Chronic Unemployment Bulletin, 2014

Softpanorama

> Insufficient Retirement Funds Problem >

Structural Unemployment in the USA >

Prev | Contents

| Next

- 20141207 : Temporary Work is Bad for Your Cognitive Health by Yves Smith ( December 6, 2014 , nakedcapitalism.com )

- 20141207 : Why Piketty is a Defender of Neoclassical Economics and an Enemy of Egalitarianism ( Dec 7, 2014 , naked capitalism )

- 20141205 : The Rise of Invisible Unemployment by Derek Thompson ( Nov 9, 2015 , theatlantic.com )

- 20141205 : Fed Watch Ahead of the November Employment Report ( Economist's View )

- 20141203 : Attacking the New Normal of Secular Stagnation by George R. Tyler ( January 2, 2014 The Globalist )

- 20141203 : Why the Next Recession Will Be Different ( Dec 02, 2014 , The Fiscal Times )

- 20141203 : Workers vs. Undocumented Immigrants The Politics of Divide & Conquer ( naked capitalism )

- 20141129 : Possible Headline for Next Friday Best Year for Employment since the 90s Hoocoodanode ( Possible Headline for Next Friday Best Year for Employment since the '90s Hoocoodanode, Nov 29, 2014 )

- 20141128 : Being homeless is better than working for Amazon by Nichole Gracely ( Nov 28, 2014 , theguardian.com )

- 20141128 : Faces of part-time workers: food stamps and multiple low-paid jobs by Jana Kasperkevic ( Nov 28 2014 , theguardian.com )

- 20141125 : At European Parliament, Pope Bluntly Critiques a Continent's Malaise ( Nov 25, 2014 , NYTimes.com )

- 20141125 : Pope visit to the Council of Europe (Strasbourg, 25 November 2014) ( Pope visit to the Council of Europe (Strasbourg, 25 November 2014), Nov 25, 2014 )

- 20141015 : Ferguson protests reveal undercurrent of dissatisfaction with economic inequality ( theguardian.com )

- 20140922 : Those Lazy Jobless by Paul Krugman ( NYTimes.com )

- 20140901 : Franklin Roosevelt On Labor, Wages, and Confidence ( Jesse's Café Américain )

- 20140207 : SP 500 and NDX Futures Daily Charts - Non-Farm Payrolls Tomorrow ( SP 500 and NDX Futures Daily Charts - Non-Farm Payrolls Tomorrow, Feb 07, 2014 )

- 20140207 : Over 1 in 6 Men in Prime Working Years Dont Have a Job ( naked capitalism )

- 20140207 : Neoliberalism and the End of Shorter Work Hours by Christoph Hermann ( January 02, 2014 , Global Research )

- 20131231 : The Task Rabbit Economy by Robert Kuttner ( October 10, 2013 , prospect.org )

- 20131218 : The Impact of Unemployment on Well-Being ( Economist's View )

- 20131020 : Ilargi Winter In America Gets Colder – Why We Choose Poverty ( naked capitalism )

- 20130807 : They wont be lovin it: McDonalds admits 90% of employees are on zero-hours contracts without guaranteed work or a stable income ( The Independent )

- 20130728 : Misdirected QE is mere sleight of hand by Henry C K Liu ( Jul 17, 2013 , Asia Times )

- 20130728 : Is This The Recovery Obama Is Talking About ( Zero Hedge )

- 20130728 : A charted history of robot evolution, and some thoughts on jobs ( FT Alphaville )

- 20130728 : Software eats the world, charges for the privilege ( July 22. 2013 , FT Alphaville )

- 20130728 : The Edifice of Recovery is Crumbling by Phoenix Capital Research ( July 24, 2013 , Zero Hedge )

- 20130718 : Research Labor force participation rate expected to stay flat through 2015 ( Calculated Risk )

- 20130718 : Weekly Initial Unemployment Claims decline to 334,000 ( Calculated Risk )

- 20130718 : Eligibility for Unemployment Insurance Benefits ( Eligibility for Unemployment Insurance Benefits, )

- 20130718 : Mass Layoffs (Monthly) News Release ( Mass Layoffs (Monthly) News Release, )

- 20130709 : Fed Watch A Solid But Not Spectacular Employment Report ( July 05, 2013 , Economist's View )

- 20130709 : Why Underemployment May Be Worse Than It Looks ( Why Underemployment May Be Worse Than It Looks, Jul 09, 2013 )

