartion to support corporate interests over

Americans safety and put money ahead of the protection of the people of our country as well as

the people of other nations is a violation of our US Constitution and these people should not

be immune from prosecution. G.W. Bush destroyed the infrastructure of an entire country and he

killed hundreds of thousand of innocent citizens just so Brown & Root and Halliburton, V.P. Cheney's

company, could receive billions of dollars of US taxpayer monies to rebuild the very infrastructure

that Bush destroyed that provided the life support for the people of Iraq.

Our Founding Fathers would never had fought to build a country of democratic principals if

they knew that the political representatives in this country would worship money and support corporate

greed over American human rights and freedoms.

G.W. Bush said that the attacks on 9-11 were because "they hate our freedoms". What a disgrace

for a President to lie and not say it was because we have been interfering and overthrowing democratically

elected governments for decades. Shame on you Mr. Bush, but you will meet your Maker one day and

you can explain why you killed so many people just so you and your friends could receive billions

of dollars in profits. "May God Have Mercy on Your Very Soul"

Mike Feder/Sirius XM and PRN.FM Radio on October 11, 2013

Best Political/Historical Book in Years

You know those reviews clips, headlines or ads that say "Must Read" or, "...if you only read

one book this year..."

I have to say, with all the books I've read before and am reading currently, this one is absolutely

the most eye-opening, informative and provocative one I've come across in many years.

And--after all I've read about American politics and culture--after all the experts I've interviewed

on my radio show... I shouldn't be shocked any more. But the scope of insanity, corruption and

hypocrisy revealed in this history of the Dulles brothers is, in fact, truly shocking.

Just when you thought you knew just how bad the United States has been in the world, you come

across a history like this and you suddenly become aware of the real depths to which "our" government

has sunk in subverting decency, freedom and democracy all over the world.

George W. Bush asked the question after 9/11-- "Why do they hate us?" The answer he came

up with was, "Because of our Freedoms." When you read this book, you come face to face for the

real reasons THEY (most of the rest of the world) hate us. It's because these Bush's "freedoms"

are only for the United States, no other non-white, non-Christian, non-corporate cultures need

apply.

The missionary Christian, Corporatism of the Dulles Brothers--John, the former head of

the largest corporate law firm in the world, then Secretary of State, and his brother Allen, the

head of the CIA all the way from Korea through Vietnam -- constitutes the true behavioral DNA

of America-in-the-world. It's enough to make you weep for the billions of people this country

has deprived of freedom and security for the last sixty years.

I grew up practically in love with America and the Declaration of Independence. When I was

a kid the USA had just beaten the Nazis. I saw the picture of the marines raising the flag at

Iwo Jima. I knew men in my neighborhood that had liberated concentration camps.

But they never taught us the real history of America in high school and barely at all in college.

If they had given us a clear picture of our true history, there never would have been a Vietnam

in the first place--and no Iraq or Afghanistan either; Global Banks wouldn't have gotten away

with stealing all our money and crashing our economy and Christian fundamentalist and corporate

puppets wouldn't have taken over our government.

Karma is real. You can't steal a whole country, kill and enslave tens of millions of human

beings, assassinate democratically elected leaders of countries, bribe and corrupt foreign governments,

train the secret police and arm the military of dictators for decades-- You cannot do all this

and escape the judgment and the punishment of history.

This book is, in fact, a MUST READ... for anyone who wants to know what their taxes have

paid for in the last half century--for anyone who wants to know just exactly why the rest of the

world wants either to attack us or throw us out of their countries. And a must read for anyone

who no longer wishes their "representatives" in Washington to keep facilitating the stealing and

killing all over the world and call it American Exceptionalism.

I'll also add that Stephen Kinzer is also a terrific writer; clear, articulate, factual and

dramatic. His inside the inner circle revelations of the Dulles brothers and their crimes is morbidly

page-turning.