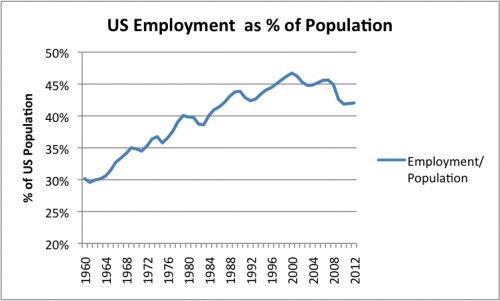

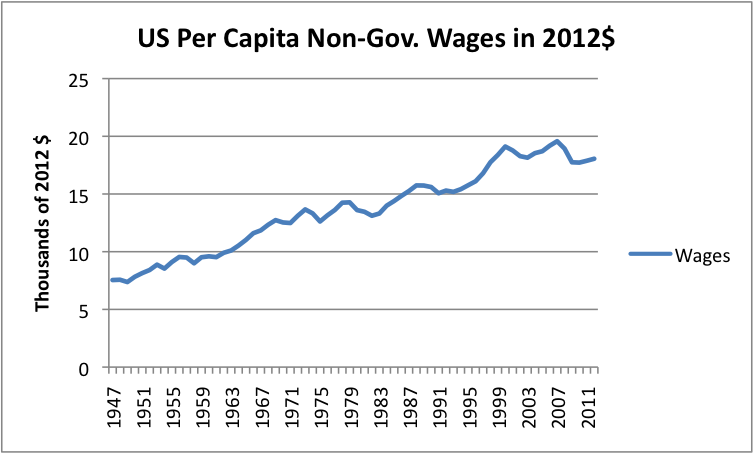

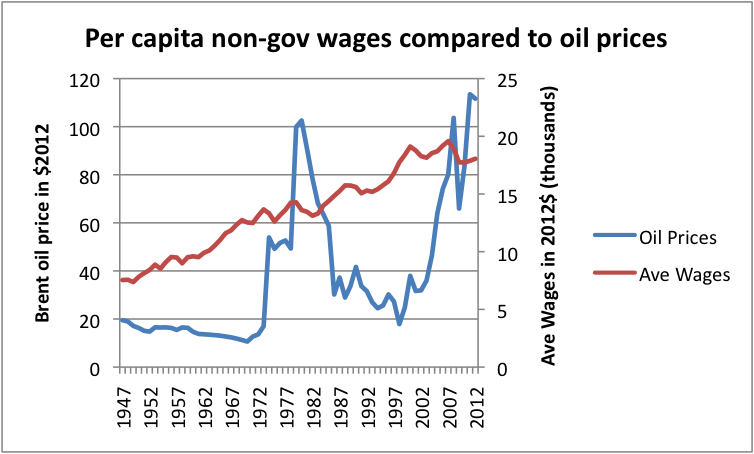

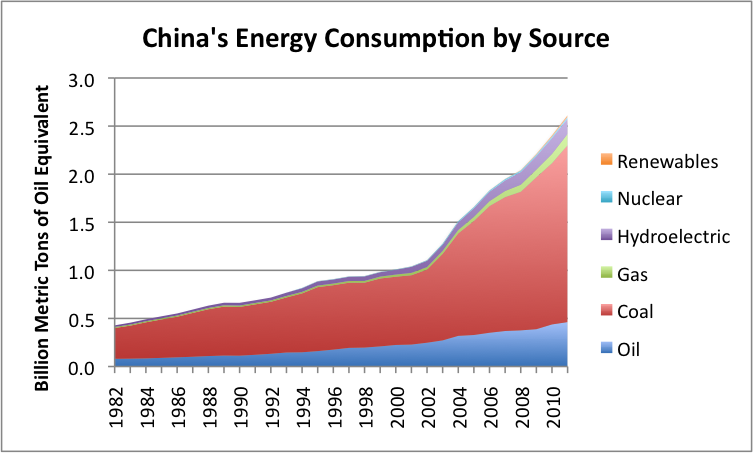

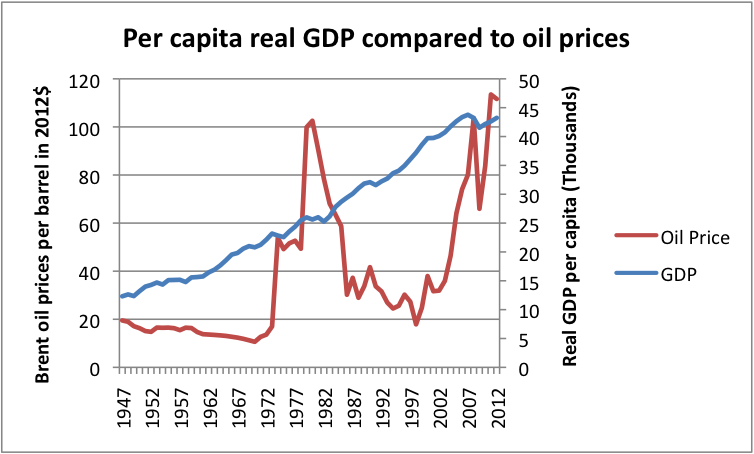

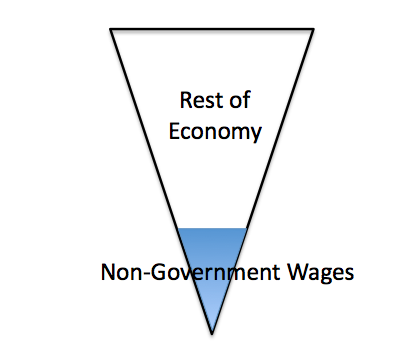

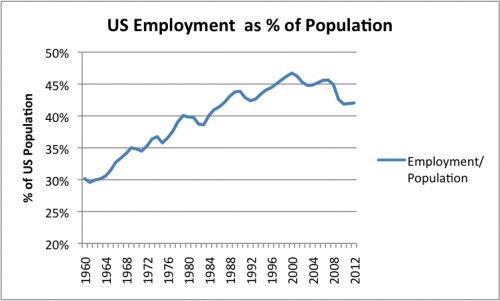

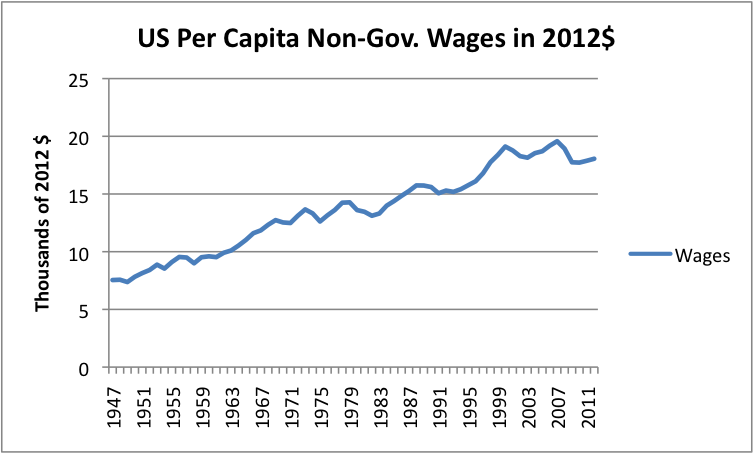

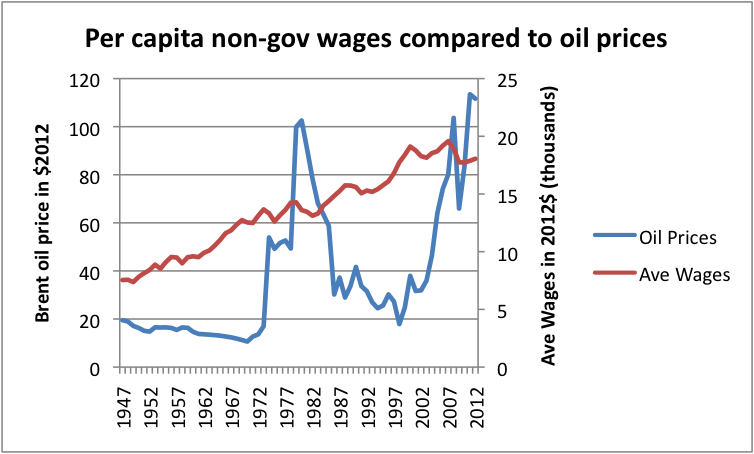

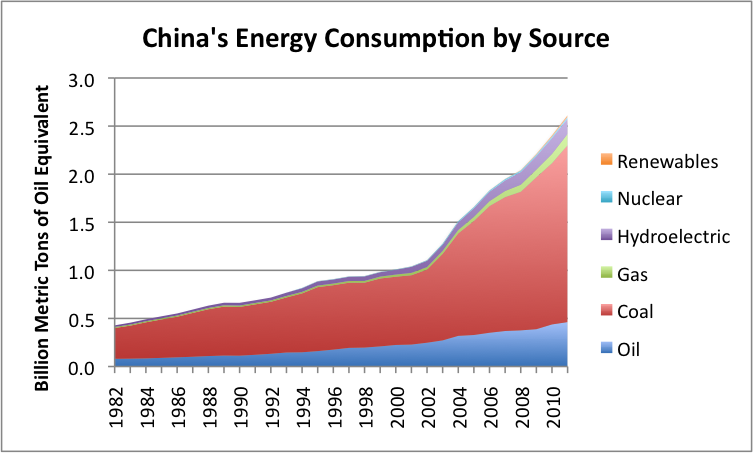

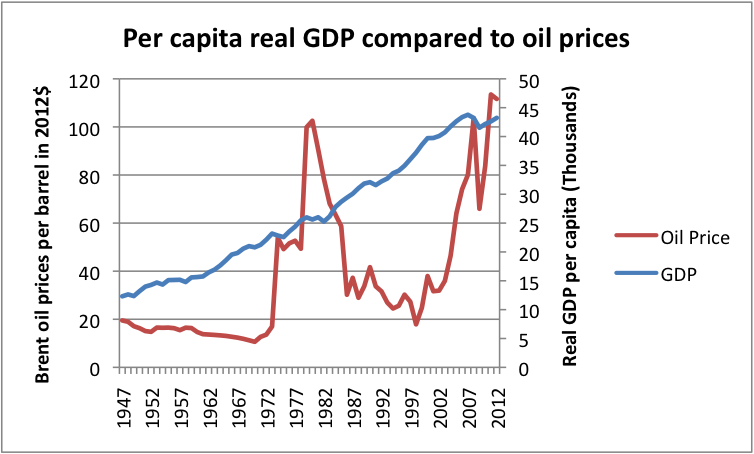

- 20130630 : The Oil Drum The Connection of Depressed Wages to High Oil Prices and Limits to Growth ( The Oil Drum The Connection of Depressed Wages to High Oil Prices and Limits to Growth, Jun 30, 2013 )

- 20130630 : Globalization and Macroeconomics ( June 19, 2013 , NYTimes.com )

- 20130620 : Men are disappearing from the workforce by Tami Luhby ( Jun 19, 2013 , CNNMoney.com )

- 20130527 : Tech Titans Are the New Masters of the Universe, Be Afraid Kotkin Daily Ticker ( Yahoo! Finance )

- 20130523 : Overdue Student Loans Reach Record as U.S. Graduates Seek Jobs by John Hechinger ( Bloomberg )

- 20130522 : In one chart we have a demand problem, not a skills problem by Heidi Shierholz ( Economic Policy Institute )

- 20130522 : The Internet Kills More Jobs Than It Creates by Jaron Lanier ( The Internet Kills More Jobs Than It Creates, )

- 20130522 : Yahoo! Finance ( Yahoo! Finance, )

- 20130512 : How Austerity Kills by DAVID STUCKLER and SANJAY BASU ( May 12, 2013 , nytimes.com )

- 20130512 : Goldman Caves The Unemployment Rate Is An Inappropriate Measure Of The Labor Market ( 05/06/2013 , Zero Hedge )

- 20130512 : The Fed Dials the Wrong Unemployment Number ( Economist's View )

- 20130508 : Rising Structural Unemployment by Tim Duy ( Rising Structural Unemployment, May 08, 2013 )

- 20130508 : Delusions of Economic Recovery by PAUL CRAIG ROBERTS ( May 06, 2013 , Counterpunch )

- 20130429 : Could Automation Lead to Chronic Unemployment Andrew McAfee Sounds the Alarm ( Forbes )

- 20130429 : The Clear Signs of a Global Inflationary Tsunami Are Already Visible Around the World ( Zero Hedge )

- 20130407 : Summary for Week ending April 5th ( Apr 07, 2013 , Calculated Risk )

- 20130310 : Fed Watch: A Solid Employment Report ( Fed Watch: A Solid Employment Report, Mar 10, 2013 )

- 20130310 : The Employment Situation -- February 2013 ( Economist's View )

- 20130310 : Jesses Café Américain US Unemployment Rates Adjusted For a Constant Labor Participation Rate ( The current elite just don't care... )

- 20130212 : Guest Post: The Siren Song Of The Robot ( Guest Post: The Siren Song Of The Robot, Feb 12, 2013 )

- 20130209 : That Robot Economy And The Rentier Class ( Forbes )

- 20130209 : Two Thirds Of Americans Aged 45-60 Plan To Delay Retirement ( Two Thirds Of Americans Aged 45-60 Plan To Delay Retirement, )

- 20130209 : Obsolete Humans Why Elites Want You to Fear the Robot Alternet ( Obsolete Humans Why Elites Want You to Fear the Robot Alternet, )

- 20130209 : Guest Post: Why Employment In The U.S. Isnt Coming Back ( Guest Post: Why Employment In The U.S. Isn't Coming Back, )

- 20130209 : Guest Post: Why Employment Is Dead in the Water ( Guest Post: Why Employment Is Dead in the Water, )

...The negative consequences of dual labour markets have been extensively documented, but so

far little attention has been paid to their effects on workers' on-the-job training and cognitive

skills. This column discusses evidence from PIAAC – an exam for adults designed by the OECD in 2013.

Temporary contracts are associated with a reduction of 8–16 percentage points in the probability

of receiving on-the-job training, and this training gap can explain up to half of the gap in numeracy

scores between permanent and temporary workers.

Starting with the seminal work by Saint-Paul (1996), there has been a large literature documenting

the negative consequences of dual labour markets in several EU countries.1 Among them,

Spain is often cited as the most extreme example, since its labour market is characterised by a

large gap between the firing costs of workers with permanent and temporary contracts, and by lax

regulation of the use of temporary contracts. Yet, so far not much attention has been paid to the

effects of dual labour markets on workers' on-the-job training (OJT) and the subsequent effect of

the latter on cognitive skills.2 A new element to add to the ample evidence of the negative

effects of duality on other dimensions of worker's performance is provided by the Programme for

the International Assessment of Adult Competencies (PIAAC), the exam for adults designed by the

OECD in 2013, in the spirit of the PISA exams but for the working-age population.

... ... ...

Concluding Remarks

The evidence presented above is not, strictly speaking, a 'smoking gun' of a harmful effect of

temporary contracts. Due to the nature of our data (a cross section), we cannot credibly establish

unambiguous causality for the statistical relation that we find. However, the evidence is quite

suggestive. We hope that future analysis will allow for a clearer causal inference, but given all

the evidence (not just ours) accumulated so far on the detrimental effects of dualism, we should

keep the suspect under house arrest and heavy police surveillance. If it really is a social danger,

we should at least try not to do more damage.

See

original post for references

Jeremy Grimm, December 6, 2014

What an annoying piece of writing! I do not believe the authors have ever worked as temps.

[I worked many years as a job-shopper to the Military-Industrial complex, a temporary engineer-programmer,

also called a contractor. No! I am not proud about it. I saw when I first started engineering

school how engineering was turning into a well-paid, but for other reasons crappy job. When

I was a kid, I saw an entire generation of the best engineers laid-off after man walked on the

moon. We all make the "best" choices open to us.]

Take the issue of training. Temps are not trained because often they are hired to provide

skills unavailable from the permanent employees, call them directs. Without some investment

in training, both time and money, directs generally lack the skills hired in with a temp. We

were always called "hired-guns", recalling the gun-fighters hired for their speed, shooting

accuracy, and willingness to shoot anyone identified as a target.

In other cases temps are hired with the needed skills, usually no different from the

skills of permanent employees doing the same job. The temps fill out temporary and long term

increases in demand for a good or service but ever remain expendable. One or two decades ago,

temps earned a pay differential for their mobility and easy expendability. In any case they

help put fear into directs.

The management at every job I was on went to lengths to create an enmity between directs

and temps. It was common practice to lay-off directs whenever opportunity presented, while

keeping the temps because they could be laid-off on a whim. Temps were often used as a prod

to push directs. As a temp I was expected to perform without training and without more than

a cursory description of the work required. Temps must read their clients desires and produce

accordingly. This is a skill lacking in many directs who require some efforts expended to explain

what was required of them.

My experiences as a temp worker clash greatly with the conclusions of this piece. Temps

have to come in already knowing the job. They have to perform or they will be laid-off,

sometimes within hours. In many cases they are expected to outperform directs and supplement

skills directs never developed. Of course, they are not trained. They are expected to bring

the skills with them. What is unmentioned in the article - often directs are not trained either.

I do not know what kind of temps and what kinds of employment the authors of this paper studied.

As I indicated above, temps are a way to steal the skills trained by other employers or to take

advantage of those who are "Smarter than the average bear" to get jobs done. Temps also give

employers a tool for increasing the anxiety of directs and forcing speedups with the stick -

"If you cannot perform as quickly and as well as the temps we keep, you too will be cast off.

Do you want to join this band of hired-gun gypsies?"

Temps give employers a tool to tell their employees how very fungible and unimportant

they are. In the days of unions, what are called temps now might have been called "scabs"

in some cases. I work in an amalgam of engineering and programming. I feel little guilt about

having worked as a job-shopper in the past and as a "consultant" in the very recent past - soon

to be unemployed. Engineers and programmers are too stupid and arrogant to ever form a union.

They are "Mexican-crabs" of the workplace (please forgive my use of a term sounding racist.

I am not racist, the term is, and the image fits too well not to use it).

Any engineers or programmers reading my comment may be my guest at feeling insulted. As a

group we deserve it, and I will go so far as to include myself if it pleases you! Lawyers are

already a casualty, but medical doctors remain as one of the last of the professions. For all

but medical doctors, profession only means that employers can legally not pay for overtime,

they neither pay time-and-a-half nor pay straight-time for hours worked. Though elliptical to

this discussion, we will all be professionals soon. It pains me to watch the demise of the medical

profession as they become subsumed into the Medical Industrial Complex.

Moneta , December 6, 2014

Unless it's for a very particular kind of job…

- -Lack of commitment on both sides

- -Lack of trust on both sides

Probably the 2 most important elements for mid to long-term business success.

craazyman, December 6, 2014

they certainly have less job security but I don't know about less cognitive skills.

if sucking up, ass kissing, looking busy, paper pushing, going to meetings and generally

unctuous bloviating are part of the family of cognitive skills then yes, temporary workers are

at a decided disadvantage. No doubt. They usually actually have to work!

to be fair, I tried to look up the original article to see what kind of inane madness was

on that test for cognitive skills but the link didn't seem to load. I admit, maybe I'm being

too cynical. (but I doubt it hahahahahhaha) sorry

Paul Lafargue, December 6, 2014

Can it be that the prime force behind devaluing labor – as in the dignity of work – are the

capitalists, freed from countervailing forces (a labor movement, government regulation, ethical

guidelines promulgated by esteemed religious figures), who gut whatever meaning remains in the

concept? Historically, can we say that the inherent value of labor (dignity) in great part motivated

the outrage of the proles of a previous era and was an impetus to fight back in order to achieve

what shreds of dignity could be achieved through solidarity? Let's assume these premises, then

is it logical to conclude that a large component of the current labor force is devoid of the

notion that there is Dignity in Labor? Further, again adopting all these assumptions, is it

important to revive that notion, by for example advocating a JG? Or, as I believe, is it better

to re-think the concept of Labor in such a way that it is divorced from the notion of a job

and squarely embedded in the tasks that promote social and individual well-being. These musings

may be criticized as an ahistorical quest for an age long gone when Labor was coterminous with

Skill, but I think we can imagine (and that may be the first step to realization) Labor more

as a ludic enterprise that may encompass skill as one aspect, but not a determining one. Those

who know the work of Johan Huizinga will recognize the drift of these remarks.

diptherio, December 6, 2014

Two words: worker co-ops

jrs, December 6, 2014

Has anyone here ever received on the job training even in jobs that lasted years? Oh probably

a boomer back in the days then? Because training is rare these days.

Management and so on are sometimes sent to training – it's a function of hierarchy of course.

Of course things might be different in the EU.

Alcofribas, December 7, 2014

Not at all. Inequalities of training curves follow exactly inequalities of salary and

robustness/precarity of jobs.

One only grants rich ones. It's a systemic faithful rule of [neo]liberalism, and so worldwide

applying.

not_me, December 6, 2014

Again we have the conflation of work with jobs; neither requires the other; one can work

without a job (ie. be self-employed) and one can have a job that does no or even negative work

(destruction) such as the military often does.

And it's a losing conflation too, from an equality standpoint, since eventually capital will

eliminate the need for almost all human workers. From whence jobs then? Pathetic and patronizing

make-work from the government?

Rather, we should aim for justice and let jobs take care of themselves since justice can

never become obsolete or be outflanked.

hunkerdown, December 6, 2014

Why would we want to *maximize* work? Trying to accelerate the heat death of the universe,

are we, or just the death of the underclass?

To hell with that Stakhanovite rubbish. We need livelihoods, not work. Work presents

itself well enough as it is.

rur42, December 7, 2014

Meaningful work … almost oxymoronic. "what kind of job do you want with that degree in sociology?"

asked the older halfbrother.

The younger halfbrother (born post WWII) replied, "I don't know, but I want to get a job

I like."

"Good god!" exclaimed the older halfbrother, born preDepression era. "I worked for 40

years and not once, not one goddamned time, did I have a job I liked."

Times change.

rur42, December 7, 2014

Should add: Younger halfbrother eventually became a tenured professor of sociology in a job

he came to loath, except for its benefits, salary, and free time.

washunate, December 7, 2014

I didn't intend to get into a detailed exchange on this. But you do raise an important clarification.

In a nutshell, especially the American context, I would describe temp work as when the employee

knows they need to be looking for another job. This could be for a number of reasons – the job

will move and the employee doesn't want to, the job will disappear, the job pays less than other

jobs, the boss is terrible, the next assignment is terrible, there's no room for growth, etc.