Chris on October 11, 2013

The Dark-side of American foreign policy

The American people and the world at large still feel the reverberations from the policies

and adventures of the Dulles' brothers. They are in part to blame for our difficult relations

with both Cuba and Iran. This history helps answer the question, "Why do they hate us?" The answer

isn't our freedom, it's because we try to topple their governments.

The Dulles brother grew up in a privileged, religious environment. They were taught to see

the world in strictly black and white. Both were well-educated at Groton and the Ivy League schools.

Both worked on and off in the government, but spent a significant amount of time at the immensely

powerful law firm, Sullivan & Cromwell. They had virtually identical world views but nearly opposite

personalities. (John) Foster was dour, awkward, and straight-laced. Allen was outgoing, talkative,

and had loose morals.

There's no need for a blow-by-blow of their lives in this review. The core of the book revolves

around Foster Dulles as the Secretary of State under Eisenhower and Allen as the Director of the

CIA The center of the book is divided into six parts, each one dealing with a specific foreign

intervention: Mossaddegh of Iran, Arbenz of Guatemala, Ho Chi Minh of Vietnam, Lumumba of the

Congo, Sukarno of Indonesia and Castro of Cuba.

The Dulles view was that you were either behind the US 110% or a communist, with no room for

neutrals. Neutrals were to be targeted for regime change. The author lays out explicitly all the

dirty tricks our government tried on other world leaders, from poison to pornography. This dark

side of American foreign policy can help Americans better understand our relationships with other

countries.

My difficulty with this book is the final chapter. The author throws in some pop-psychology

such as; people take in information that confirms their beliefs and reject contradictory information,

we can be confident of our beliefs even when we're wrong, etc. The Dulles brothers are definite

examples of these psychological aspects. Then the author says the faults of the Dulles brothers

are the faults of American society, that we are the Dulles brothers. I felt like a juror in a

murder trial during the closing statements, "It's not my client's fault, society is to blame!"

In most of America's foreign adventures, the American people have been tricked with half-truths

and outright lies. Further more, these men received the best educations and were granted great

responsibility. They should be held to a higher standard than "Oh well, everyone has their prejudices."

I agree with the author that the public should be more engaged in foreign policy and have a

better understanding of our history with other nations. However, I think he goes too far in excusing

their decisions because they supposedly had the same beliefs as many Americans.

Harry Glasson August 24, 2015

So Eisenhower wasn't really a "do nothing" president, but based on this book, I wish he had

done less.

This is the most interesting and important book I have read in the past twenty or more years.

Most Americans, myself included, considered John Foster Dulles a great Secretary of State, and

few ordinary people knew Allen Dulles or had any idea how the CIA came to be what it is.

Learning the facts as they have been gradually made public by those who were witnesses, and

others who researched and wrote about the behavior of the United States during the height of the

Cold War has been an enlightening and saddening experience. I was in high school during Eisenhower's

first term, in college during his 2nd term, in the Air Force during JFK's time in office and deployed

to Key West during the 1962 Cuban Missile Crisis.

My view of America was the same as that of most Americans. I was patriotic. I bought into the

fear of Communist world dominance and the domino theory. But there was much that was being done

in the name of fighting Communist domination around the world that was monumentally counterproductive,

and contrary what we consider to be some of our basic principles.

This book helps fill important gaps in my knowledge. I highly recommend it to anyone who would

like to know what really was going on during the Cold War, its impact on where we are today, and

Kinzer's take on why it happened that way.

Mcgivern Owen L on August 15, 2015

The Cold War at it Core

This reviewer generally takes careful notes while he reads-the better to compose a future review.

In the case of "The Brothers", he was drawn right into the flow of the story.

"The Brothers" covers the period from the late 1940s to the mid -1960s when John Foster Dulles

was the powerful Secretary of State and Allen Dulles was the Director of the Central Intelligence

Agency. They fermented regime changes in Iran. Guatemala, Indonesia, the Belgian Congo and Iran.

And, as many know by now, Cuba as well. The troubles they stirred up in Iran and Cuba persist

to this day. The book jacket also states that the Dulles' "led the United States into the Vietnam

War..." That statement is unproven within these pages. The Vietnam conflict was vastly too complicated

to be reduced to one sentence.

"The Brothers" is sharply written and well documented. There are 55 pages of end notes in a

328 pages of text. Author Kinzer ostensibly turns on the brothers for all their regime changing

activities. He then reverses course and arrives at a most sensible elucidation: The brothers Dulles

were a product of their times and "exemplified the nation that produced them". A different kind

of leader would require a different United States". This reviewer can live with that sentiment.

There was a deadly serious Cold War in session during this period the brothers Dulles were

at the core. Author Kinzer deserves credit for capturing the essence of that era as well as he

does.

Amazon Customer on August 10, 2015

Informative and entertaining while also scary. Author oversimplifies, omits much about diplomacy

besides the Cold War.

This is my third Kinzer book (The Crescent and the Star and Reset), he is a master at spinning

off new books from research collected while writing other books. This work peels back the cover

on U.S. covert and overt foreign policy in the 1950s and what happens when two brothers have too

much power within an Administration that has the public's trust and far too little of its scrutiny.

It is a joint biography of John Foster Dulles and Allen Dulles who were Secretary of State (1953-1958)

and CIA Director (1953-1961), respectively.

Some reviewers have pointed out that Kinzer tends to oversimplify his message. For example,

Eisenhower and Dulles' overthrow of Mohammed Mosadegh, for example, may have had something to

do with our needing Britain's support in SE Asia more than simply a crusade to eliminate anyone

who was not clearly "for us" or "against the Communists." This book covers some of the territory

of Trento's Prelude to Terror, Perkin's controversial Confessions of an Economic Hitman and the

similar compilation A Game as Old as Empire. You may not believe what you read here as the facts

certainly seem more like fiction. Did the U.S. really (clumsily) secretly spend blood and treasure

to try and subvert governments on every continent? How many assassinations and overthrows did

Eisenhower surreptitiously give the go-ahead on? Eisenhower essentially comes across as a monster

from our 2015 vantage point. But is he any different than a President Obama who is given intelligence

and orders drone strikes to assassinate enemies of U.S. foreign policy? You be the judge. This

book speaks volumes about what is learned by declassification of documents over time. I will say

that I read a great biography on George Kennan last year and there appears to be little overlap;

Kennan's foreign policy may have been too dovish for the Dulles, but he had helped create the

precursor to the CIA, the Office of Policy Creation, on which both Dulles brothers worked--this

connection gets no attention from Kinzer. Much of the diplomatic effort during the Cold War--

which did exist-- at this time are left unmentioned by Kinzer, which is problematic.

The Dulles family grew up with an international mindset. One grandfather (John W. Foster) was

an Ambassador (before that title was formalized) to several countries, including Russia, before

becoming Secretary of State.The other was a missionary to India. They had other family connections

working in diplomacy and such a career seemed just fine to them. Their father was a conservative

Presbyterian minister who had an awkward relationship with his wayward children. Kinzer writes

that the boys (and their younger sister) essentially saw America as the City on a Hill that was

bringing light to the nations through democracy and capitalism.

Studying at Princeton hitched them to the rising star of Woodrow Wilson, who they adored.

Sister Eleanor deserves her own biography, she was a pioneer as a PhD female economist who did

relief work in WWI, attended Bretton Woods after WWII, and made her own career in diplomatic service.

John Foster (Foster henceforth) attended the Paris peace conference with Wilson and was disappointed

with the outcome, both he and Eleanor arguing along with J.M. Keynes that the German reparations

were simply setting the stage for the next European war. At the time, Foster was working in international

law for U.S. business interests, and even supposedly ghostwrote a rebuttle to Keynes' book to

serve his own interests. Foster's law firm designed the legal arrangements by which U.S. firms

could profit off the German reparations, which allowed him to be wealthy even during the Great

Depression. He was the more religious of the bunch and was mostly faithful to his wife.