But the common principle in MMT is that JG is not designed for long-term mass employment.

It's supposed to transfer workers to the private sector. That's temp work.

Or are you suggesting that 100 million workers should be on the public payroll indefinitely?

Maybe more than that?

Just to put some numbers to things:

99 million workers made less than $40K last year (SSA #s –> totally random number since MMTers

can't agree on even a rough figure for the JG wage to be)

2 million people in prison who obviously don't want to be there, including 1 million who are

working as modern day slaves

92 million people not in labor force (BLS #s)

13 million full-time students in higher ed (NCES #s)

So that's about 200 million people (some overlap between full time students and workers,

of course - hmm, I wonder how the cost of college keeps going up despite massive unemployment

if buffer stocks are supposed to act as price anchors?). And of course some people are quite

happily retired, almost as if not going to work is more fulfilling than going to work…

To suggest that even a small portion of those who would benefit from a JG would have a job

as long as they want it is to say that the government will expand public sector staffing on

a massive scale. I'm not saying that can't happen. Quite the opposite, I'm taking seriously

what it would mean to offer an actually decent term of employment.

Rather, what I have run into is that when I suggest a JG that provides good working conditions,

meaningful work, and decent pay would attract tens of millions of workers, I'm usually ridiculed

for such absurdly high numbers.

But it can't go both ways. Either the JG is low-wage temp work that gets people back into

the private sector, with all the attendant problems of inequality and poor job performance inherent

in crap jobs, or it's a career opportunity that will massively expand the scope of government

permanently.

Now I'm not instinctively opposed to the latter; many Americans, especially younger ones,

are openly socialist, and it's a position that should be taken seriously. But it's not what

MMT is talking about. MMT is still fundamentally rooted in the idea of private sector decision-making,

right down to valuing increases in net private sector savings.

Moneta, December 7, 2014

The word stupid crossed your mind, not mine!

Cognitive refers to how the brain processes data. Without the temp work, he most probably

would not have had the same thoughts which made him structure his life around fear. Therefore

the temp work had a cognitive impact.

Jeremy Grimm, December 7, 2014

Fear? Others may speak for themselves – yes fear.

I became an engineer through fear. I have other gifts I might have tried. I working as an

engineer for DoD out of fear, as I watched non-DoD engineering jobs disappear and turn to shit.

Fear and anger against my employers kept me working as a job-shopper.

I quit job-shopping when I married - very late in life. It took me too long to learn my greatest

desire was to have children and a family. I greatly feared losing the mobility which kept me

employed.

Fear kept me working for the same consulting company as the market for engineers grew grimmer

than when I started work in the middle 70s. I had my two children and not too long thereafter,

I was divorced for reasons I still neither know nor fathom. Fear kept me working in engineering

as I grew older. Did you know once the state of New Jersey sets your child support payment,

based on your employment at the time of your divorce, changing it, whether you lose your job

or not, is nearly impossible - and not paying the set amount could place you in jail? Yes, fear!

As I grow old, the costs of college for my children, medical care, housing, and food grow

- some like college and medical care growing at rates I could never have anticipated and never

properly saved for. I am very afraid for the future. I am afraid for my children and the kind

of life they may have as the world I knew, and watched collapse, grows worse by the month. So,

yes I fear.

As I face unemployment, two years before retirement age, I cannot share your optimism that

I can probably land another job - unless you mean I could leverage my past experience working

graveyard cleanup crew and hamburger flipper for Foodmaker Corporation. So I fear losing my

job, such as it was.

Where we might disagree though is whether fear is a part of just middle class culture. I

know and have lived with those I considered poor, certainly not middle class in their values.

They too know fear - fear as well as they know hunger - a feeling I have so far avoided.

Remember the wisdom from "The Prince", whether it is better for retaining control to be loved

or feared?

What of the rationality of my fears? Fear is not a rational emotion. I believe a rational

thinker coldly examining my situation would feel fear. Middle class culture inculcates fear

- fear of slipping from the middle class. Is that fear so irrational - just a part of middle

class culture? I believe it is an ancient fear lived out lifetime-by-lifetime as those few who

rose up from poverty saw how many slipped back into poverty. I do not believe the wheel of fortune

spoke to kings and lords.

I remain fearful. My theme for many years comes from an old folk song, Joan Baez sang, which

admonishes "whoever treasures freedom, like the swallow, will learn to fly." I would fly - but

I do not know where to fly to. I am too old to be a revolutionary.

I fear too many of those younger than I am, facing situations more dire than any I faced,

will also not know where to fly to. Given how little it would cost to avoid this growing desperation

I believe those who own our fates have lost their way. I fear the consequences and long to get

far away from any large cities. When there is no hope left and nothing left to lose - nothing

will hold back the anger and blood lust of the disposed. I fear our lords and ladies are too

confident in their trust to militarized police, NSA, Blackwater and their like for defense of

their privileges. I fear becoming part of the collateral damage.

So yes, scared, and whether rational or not fear.

More directly referencing your comment - do you really believe engineers "can probably land

another job etc.?" and hence their fears are irrational or middle class? Most of the jobs for

engineers, to replace the job I will lose, are a thousand miles away and a thousand figurative

miles from the work I have done in the past. Employers started hiring people only to work at

jobs they have already done for years. That is why there are so few "quailed" STEM workers.

Except for the few scattered duplicates of my present job, my prospects are not bright. Fear

is not irrational. What makes my fear grow is how much my prospects are better than those of

the large part of our population seeking employment. Projecting my fears upon them and transforming

them through the options of this other population I grow extremely fearful of what may come.

Like the swallow, I would fly away - but to where?

Alcofribas, December 7, 2014

Thank you for your contribution, you nail the undergrounded reason why not only individuals

but entire societies become hopeless. Fear.

Remember the wisdom from "The Prince", whether it is better for retaining control to be loved

or feared?

Wisdom ? In the old days, power was conquered by arms, and retained with dogmas and affective

common events, celebrating the nations' self confidences. 1% of populations was educated. Now,

in themselves called democracies, only the way to reach the power level is apparently democratical.

The use of institutions is not. What to think about the 1787 Constitution of USA ? The best

religion to keep people fear and obey is neoliberal economy, dedicated to educated but frightened

and individually exploded populations. In the name of individual freedom, of course.

What is equal freedom when some play with good cards and the largest part of humanity with bad

ones ? When few rule the rules and others don't know obscene rules (out of the public scene)

? A mechanism to enlarge inequalities and a common suicide. The best ideas, as freedom, when

led to extreme, drive to the worst. Running fair institutions, fair rules, cannot be done with

faith of many in few representatives. Of course, families and frienships are broken by enforced

job mobility. Lost in translation…

"Democratical" powers are lost too or become schizophrenic. Huge promises to common citizens

during campaigns followed by crucial choices when elected : to have or not to have the courage

to change rules, reform institutions when they appear to be structurally unefficient ? PRC hasn't

this problem, runs a safer and cleverer capitalism…but treats people as unbrained chess pieces.

Can Dollar remain the widespread exchange money ? If for common american citizens, the interested

answer is NO (US public debts can only increase), for TBTF bankers and many congressmen, the

answer is YES : they don't sincerely regulate finance markets to protect citizens and real economy

enterprises. Financial markets rules the politician agendas. An instable world is good for speculators,

their greatest fear is to loose the power to evaluate the wealths of States's public finances,

firms values, labor's retribution. Going back to the 1936-1971 conception of banking ? Was the

american people happy with bankers during those days ? Is financial globalization a huge private

card for keeping UNO and democracies powers stupids ?

Like the swallow, I would fly away - but to where?

Can you escape from earth ? No and neither me. So the answer to feel secure for ourselves and

future generations stands on two points imho : 1- what I can do alone (effectively to be poor

in open country is not a life without beauty, even if rude), 2- what I can do as a social being

(to find out with others how to make democracy evoluate).

First solution is the hermit choice, or hermit community, that can be a solution for an existing

person, but not for his descendants. You can do that inside the local national you're living

in. Second is to recognize we are not what the liberal dogma says, simply individual living

objects that product and consume, born with good or bad cards in our hands. The difficulty is

just that 200 states organizations are unable to fit the problem of global challenges, climate

changes or finance regulation or inequal capitalism, for examples. You first need in that case

to understand what your citizenship has become, on 7 december 2014. Is it only New Jersey and

America based ? Or should it be World based too, but isn't ? So my answer stands here : I wish

you not to fear or dream for a fly to nowhere, not to dream to a sudden and perfect and unalterable

divine change of rules and powers structure, but to be convinced that billions of citizens worldwide

share with you the will of stability rather than profit. From purely ideological solutions,

communism and liberalism, teached on different territories to be both the best/the worst things,

we have to convince ourselves none was pure and true, but a part of truth stood in both, and

that the planet will be a very safe and beautiful place to leave on if we manage to bring up

new politicians, more balance managers than heroes. Democracies are sick, shooted with liberal

drugs that benefit to few and destroy many lifes. Fascimus trends go up, but the worst has not

come yet and can still be avoided. We have to keep lucid peoples for that.

optimader, December 7, 2014

Your comment is far more insightful than the article.