Meanwhile, Allen Dulles was serving in the newly-formed Foreign Service while sleeping with

as many women as would have him. In a "What would have been?" moment of history Allen reportedly

brushed off meeting Vladimir Lenin, after Lenin supposedly called him just before Lenin went to

St. Petersburg for the Russian Revolution, in order to engage in a soiree with a couple of blonde

Swiss females. His own sister recounts that he had "at least a hundred" affairs, and his wife

approved of some and disapproved of others. A sign of the times, they remain married although

she probably miserably. This continued on all through his CIA years and makes one wonder why recent

CIA chief David Petraeus had to resign for anything.

Kinzer interestingly calls Wilson out for being a hypocrite, citing his inconsistent application

of the doctrine of self-determination. While that doctrine stirred nationalist sentiment in Eastern

Europe and the Middle East, Wilson obviously didn't apply it to the Philippines, Hawaii, or other

U.S.-occupied territories. Nonetheless, the three sibling Wilson devotees attend the Paris peace

talks together. Foster returns to his law firm where he's made a full partner while Allen remains

in the Foreign Service until joining the firm himself in 1926.

The author ignores much of Foster's religious interest and involvement in these years. Foster

changed his mind several times in life, whether in his religious devotions or from isolationist

to interventionist. Interestingly, Foster was a German sympathizer and refused to believe any

tales being produced about the Nazis as his firm had many German business interests. Allen disagreed

strongly after touring Germany himself, and after Germany began defaulting on its debts the firm

severed ties.

Allen Dulles built up his network through the law firm, the Council on Foreign Relations, and

his old Foreign Service contacts and made a fortune molding business deals for European connections,

including those in Nazi Germany. After the U.S. enters the war, Dulles is recruited by "Wild Bill"

for the new OSS, becoming the first OSS officer behind enemy lines, sneaking into Switzerland

to do so. He meets with all sorts of characters while feeding intelligence to the U.S., much of

which was false, but enough was helpful enough to expand his reputation. Of course, he has many

affairs, including a long one with a woman his wife approved of and shared with him. Interestingly,

when the Valkyrie operation was launched by German traitors to kill Hitler and restore order,

Dulles was the main contact with the U.S. relaying news back to Washington. The participants wanted

to sue for peace, but FDR officially rejected the olive branch and Dulles was not allowed to negotiate

on any such olive branch. After the War, Truman abolishes the OSS.

Foster helps draft the U.N. Charter and becomes an internationalist, seeing world peace as

a Christian ideal. Foster apparently contributed to the "Six Pillars of Peace" outline by the

Federal Council of Churches in 1942. He eventually reverses after the Iron Curtain falls, becoming

a militant anti-Communist and seeing the USSR as truly and evil empire, the antithesis of everything

American. Reinhold Niebuhr eventually pens critiques of Foster as he begins to promote a black-and-white

vision of the world.

Both brothers backed the Dewey campaign in 1948, which left them disappointed. However, Dewey

appoints Foster Dulles to fill a void in the Senate, which immediately elevates Foster into a

higher realm, although he promptly loses the special election for the seat. Nonetheless, he is

appointed to the State Department by Truman and impresses people in negotiating the final treaty

with Japan in 1950. This makes him a good choice for Secretary of State when Eisenhower is elected

in 1952, and Foster promptly works on a policy of "rollback" to replace the "containment"

policy of Truman and Kennan.

However, Kinzer also writes that NSC-68, a top secret foreign policy strategy signed by Truman

in 1950, was monumental in militarizing the response to the USSR and that the Dulles operated

under an NSC-68 mindset. "A chilling decree" according to Kinzer, NSC-68 called for a tripling

of defense spending in order to prevent Soviet influence from overtaking the West. Allen Dulles

was appointed the first civilian director of the CIA and the die was cast.