I observed highly skilled PEs of my fathers generation offed in perpetual fear of being offed

in the 1970s when they were in their late 40s-early 50s. Ugly. Observing them focused my personal

strategy.

The only real difference between permanent employees and temps is that the permanent

employees don't realize they are also temps. The bottom line is skillset, the one thing

a former employer cant do is take away what you know.

Lambert Strether, December 7, 2014

"The only real difference between permanent employees and temps is that the permanent employees

don't realize they are also temps."

Reminds me of the time I pointed out to a supervisor that there was no yarn on the floor

for the morning shift. Because of the layoff to come in a few hours, stupid me.

hunkerdown, December 6, 2014

I think Massinissa is correct. There is a class that feels itself entitled as a matter of

identity and tradition to exclude others from control over the means of production, and one

suspects they would sooner not live than live without their tradition of uselessness.

NotTimothyGeithner, December 6, 2014

Anecdotally, my next door neighbor had to be separated from his family for contracting work.

His wife wanted to stay with the kids*. Eventually, they moved, but the kids had to leave their

friends. The woman across the street divorced her husband over a similar situation. It's not

just the mental health of the worker but the family.

*The wife didn't take care of their hydrangeas, and the kids are ruining a hedge in Colorado

now and not leaving my gate open. All in all, my mental health has improved considerably since

they left.

Pepsi, December 6, 2014

Being stressed, exhausted, and poor is bad for the mind. Good to see some empirical evidence.

Noni Mausa, December 6, 2014

Controlling for motivation seems to me to consist of controlling for naïveté, or its opposite.

My current, half time job is a case in point. I get very little explicit training (the corporation

doesn't even have a training manual, for instance.) Yet, I am expected to know our point of

sale system, ship and receive, care for customers, understand and demonstrate our hundreds of

tools and paints and finishes, accurately recommend materials and tools for specific projects,

open and close the store, cash out and take in the deposit at the end of the day, create signage

and displays, clean the building, including the lunchroom and washrooms, and more. Any upgrading

of my knowledge of using our tools and supplies, I am expected to do on my own time at my own

expense. I am also expected to keep abreast of our many rotating sales and, I was told a number

of times, to memorize all the SKU numbers of our thousands of stock items. (Yeah, like that's

going to happen.) I am a keyholder, have been there 18 months, and am not in line for any bonuses,

raises, or other benefits. I make $11.25 an hour, about 75 cents above our minimum wage.

Why am I still there? Only because I am retired and find the job an interesting pastime,

which I can leave at any time without a backward glance. There is zero loyalty on either

side, and I could easily put down my clipboard any time and say, "You know what? I don't need

this."

My fellow staff members, including our young, overworked manager, do need the money, but

their stress levels from overwork and unrealistic demands cannot be good for their health.

Alcofribas, December 7, 2014

Some things to be explained to US contributors :

1- Till the 70's, Spain was not a democracy but run by a fascist regime. It hardly makes

2 generations. Not enough to change minds and turn them into respect of workers as doubtless

Know-how wealth of the firms. Quite the opposite of german situation, in which Kurzarbeit (time

reduction of work/incomes for everybody inside the firm when orders slow down, but no difficulty

for restart after the bad period, at no training cost and no research time loss).

2- There stands a main difficulty inside Europe, while inside the euro zone two employment

markets, supported by two different layers of cultural skills interfere. The study nails

rightly that in south european countries, a post feudal scheme of societies separates the population

in two parts : strong rights granted one, middle and upper class, and large far less granted

one.

A kind of two levels of citizenships system that underlay all relationships, very evident

in terms of temp or permanent jobs, without any consciousness that quality is everywhere in

the firm (from the boss to the few considered worker) or isn't. Management is there a purely

hierarchical organization, some taking all decisions, others executing them. Mix that with the

old taylorist division of tasks and you get it. In the north countries, despite of recent neoliberal

taste for financial profit even in manufacuring firms, the project culture and importance of

many small self-governing firms make for long a true concern for everyone in the firm's life.

This of course relies on very strong attachment to local social life, and technical improvements

are seen as survey conditions. Of course too, there only can be found two colleges co operating

together the strategical management of firms, one with employees, one with managers and shareolders.

Both being responsible of good or bad decisions, what Germans call Mitbestimmung. Not only the

single labor market is largely dominant, but unemployment increases slowly in that case, without

considering state's sectorial implications to enforce specific policies. And don't forget that

the cohesive action of Landern (micro economy) and federal german (macro economy) powers is

a real success.

3- Mobility for jobs inside Europe is strictly reserved to high educated people, because

of the creation of a continental multicultural country by union of many micro states. When nothing

has been done seriously to give all european citizens multilinguistic skills, engineers (speaking

3-4 langages) can easily find jobs where they are, and masons and carpenters are captive of

local employment situations.

4- Applying the selective dogma of comparative specialized competences, most european governments

have made of Europe a catastrophical continental area with well and bad diversified zones. Spanish

growth depending massively of building sector, spanish economy was brillant when financial risks

were taken by the government, local powers, banks and the citizens. Miracles don't exist. Never.

5- Inside a common money zone, you need a central state. Both to stop divergent local economical

policies, and to protect people when a great crisis occurs. Without this, some zones hardly

impressed severely fall down and no help is to be expected to restart economy and prevent deep

social consequences.

6- Potential Europe's GDP is being injured. Young generation of Europeans is now paying for

the irresponsible acts of their parents : maintaining local sovereignties in the macro economical

competence is a major political fault.

sgt_doom, December 7, 2014 at 3:07 pm

If only Thorstein Veblen were alive. Imagine what total mincemeat he would make of either

Piketty and Krugman for their reasoning.

Moneta, December 6, 2014 at 7:18 am

We are not going to get to equality – if we do ever get there – in one giant swoop. It's

going to be a little bit at a time, one idea at a time. And Picketty's work is somewhere along

that spectrum. It's still on the neo side, bit it's enough to get the neos rethinking their

ideologies. Then, when the neolibs have finally digested the fact that we need a little redistribution,

somebody else will come along with something a little more "osé".

And so on… if new ideas are too extreme, the neolibs will NEVER get converted, they will

just push back

hunkerdown, December 6, 2014 at 2:32 pm

Why would they understand something that goes against their class interests?

Frankly, one of the few advantages of the (insufficiently warmed) "melting pot" is that it makes

white cultural imperialists look silly. If one isn't particularly attached to the Establishment

and the claims it enforces (whether simply by the circumstance of bearing no such claims, or

by disinterest in what is on offer), it's better to prevent the ownership class from their superficial

ethical pleas that they have common cause with those outside of it, so that they can be prevented/extracted

from involvement within the political spheres in which their participation and presence are

*at best* a formerly necessary but now obsolete evil.

Moneta, December 6, 2014 at 8:52 pm

The neoliberals are not only found in the establishment.

NoFreeWill, December 6, 2014 at 3:26 pm

Actually it is extremists, like Malcom X, Communists, and the Tea Party, that scare the elite

into granting Martin Luther King a pulpit (and civil rights legislation), unions, FDR and welfare,

social security, etc., and government shutdowns/Republican resurgence. Reformism has only ever

succeeded when married with a more extreme threat (violence) waiting in the wings.

Moneta, December 6, 2014 at 8:45 pm

The thing is that in this case the extremist will only be able to accomplish anything once

the average population understands the full extent of the wealth distribution problem…

Which was not the case a year ago or even two. Why would the establishment be afraid

of extremists if they have no sway on the average Joe?

Vatch, December 7, 2014 at 12:16 pm

I believe that technique known as "Good cop, bad cop".

Moneta, December 6, 2014 at 7:43 am

To everything there is a season, a time for every purpose under the sun… All research shows

that Westerners, Americans in particular, were totally out of touch with the reality of wealth

distribution.

Pipetty's book has finally pulled the scales off many eyes. It has finally opened up the

conversation. That's it, that's all.

Now it's time to move on to the next step. No one book or person will offer the holy grail.

Moneta, December 7, 2014 at 7:26 am

And maybe it's not the book that opened the eyes but the eyes opening and/or the awakening

that propelled the book.

A case of what came first, the chicken or the egg? The population needs to understand the

extent of the theft (which is still not well understood) before anything can change.

This is perception vs. reality:

http://www.ritholtz.com/blog/2013/03/wealth-inequality-in-america/

MartyH, December 6, 2014 at 7:53 am

Thanks for pointing out an important video. Both speakers make interesting, and ocassionally

controversial, points but in the end, several simple things stood out. They agree that the ISLM-dominated

professional foundation ignores "money" and, thus, credit (leverage). Ultimately, that means

that Economics is attempting to be scientific without dealing with one of its foundational concepts.

They also recognize other weaknesses but I felt Yanis's comparison of Piketty's position with

that of John Rawls and the recounting of Nozick's Libertarian attack on that position was most

valuable.