The 1950s roll like the Wild West, with Eisenhower signing off on expensive operations, assassinations,

and propaganda campaigns at home and abroad. Supposedly, more coups were attempted under Eisenhower

than in any other administration, and recently declassified documents show that Dulles' CIA actively

engaged in Eisenhower-warranted assassination plots in the Congo and elsewhere. Perhaps Richard

Bissell, Eisenhower's enforcer is more to blame than Kinzer allows. The CIA-backed 1954 coup in

Guatemala was actually initiated by Truman years earlier, but demonstrated Eisenhower's resolve.

"Once you commit the flag, you've committed the country." Dulles' secret armies in Guatemala and

the Philippines needed U.S. airpower for support. If the media went with a story exposing operations,

or a pilot was shot down, it didn't matter-- the mission must succeed once the U.S. was committed.

The CIA even used religious-based propaganda in Guatemala to foment political change, having priests

on the CIA payroll publish editorials denouncing Communism.

Guatemala also showed the intersection of U.S. business interests and foreign policy. The coup

was encouraged by the United Fruit Company, which had been a client of the Dulles' NY law firm

and Allen Dulles had served on its Board of Directors; others in the Eisenhower Administration

had ties. While Guatemala's president was democratically elected, he was a leftist, and anyone

showing Leftist sympathies was to be eliminated, particularly in the Western hemisphere. The

1953 coup of democratically elected Mohammed Mosaddegh in Iran was similar in the sense that it

was made more urgent by Mosaddegh's nationalization of British oil interests after the Brits refused

to let Mosaddegh audit their books or negotiate a better deal. Kinzer writes, however, that

Foster in particular was unable to see anyone as "neutral." Mosaddegh believed in democracy and

capitalism and could have been an ally, but Mosaddegh and others like Egypt's Nasser were nationalists

who favored neither the US nor the USSR, but courted deals from both. Kinzer writes that Foster

saw a danger in a country like Iran becoming prosperous and inspiring others toward neutrality

that might result in eventual creep toward the USSR, hence he and others like him had to be eliminated.

How much the coup was driven to help the UK is unknown. The blowback from intervention in South

America and Iran has since come back to haunt the US in the form of skepticism and greater Leftist

angst against the US and the 1979 overthrow of the Shah.

Ho Chi Minh had initially offered the US an olive branch after WWII and was not opposed to working

with US interests, but the more he was rebuffed the more he turned to harder Communism. John Foster

Dulles apparently hated the French for abandoning Vietnam, and never forgave them. While Eisenhower

did not want to replace the French in Vietnam, he eventually warmed to the idea as Foster promoted

the "domino theory" that if one nation fell victim to Communism then others would soon follow

and the eventual war would widen. Better to install brutal dictators as in Iran and South Vietnam

than let a country fall. Another enemy was Sukarno in Indonesia who was trying to thread the needle

between democracy, socialism, nationalism, and Islam. This type of neutrality was against

the Dulles' worldview, and in his memoir, Sukarno lamented "America, why couldn't you be my friend?"

after the CIA spent a lot of manpower trying to topple his regime in 1958. There was also the

training of Tibetan rebels in Colorado in 1957 and the ongoing plot to assassinate Congo's Lumumba,

given with Ike's consent.

Allen Dulles' reign at CIA reads like the nightmare everyone worried about "big government"

warns you about. Experiments interrogating prisoners with LSD, the purchase to the movie rights

of books like The Quiet American in order to sanitize them, planting stories in major newspapers,

planting false documents in Joseph McCarthy's office to discredit him, along with the private

armies and escapades. Dulles comes under official criticism by Doolittle, who wrote that he was

a bad administrator, bad for morale, and had no accountability-- all of which was dismissed by

Eisenhower who saw Allen as the indispensible man.