I generally like to give authors, academic or otherwise, a chance to mature before coming

to some of the conclusions these speakers and so many others have drawn. Piketty's argument,

as I understand it, represents a recognition and validation of a condition. I think we should

give him and the community time to mature that thinking and help it evolve, hopefully in ways

suggested here.

susan the other, December 6, 2014 at 12:49 pm

Thank you for this interview. What to do with an economic "process" that is so efficient

at making money that it destroys its own reason for being? Purportedly creating an ever better

life for us humans. Capitalism is just that efficient. It accumulates more money than god. So

then all the capitalists say, well capital isn't money. OK. Whatever. I can vaguely understand

it the other way around, that money isn't capital.

Because capital is all of us getting together to cooperate to make a better world and money

is just an exchange mechanism that facilitates it. If capitalism can't evolve to be a distribution

mechanism that prevents inequality, capitalism will kill itself.

And speaking of libertarianism, it seems like libertarianism has been the underlying rationale

for capitalism for several hundred years and it has brought us to this impasse. Varoufakis'

best question was "Who is going to take out the garbage?" He was talking about bargaining power

but he was inadvertently prescient. Applying inequality to analyze capitalism we see ridiculous

wealth on one end and lotsa garbage on the other end. If we recycled this imbalance, forcing

the wonders of capitalism to actually pay for environmental destruction and barges of garbage

dumped in the ocean rather than recycled and etc. then human inequalities would be greatly diminished

and great wealth would probably never accumulate.

Jack King, December 6, 2014 at 2:22 pm

"The worst form of inequality is to try to make unequal things equal." - Aristotle

susan the other, December 6, 2014 at 2:48 pm

What did Aristotle say about making equal things unequal then?

bobs, December 7, 2014 at 12:25 pm

"[Piketty wants to prove] the proposition that this historical trend of increasing

inequality is capitalism's 'natural' tendency." [Yanis Varoufakis, Oct. 2014]

According to Piketty, the culprit is not the state of nature but capitalism itself. His book

makes a strong case. His remedy might well be impractical but it's rather disingenuous to attack

an economist for failing to come up with the perfect cure for capitalism at the end of a long

book whose main purpose is to present facts, trends, and relations.

Fact is, Piketty and Saez have done more to nucleate a debate on inequality than anyone else

on the left. So perhaps their theories are not quite right. Yes, that's called economics, a

field where no theory is ever quite right. Varoufakis seems to imply that, if only we had the

theory right, we'd be fine: "Piketty's particular theoretical construction, in the end, is the

greatest enemy."

Not Goldman Sachs or Jack Lew, mind you. No, no, the greatest enemy is the wrong set of mathematical

equations.

Speaking of which, Piketty was invited to talk to Jack Lew. Indeed, and Varoufakis advised the

Papandreou government for years. None of this is relevant to the discussion.

Marko, December 7, 2014 at 4:02 am

Odd.

Just recently Piketty was being praised here for "shredding" marginal utility , a neoclassic

touchstone :

http://www.nakedcapitalism.com/2014/11/shaky-foundations-neoliberal-economics-marginal-productivity.html

The worst "enemies of egalitarianism" are those who try to destroy their own allies , in obvious

attempts of self-promotion. Luckily , in this case , their aim was off , and they merely shot

themselves in the foot.

Like "bobs" , above , I thought Varoufakis was better than this. Unlike bobs , I don't now.

docg, December 7, 2014 at 12:55 pm

Most of this discussion struck me as incoherent. And I say that as long-time admirer of Varoufakis,

whose blog I've followed with great interest and sympathy. He is definitely one of the good

guys. So why so many cheap shots at Piketty? I get the feeling there is something personal going

on. If Varoufakis sees Piketty as part of the neoclassical mainstream then where does he see

himself? If he's a socialist he should come out and say so. If not, then what?

I like the idea of a wealth tax. Unlike so many economic prescriptions, it's simple and

to the point and everyone can (more or less) understand it. And no, your grandmother need not

worry about her silverware because obviously silverware sitting in a drawer isn't wealth in

anyone's definition of the term. Now piles of silverware sittting in a warehouse, that's a different

story.

As for confusing wealth and capital, Varoufakis himself seems to be confusing productive, socially

useful capital with any sort of capital at all (such as a warehouse full of silver or gold).

The sort of wealth represented by multiple dwellings, luxury items, investments in purely financial

products, vast real estate holdings, bank accounts, tax shelters, gold, silver, etc., i.e.,

unproductive and socially useless wealth, should certainly be taxed. And if you're worried about

everyone's grandmother, then tax all such wealth over and above a certain reasonable limit,

say a few million dollars worth. I.e., excess wealth. Wealth in the form of productive and socially

beneficial investments or projects, such as factories, socially valuable services, entertainment,

the arts, etc., should not be taxed. Not, at least, any more than it already is.

Of course, the existence of a wealth tax of any kind as a solution to inequality already implies

a very strong role for government and the type of government that would be committed to using

that tax as a means of redistribution. Which tells me that Piketty is, at heart, a socialist,

whether he wants to admit it or not. As for Varoufakis, I'm not sure exactly where he stands.

Edward McKenna, December 7, 2014 at 3:40 pm

There is much in this video that runs counter to what Piketty has actually written in his

book. I will just present one example. Both the interviewer and Varoufakis insist that power

plays absolutely no role in Piketty's analysis. Yet Piketty writes on page 305 "This theory

(neoclassical marginal productivity theory-ed.) is in some respects limited and naïve. (In

practice a worker's productivity is not an immutable, objective quantity inscribed on his fore

head, and the relative power of different social groups often plays a central role in determining

what each worker is paid.)

Nor is this an isolated quote. There are a number of places where Piketty refers to a bargaining

model based on power as providing a superior answer to how distribution is determined. Moreover,

in later chapters he explains why those with a greater share of wealth are able to attain a

return on wealth that increases with the amount of wealth. The reasons he provides are squarely

consistent with a relative power argument.

I believe that Yves reference to the Cambridge Capital Controversy as decisive evidence against

Piketty is also misleading. While his presentation of the controversy is flawed and inadequate,

there is nothing in his work that violates the conclusions of this controversy. The main conclusion

was that there was no physical unit in which to measure capital so that an aggregate measure

of capital could be obtained. Nowhere in his analysis does Piketty make use of such an aggregate

measure. Indeed, all of his work is in monetary terms, which one would have thought would have

been appealing to most heterodox economists, who make much of the fact that we live in a monetary

economy. ( There was one other important conclusion that came out of the controversy,But this

is a discussion for another time).

"invisible unemployment" is a discouraged workers and part-timers who want more hours. The official

unemployment rate doesn't consider them unemployed. So when we talk about the official unemployment

rate-now at a lowish 5.8 percent-we're ignoring these workers. They're statistically invisible. As the

saying goes: "It just goes to show how figures lie and liars figure". When Govt's resort to this level

of deceit and trickery the shadow of the USSR decend of the USA.

We're adding lots of jobs in industries with stagnant wages, and a few jobs in industries with

rising wages, according to new research out of the Cleveland Fed. "It may seem counterintuitive

that wages and salaries are growing the slowest in industries where jobs are growing the fastest,

but it actually is not," writes LaVaughn M. Henry, vice president of the bank's Cincinnati branch.

We're adding few jobs in goods-producing industries like manufacturing, which have the highest overall

post-recession wage growth, and lots of jobs in service-producing industries (e.g. health care,

leisure and hospitality, and education), which have the lowest real wage growth.

… ... ...

What is "invisible unemployment"? It's discouraged workers and part-timers who want more hours.

The official unemployment rate doesn't consider them unemployed. So when we talk about the official

unemployment rate-now at a lowish 5.8 percent-we're ignoring these workers. They're statistically

invisible.

... ... ...

In 2002, official unemployment swamped invisible unemployment. The official unemployment rate

was an accurate description of the labor force. But the spread between invisible and official unemployment

is shrinking. In the last 20 years, the six months with the smallest gaps between official and invisible

unemployment were all in 2014. That means the official unemployment rate is getting worse and worse

at describing the real conditions facing American workers.

Invisible unemployment is hurting the participation rate even more than economists predicted

with an aging work force. The entire developed world is getting older. But U.S. participation fell

faster in the years after the recession that just about any other country.

The rise of invisible work is too large to ignore

By "invisible work," I mean work done by American companies that isn't done by Americans workers.

Globalization and technology is allowing corporations to expand productivity, which shows up in

earnings reports and stock prices and other metrics that analysts typically associate with a healthy

economy. But globalization and technology don't always show up in U.S. wage growth because they

often represent alternatives to U.S.-based jobs. Corporations have used the recession and the recovery

to increase profits by

expanding abroad,

hiring abroad, and controlling labor costs at home.

It's a brilliant strategy to please investors. But it's an awful way to contribute to domestic

wage growth.

Derek Thompson

is a senior editor at The Atlantic, where he writes about economics, labor markets, and the entertainment

business.

tommariner

"Unemployment" statistics has been the political advertising media for every Administration

in modern times.

The reason we give the press protection is they are supposed to ignore the rosy exaggerations

and uncover White House incompetence. When major media only does their duty of the truth under

Republicans, why should they have the protection under a Democrat Administration?

LVTaxman > SimplyNaive

But policies have crushed the middle class making a part-time economy. The work force participation

rate hasn't been this low since women moved into the workforce en mass in the 70's and 80's.

Policies to help the middle class? How about more off shore drilling similar to the 80's

and 90's. How about getting rid of the employer mandate to allow people to work more hours and

encourage growth instead of limitations? How about fewer regulations to encourage more business?

How about not having the highest corporate tax rate in the world so that there is incentive

to expand in the United States?

60,500 pages of regulations in 5 years is astounding considering how many there were already

on the books.

LVTaxman > SimplyNaive

In the economic freedom index, the US dropped from 5th in 2008 to 12th in 2014. These are

the policies put in place by Obama.

"Burger flippers" is traditionally an entry level job, not a career. Under Obama, it has

become a career because of his job killing policies and regulations. Overqualified people are

working below their education because policies have has stifled the slowest recovery in history.

Black teen unemployment is over 50% because of his policies.

Why is there no demand - not enough people are in the workforce. People see the US economy

as the closed one because we put up barriers to success. It is easier to assemble overseas,

put in a container on a tanker and ship to the US than fight the regulations and taxes in the

US. If we made it easier to put business in the US, it would happen as long as it kept pricing

and timing better than the cost and timing of shipping.

The best example is California. Why do you think all the auto manufacturers and oil companies

have moved headquarters out of the state? They stayed in the US, but left California due to

taxes and regulations. Northup Grumman took their thousands of high paying jobs to Virginia

to get out of the stifling business climate. On a world stage, that is where the US is headed.

As far as your analogy of tax simplification - all accountants will still have jobs. Our

work changed tremendously with automation and the advent of Peachtree then Quickbooks. We adapt.

As the number one issue is hidden revenue, as long as there is a tax, there will be issues,

the IRS is not going away. If it is simplified, we can provide better planning services instead

of the constant fight to keep up with the goofy law changes, expiring and non-expiring extenders,

etc. Planning with more certainty would be a big boost in our quality of service.

SimplyNaive > LVTaxman

"In the economic freedom index, the US dropped from 5th in 2008 to 12th in 2014. These

are the policies put in place by Obama.

"Burger flippers" is traditionally an entry level job, not a career. Under Obama, it

has become a career because of his job killing policies and regulations. Overqualified people

are working below their education because policies have has stifled the slowest recovery

in history. Black teen unemployment is over 50% because of his policies."

it has nothing to do with Obama. Because of globalization more and more jobs have shifted

overseas. We have become a nation of Facebook programmers,bankers and rentiers on one side and

a mixture of welfare recipients, freelancers and servicing men on the other side. What do you

want black teens and for this sake other teens to do? Get a job? To do what? Go to college?

And after that to do what? The recovery is slow and may even reverse because the prosperity

was not real for the last 20 years and was based on the asset bubble ( like houses) and extreme

debt leverage. Americans was buying more on ever expanding credit and hit the ceiling. So called

growth happened because of the credit expansion. No wage growth.

'Why is there no demand - not enough people are in the workforce. People see the US economy

as the closed one because we put up barriers to success. It is easier to assemble overseas,

put in a container on a tanker and ship to the US than fight the regulations and taxes in the

US. If we made it easier to put business in the US, it would happen as long as it kept pricing

and timing better than the cost and timing of shipping."

Motorola tried with fanfares to assemble cell phones here. Hurray, lot of noise on opening

and not much noise when they closed it 2 years later. Why? Actually not because of the labor

cost but because of logistics, suppliers and efficiency. We just lost the competence to make

and produce.

A friend of mine is in semiconductors. Most of the companies here become fabless. MIles of

empty former bustling poants in San Jose. All is made in Taiwan, Korea and China, You just need

to draw on a napkin a rough sketch what you want and they say yes, how many and when. Done.

We lost the whole industries with the supply chain, now how and experienced workers

The best example is California. Why do you think all the auto manufacturers and oil

companies have moved headquarters out of the state?

That is a fool game. Sure they can move to Tennessee or Texas because the cost of doing business

is less plus subsidies.And how does it help workers. 1000s out in California with higher wages

and 1000s in somewhere with lower wages. The next step will be to move to another state with

even lower cost or abroad. And as I said they entitled to do so. The companies are not for charity.

In terms of accounting I agree with you that it is nightmare. However it feeds a lot of people.

If anybody can use Quickbooks, or any other tax software the loaf of bread will be much smaller.

However, I believe that one of the reasons why there is no tax simplification is because of

the huge accounting lobby.

jericho > LVTaxman

"They stayed in the US, but left California due to taxes and regulations. Northup

Grumman took their thousands of high paying jobs to Virginia to get out of the stifling

business climate."

Yeah, and Boeing just bailed out of Wichita, where they'd had a presence since WWII, because

Brownback has cut taxes and services and driven Kansas right into the ditch. It's not as simple

as you make it.

searambler > LVTaxman

The workforce participation rate is declining in large part because the baby boom generation

is retiring. That's a demographic fact.

Explain how expanded off shore oil drilling in the Gulf or Alaska will help the middle class.

Explain how having fewer poor and middle class people insured will help the middle class. Explain

why it's OK to sacrifice our environment and our air quality in order to allow corporate polluters

to pollute more.

Killing the planet for short term limited financial gains by a few industries is short-sighted

and stupid. What a legacy for our grand kids.

No corporation actually pays our 'official' corporate tax rate. Many big billion-dollar corporations

end up paying zero taxes. The tax code is written to benefit the corporate-Americans who have

the money to buy favorable tax policy. And the last change to this nations tax policy was the

two massive cuts enacted by GW that drove our deficit and our debt into the stratosphere.

And big numbers aren't astounding considering how incredibly complex our society has become.

Seriously.

What else ya got?

marathag > searambler

"The workforce participation rate is declining in large part because the baby boom generation

is retiring."

55-74 year olds are not retiring as fast as you think, they are staying in the workforce

longer

According to a 2014 report from the Bureau of Labor Statistics, "among 55- to 64-year-olds,

the [labor force] participation rate was 61.9 percent in 2002 and increased to 64.5 percent

in 2012. BLS projects their participation rate to increase further, to 67.5 percent in 2022.

The participation rate for people ages 65 to 74 years was 20.4 percent in 2002 and rose

to 26.8 percent in 2012. BLS projects the rate for this age group to continue increasing,

to 31.9 percent in 2022. People age 75 and over participate in the labor force at comparatively

low rates, but BLS also projects their participation rate to rise from 7.6 percent in 2012

to 10.5 percent in 2022."

Source:

Bureau of Labor Statistics. (2014). Labor force participation projected to fall for people

under age 55 and rise for older age groups: The editor's desk. Retrieved January 10, 2014, from

http://www.bls.gov/opub/ted/20...

JonF311 > marathag

If you exclude college age people and early retirement age people, workforce participation

has been recovering since 2011.

It's still quite low, and will likely never reach the late 90s peak again (which was abnormally

high), but it should eventually get back to the historical norm.

GoldBell

It is insulting to the intelligence of the majority, average people, to act as if no

one knows why wages and the amount of full time jobs are so low. The super wealthy and their

thuglings must really believe the Bell Curve and that anyone not living in Wealthy America is

stupid.

The Cause is So Called Free Trade

Those Corrupt, Anti- American Majority Trade Deals

Seriously, after decades of telling working Americans they have to accept paying US prices to

live but compete with low wage developing nation workers, you really think that they do not

know?

Just because Global Corporate Media does not cover it Truthfully and Fully does not mean they

do not know.

Benson Stein > Samuel C Cooler

Nice idea, but I doubt it will ever happen. The globalists/capitalists will never turn back

globalization of the economy. The/Their entire future is riding on it. There is about as much

chance of it happening as there was of stopping the Industrial Revolution. We are in the beginnings

of a quite nasty phenomenon, equal in importance to the Industrial Revolution. Five hundred

years from now, if humans survive, they will be teaching of this present economic period in

similar terms of importance, if not greater.

Sisyphus > Samuel C Cooler

And now we're starting to send lots of white collar jobs overseas. See accountants--used

to be a fairly stable, decent-paying, if boring, job for Americans. Now, more and more companies

are sending the majority of the work overseas to Indian workers, and only keeping around some

token US employees to make customers feel like they're still dealing with US expertise, when

the work is all being done overseas.

Globalization is what's going to kill the American Dream. Without law to say that you cannot

hire foreign workers to do a job that you could hire Americans to do, or some other legal disincentive

for offshoring work, companies will continue to do so.

Why hire an American accountant at $50,000 a year, when you can hire 2 or 3 Indian/Chinese

workers to do the same work, and STILL save money.

Dane Elder

The unemployment and the wage issue is not invisible. Wages are kept down by the confluence

of Big Data and lack of transparency and accountability in the hiring process. I have a friend

who had traveled to multiple interviews, and suddenly, without any fanfare, had not had any

calls back. His personal information is in the hands of the prospective company, and all of

the risks associated with that have been transferred to him--with no compensation for such a

risk. It has a chilling effect on the job search. I myself will not do business with companies

who pool applicants (yes, this means you also, Papa Johns and Jimmie Johns), nor will I do business

with companies that lie about their positions. Once I hear about it, I don't even give them

the time of day. And I have not had a pizza from Papa Johns or a Jimmy Johns sub for nearly

two years, now. Further, I will continue to build my own private database of companies who have

only online applications, and I will continue to ask my friends and friends of friends how their

own job search is going. You want to keep playing me, companies, just keep it up. You will be

out of business before long.

masher > Dane Elder

I can import foreign labor from all over the world into the US on work visas. You just need

to work harder.

jared > Dane Elder

what does "pool applicants" mean?