Eventually both John Foster Dulles and Eisenhower become old and unhealthy, Eisenhower suffering

a heart attack in 1955 and Foster dying of cancer in 1959. Allen Dulles' libido slows slightly

as age takes its toll and he becomes more detached from operations at the CIA, creating a more

dangerous situation. When Castro seizes power in Cuba, the Eisenhower Administration made

it official policy to depose him. While Dulles was officially in charge at the CIA, he was

far detached from the details of the anti-Castro operations which the media had exposed and continued

at great risk of failure.

Newly-elected JFK inherits the Bay of Pigs invasion plans and faces a political dilemma: Back

off and be accused of sparing Castro since the government was invested in success, or go forward

and risk a disaster. Unlike Eisenhower, Kennedy would not consent to air support or other official

military measures to help the CIA's army once it landed, dooming the operation. Those closest

to the operation begged Dulles and others to cancel the operation to no avail. Dulles was enjoying

a speaking engagement elsewhere in the region, giving the appearance of attachment to the operation

while being completely oblivious to its failure. The White House forced him to resign in 1961.

Dulles' last act was on the Warren Commission investigating JFK's assassination. This was

problematic because Dulles' goal was to keep CIA assassination operations in Cuba a secret. Kinzer

writes of Lyndon Johnson's desire to make Oswald a lone gunman with no political attachments,

which brings us to a whole other story.

Kinzer concludes the book with armchair psychology, writing that the Dulles brothers succummed

to cognitive biases, including confirmation bias. They saw everything in the world as they wanted

to, and not as it was. They were driven by a missionary Calvinism and the ideal of American Exceptionalism

that clouded their lenses. They also seemed to consider themselves infallible in their endeavors.

Ultimately, "they are us," writes Kinzer, which is why it is important to learn from them. The

parallels with recent American military and para-military endeavors is also clear, but Kinzer

lets the reader make those comparisons.

I learned a great deal from the history of this book, studying the Dulles is an integral part

in studying the execution of American foreign policy in the Cold War. Some of the omissions, simplifications,

and psychoanalysis mar the book somewhat. 3.5 stars out of 5.

Doug Nort, on April 23, 2015

Too Much Passion;Too Few Facts

This book is marred by Kinzer's repeated overstatements and failures to marshal facts to support

his theses about the Dulles brothers.

His failure to persuade me begins early: In the introduction Kinzler wrote of the naming of

Washington's Dulles airport: "The new president, John F. Kennedy, did not want to name an ultra-modern

piece of America's future after a crusty cold-war militant." He provides no documentation that

Kennedy himself thought that. Given that JFK was proud of his own credentials as a cold warrior,

it is unlikely that was his objection. It is much more likely his objection (or that of the staffer

speaking for him in the matter) was that Foster Dulles was an iconic figure of the Eisenhower

administration-which Kennedy and his New Frontiersmen viewed as having made a hash of things-or

that he was a stalwart of the Republican Party, or that Dulles disapproved of a Catholic becoming

president. Kinzler apparently thinks his sweeping statement is self-evident but it isn't to me.

A few pages later Kinzler gives us another hint that the pages to come will contain sweeping,

unsupported generalizations. He wrote "The story of the Dulles brothers is the story of America."

My goodness, didn't they share their times with FDR and Ralph Bunche and Dwight Eisenhower and

Tom Watson and A. Phillip Randolph and George Marshall and a host of others who, although coming

from backgrounds quite different from the brothers Dulles, are just as much the American story?

The accomplishments and peccadillos of two brothers with an upper-class pedigree is hardly "the

story of America."

Chapter eleven contains several such unsupported or historically blinkered generalizations.

At one point (sorry-I'm a Kindle reader, no page numbers), after noting "the depth of fear that

gripped many Americans during the 1950s." Kinzler asserts that "Foster and Allen were the chief

promoters of that fear." Crowning the brothers as chief fear-mongers ignores some powerful other

voices: Khrushchev, Joe McCarthy, General Curtis Lemay, Nixon, Churchill, Drew Pearson, Robert

Welch and his John Birch Society-the list could continue.

At another point Kinzler says, "They [the brothers] never imagined that their intervention[s]

. . . would have such devastating long-term effects." He cites Vietnam, Iran falling into violently

anti-American leadership, and the Congo descending "into decades of horrific conflict." Regarding

Vietnam, I think most historians would say that JFK, LBJ, and McNamara bear much, much more responsibility

than do the Dulles brothers. As for their Iran and Congo sins, I believe those developments were

much more due to unpredictable consequences than to the Dulles' blindness. Yogi is right: "Predictions

are hard, especially about the future."

And on the same page (excuse me "location") Kinzler is quite certain that "Their lack of foresight

led them to pursue reckless adventures that, over the course of decades, palpably weakened American

security." The reader who already believes that will nod and read on while the reader who expects

this ringing declaration to be followed by specifics that provide powerful support will read it

and say, like the customer in the fast food ad, "where's the beef?"

OK, enough already. Kinzler's writing obviously pushed my buttons and I wouldn't have finished

the book but for it being a selection of my book club. I am fine with criticism of people and

policies when well-documented-for example Michael Oren's Power, Faith and Fantasy-but I lose patience

with book-length op-ed pieces such as The Brothers.

Dale P. Henkenon, April 6, 2015

Cuba Si! Yankee No!

If a work based on Cold War history could construct a case against American (U.S.) exceptionalism,

The Brothers by Stephen Kinzler would be a strong candidate. It illustrates the dangers of a coupling

of foreign policy and covert operations involving what we now know as regime change.

It is a story of the Dulles brothers and coups arranged by the executive branch triad composed

of the President (Ike) and the dynamic duo of the Dulles brothers as Secretary of State and Director

of the CIA (without congressional oversight) in Guatemala, Iran, Cuba, Indonesia, the Congo and

Vietnam.

It is a story that deserved to be told and it is told well. It is somewhat slow going at the

start and one-dimensional but is a captivating read regardless. It is not a rigorous biography

or history of the era and the events it depicts. It is driven by the thesis that our actions in

the developing world even though driven by anti-communism or American idealism or Christian fundamentalist

fervor (all were involved) can have baleful results.

The results can be so bad that Americans are now resented and even hated and have been for

generations in large parts of the world. Highly recommended.

R. Spell VINE VOICE on March 28, 2015

Who We Are as Americans in the 50s

Engaging historical perspective that while dragging and repetitive at times, has so much information

that frames our world now, and generally NOT in a positive way, that it should be required reading.

Yes, I was aware of the name as a 61 yr old. But I was not aware of their roles. Not aware of

brothers. Not aware of Allen's involvement in the CIA Nor aware of their careers at the massive

law firm of Cromwell and Sullivan.

But reading this was stunning and made me angry. George Dulles was more responsible for the

Cold War than anyone. And documents after the war shows the Soviets were not near as devious as

we give them credit for. But our fear painted a view of a hidden enemy bent on our destruction.

We missed opportunities with Khrushchev. More importantly and totally unaware to me, these guys

we responsible for government overthrows and were actively involved in the 1950s with alienating

Vietnam leading eventually to a horrible loss of civilian lives and more importantly to me, American

soldiers who were led in to the wrong war at the wrong time.

But let us not forget the documented CIA overthrows of Congo, Guatemala,Indonesia and Iran.

Is this America? Well, in the post WWII world, we lost our values and stooped to such tactics.

There are stories here America doesn't study and they should. How the interface of commerce,

politics and war can lead to disastrous results that haunt us today.

Read this book to learn. Not all of it will make you proud. Yes, I learned. And yes, I'm angry

and ashamed.