Benson Stein > jared

It means inviting, attractive but impoverished, female applicants to the pool parties at

your mansion. Where they can be hit upon and seduced by pot-bellied, middle age, executives,

of the ruling class.

Unka_George

We can spin the numbers all we want, but we are a consumer/consumption driven debt based

economy. While it may be momentarily profitable for employers to drive their labor costs

down by worker exploitation, and for the rentiers' share of the GDP to increase, it is national

suicide in the medium to long term.

It is clear we need to significantly increase the minimum wage and index it to both inflation

and worker productivity to insure the economic gains benefit everyone. It may also be necessary

to impose a capital levy on net assets above a reasonable floor (such as the median lifetime

family income) on all all assets owned or controlled by U. S. citizens and corporations, no

matter were these assets are physically/legally located.

Jeff T

Bottom line. As the global economy has grown we have not adjusted. Our political system is

not capable of dealing with the new paradigm and we are seeing the effects. Additionally, the

average U.S. citizen also has no appreciation of this new order and continues to vote for absolute

greedy and corrupt idiots who tell them what they want to hear vice what they need to hear.

The global economy is a tough place and it takes no prisoners. We better start having an honest

conversation about this because it is not going to get better on its own. A good first step,

dump the Democratic and Republican Parties. They are a cause/hindrance, not a help.

usabroad > Jeff T

Yes. This is especially clear living abroad. American corporations are everywhere on the

planet but our people and our domestic cultural concepts and identity are still North American

centric. Many distribution rights for corporate products are held by local partners who are

not American and few Americans work in such US brands like Proctor and Gamble etc.

Perhaps we could pass a law forcing American corporate to hire a % of their workers from

US citizens on a global basis, facilitating the global outlook of the American people that would

benefit the corporate and our nation.

shinynewtoken

I suspect #1 is most likely what is happening (although it's all connected). The economy

is bifurcating between high-paying/skill jobs where there is wage growth and low-paying/low

skill jobs where there is little to none. And the economy is creating mostly the latter. And

those are the jobs where most people who are in the invisible unemployed are going to return

to. Plus, the supply of labor for those jobs remains high, in part, due to our immigration policies.

And certainly, globalization plays a role in keeping down wage growth, as well.

This is really the defining issue of our times for most Americans, and it's an obvious reason

why the Democrats these days seem so out of touch to most Americans: when you're talking about

amnesty (to further depress low-skill wages), global warming, and the war on women, you're just

not addressing the concerns of the vast majority of the country. Whichever party solves this

issue will be in power for at least a decade.

SAlfin > shinynewtoken

That may be true, but even the low-paying retail jobs are suppressing full employment by

not giving their employees full time hours to avoid paying benefits. You can't buy your own

benefits working two 30-hour/week jobs at Starbucks; it doesn't pay enough.

So to recap, not only are companies suppressing employee hours and fighting minimum wage increases,

they are offloading benefit costs like health insurance to the taxpayer dime. And we wonder

why ACA is necessary?

OrangeGina > SAlfin

I believe it demonstrates why Single Payer is necessary, as it would take the employer out

of the picture. These are the gyrations needed to get there, it seems.

kmihindu > shinynewtoken

And even the skilled, higher paying jobs are very insecure. I am a scientist and

have seen colleagues (bachelors, masters and PhD-educated) struggle as federal funding gets

tighter and tighter, and congress/the president screw up budgets through sequestration and defunding

(significantly reducing funding) already funded projects.

And when you talk about the havoc this is wreaking, you get to hear nonsense about "getting

off the government teat".

Basic scientific research - the type that leads to ground breaking innovation is never

going to be profitable enough in the short-term to be privately funded.

So, if you want to watch loved ones suffer needlessly from diseases that require breakthroughs

from basic science research, by all means, defund that research and crow as scientists like

myself scramble to find employment. If I lose my job, society will be much better served by

me applying my knowledge and skills to the private sector, tweaking existing drugs just enough

to extend the patent and increase profits.

masher > Willow_girl

No, we had a labor movement and we ONLY had a labor movement because we ended slavery and

we slashed immigration. You can't have a labor movement AND have slavery and liberal immigration.

In the 1970's liberal and corporatist pushed for and won a massive expansion of immigration

quotas. We nearly tripled immigration in the 1970's. We went from 350,000/year to over 1.2 million/year!

And we started flirting with trade with nations like communist China. Bill Clinton pushed for

and won China's entrance into the WTO. Clinton also signed NAFTA into law. Trade with China

is effectively the same as having slave labor here.

Now, look at the unions and think about how they view immigration and trade with China. I don't

see one union fighting to reduce immigration to under 300,000/year. So the unions are not labor

movements anymore. They are something else, perhaps they are pension funds.

RobertSF > masher

liberal and corporatist

The correct term is neoliberal, which has nothing to do with traditional liberalism, just

like neocon (short for neoconservative) has nothing to do with traditional conservatism.

Neoliberalism and neoconservatism are mutually compatible ideologies that leverage the power

of technology to create a powerful, transnational, economic elite. The difference between

the two is stylistic. Neoliberals would use economic forces while neocons would use military

forces. And the two are mutually compatible because a person can believe in both without conflict

-- witness Obama, who is as much a hawkish warmonger as Bush and as much a corporatist lackey

as Clinton.

Abraham_Franklin > Willow_girl

American jobs paid well after World War II in part because the war left the U.S as the only

country with any significant industrial capacity.

efcdons > Abraham_Franklin

Can we kill this bs idea once and for all?

The Europe-in-Rubble

Excuse - NYTimes.com by Paul Krugman

It's not true.

Willow_girl > swampwiz0

Do you really think people would starve and go homeless before they'd buck up and get to

work? Heck, probably half the people on welfare are already working -- under the table for cash,

or in some illicit activity. This is where people who don't understand how the system works

frequently err in their thinking. They see well-dressed people using a SNAP card, then getting

into a late-model vehicle, and think that welfare alone provides a lavish lifestyle. It doesn't;

but for most recipients, it is only one among several income streams.

masher

Notice that there is no mention of what the rest of know is the obvious reasons: offshoring

of factories to dictatorships like Vietnam and China, NAFTA, and too many immigrants.

Between work visas, 1.2 million immigrants/year, student visas, and de facto amnesty for illegal

labor we know why wages are suppressed. Wages in the US can't rise because our government works

hard and does a great job of helping employers import labor or export jobs. Wages just can't

rise when you have a federal government dedicated to immigration as a tool of "helping employers

find the workers they need".

You all need to stop and think about that for a second. Do you not understand what our politicians

(both parties) are really saying when they say its the government's job to "find the workers

that employers need"?

Sam Smith

And it used to be that lower wage workers could put together a couple of jobs and survive.

Now corporate America only offers flex time jobs (with a snazzy its flexible title). Those flex

time jobs mean you don't get to pick your schedule and you must be available at all times. So

each week, and each month and even each day can be adjusted based on the outcomes of big data.

So, you are a single Mom and you've paid a baby sitter to pick up the kids so you can work at

Home Depot, at any time during your shift if the store data numbers dip you are sent home. Outcome,

you end up paying the baby sitter more than you earned that day.

And since you have no set schedule, you can't pick up a second part time job either. Low wage

workers are now at the will of big data outcomes, and yes the company vastly improves efficiency,

but the workers have no autonomy or ability to control their schedules which dramatically impacts

child care, transportation options and needs (no set time for someone to pick you up), ability

to take classes, etc.

Abraham_Franklin > RobertSF

If you have one full time job, flex time may be a burden but it's doable. If you have two

part time jobs, flex time becomes a logistical nightmare.

Again, blame the ACA and its absurd mandates that are encouraging employers to convert full

time positions into part time positions.

RobertSF > Abraham_Franklin

No, blame employers for their unquenchable sociopathic greed.

I'm reminded of when you don't want the cat on the couch. You push him off on one end and he

gets up on the other end. If you put your hand up, he goes around it. If you actually put your

hand on his head, he'll push against it, trying to get on the damn couch. He'll even meow in

frustration, while you're going, "Stupid cat, I don't want you on the couch!"

But at least the cat has the excuse that it's just a dumb animal. What excuse do employers have?

In how many ways must they be told that they need to take less profit because they're killing

the goose that lays the golden eggs? Companies like Walmart and McDonald's have seen several

years of slowing sales because, in their obsession to cut labor costs, they didn't stop to think,

"Oh, these are the people who buy our stuff."

And asking employers to provide health insurance to their employees is not an absurd requirement.

Even slave owners didn't leave their slaves to die of disease (they had paid too much for them).

Abraham_Franklin > RobertSF