Schnitzon February 25, 2015

Allen Dulles May have Inadvertently Saved the US from a Nuclear Holocaust

It is ironic that the Bay of Pigs debacle commissioned by Allen Dulles may have inadvertently

prevented the incineration of millions of Americans in a nuclear holocaust. As the author points

out when John F. Kennedy assumed the presidency he was told by his predecessor Dwight Eisenhower

that the invasion of Cuba by Cuban refugees with support from the US should move forward. As a

young, new President of the US, Kennedy did not want to appear weak so when Dulles presented him

with the plan seeking his approval Kennedy found himself in a box.

On the one hand Kennedy had doubts regarding the chances for success. On the other hand he

wanted to appear strong to the people of the US and the world. This was the first true test of

his presidency and legacy. After the abject failure of the operation Kennedy to his credit took

full responsibility in his address to the American people but he would never again trust the CIA

or the military.

Fast forward tot he Cuban missile crisis. If Kennedy had not experienced the Bay of Pigs failure

he probably would have placed more trust in the military and CIA who were vehemently urging him

to bomb Cuba at various stages of the crisis. If he had taken the military's advice it would have

likely resulted in escalation and possibly nuclear war with Russia. As it turned out Kennedy rejected

the advice and negotiated a settlement which saved face for both sides. Kennedy's wisdom born

of a past failure saved the day.

Compelling and informative about an era which had a darker ...

OLD1mIKEon February 17, 2015

The Dulles Brothers. They changed History.

Five Stars. Great book. Readable. Well researched, Informative. Highly recommended for someone

interested in mid 20th century history or understanding the root cause of the anti-american animosity

in certain parts of the world.

The Dulles brothers played pivotal roles in an incredible number of historic events that shaped

the 20th century. They exemplified american attitudes and beliefs of their day and were placed

in positions to act on these beliefs. The book not only presents their part in history, but also

helps us understand the reasoning behind their actions.

I should leave the book review end with the above paragraphs, but I was originally unaware

of how many key historical events of the 20th century the brothers participated in and influenced.

I find it impossible not to casually speculate on their effect on history. John Foster helped

write the Reparation portion of the WWI Treaty of Versailles. Some historians believe German anger

over the unfairness of the reparations to be one element causing WWII. John Foster helped write

the 1924 Dawes Plan that opened the door to American investment in Germany. Even in 1924 John

Foster was obsessed with fighting communism. He saw a strong Germany as an effective stop gap

against communistic expansion. Foster used his affiliation with Sullivan & Cromwell and his friendship

with Hjalmar Schacht, Hitlers Minister of Economics, to increase American investment in Germany

and its industry. Without international investment, Germany probably could not have supported

it's military aspirations. Allen and the CIA was instrumental in the 1953 Iranian Coup that overthrew

the democratically elected Iranian Government to install the Shaw of Iran. This action and the

heavy handed governing style of the Shaw certainly led to some of the anti American resentment

in the middle east today and the Iranian (Islamic) Rebellion in 1979. The Iranian Rebellion probably

helped elect Ronald Reagan in 1980. In regard to Vietnam. Foster, acting as Eisenhower's Secretary

of State, refused to sign the 1954 Geneva Accord. Over considerable objections, John Foster and

Allen chose and installed Ngo Dinh Diem as the 1st president of the newly created Republic of

South Vietnam. Diem had been a minor official in Vietnam and was Interior Minister for three months

in 1933. He had not held a job since. Once in power, Allen's CIA helped keep him there. John Foster

continued to support the escalation of our involvement in Vietnam until his death in 1959. Allen

took a hands off approach to the Bay of Pigs operation (17 April 1961), but as the Director of

the CIA, it was his responsibility. JFK fired him in November 1961. There are JFK Assassination

Conspiracy Theory's that include CIA involvement. It is interesting that Lyndon Johnson personally

chose Allen to be a member of the Warren Commission. Add U2 Spy Planes, Congo revolts, overthrow