Ralph

Musgrave said...

February 28, 2017 at 4:06 PM

Brian,

For the second time, you claimed "Nobody says there is no relationship between supply,

employment, and inflation." My answer is the same as before: what does Brian Romanchuk mean by

saying NAIRU should be "bashed, smashed and trashed". Seems a pretty outright condemnation of

the whole idea to me.

Tom,

You say "Probably better to say that there is no necessary or constant

relationship…". Quite agree. But whoever said there WAS a constant relationship?

Certainly not the Fed. Anyone with a bit brain ought to realise that NAIRU will vary with a

whole host of variables: standards of education, recent unemployment levels (hystersis) and so

on.

EK-H,

You make the naïve mistake many people make of thinking the because something cannot be

measured accurately that therefor it does not have a precise value. The amount of iron in the

Moon has a very very precise value indeed. Ask God how much iron there is on and in the Moon

and he'd tell you the figure to the nearest 0.00000001%. In contrast, astronomers might not

know the quantity to better than plus or minus 10% for all I know. It is therefor perfectly

permissible to write equations or get involved in discussions which assume a very very precise

value for the amount of iron in the Moon. Same goes for NAIRU.

Much of the stuff I've written makes the latter assumption: it is helpful to make that

assumption sometimes.

Auburn

Parks said..

February 28, 2017 at 4:39 PM .

No Egmont, its not about scientific idiocy. Its about the nature of the subject. Economics

is not different than social psychology in this regard.

Ralph-

NAIRU is a specific claim and estimate about the way the economy works. As you discovered

yourself, the Fed literally produces a NAIRU estimate and uses that estimate to determine

policy. NAIRU cannot be estimated accurately, and furthermore there is zero evidence of

accelerating inflation. So there is literally nothing redeeming about the theory except to

say that there is some relationship between supply labor, and inflation. Which is to say,

that your support of the thing is wrong, and all of our criticisms that NAIRU is trash are

correct.

What is the unemployment rate that would correspond to accelearating inflation right now

Ralph?

Auburn Parks said..

February 28, 2017 at 4:42 PM .

The answer is that there is no unemployment rate that generates accelerating inflation. As

inflation is not simply a relationship between unemployment and prices. Inflation is a result

of many different types of inputs.

There are literally zero examples of low unemployment rates, even below 1% during WWII,

that have resulted in accelerating inflation. You and the NAIRU crowd have no legs to stand

on.

AXEC / E.K-H said..

February 28, 2017 at 4:43 PM .

Ralph Musgrave

You say: "You make the naïve mistake many people make of thinking the because

something cannot be measured accurately that therefore it does not have a precise value."

You make the same mistake as all illiterate persons, that is, you cannot read. What I have

clearly stated is: "NAIRU is dead, not because of measurement problems, but because the

underlying employment theory is false."* The measurement problem is a side issue.**

Egmont Kakarot-Handtke

* See 'NAIRU: an exhaustive dancing-angels-on-a-pinpoint blather'

http://axecorg.blogspot.de/2017/02/nairu-exhaustive-dancing-angels-on.html

** See 'NAIRU and the scientific incompetence of Orthodoxy and Heterodoxy'

http://axecorg.blogspot.de/2017/02/nairu-and-scientific-incompetence-of.html

AXEC / E.K-H said..

February 28, 2017 at 5:11 PM .

Auburn Parks

The moronic part of economists, i.e. the vast majority, maintains that economics is a

social science. Time to wake up to the fact that economics is a system science.#1

Economics is NOT a science of individual/social/political behavior - this is the social

science delusion - but of the behavior of the monetary economy . All Human-Nature issues are

the subject matter of other disciplines (psychology, sociology, anthropology, biology/

Darwinism, political science, social philosophy, history, etcetera) and are taken in from

these by way of multi-disciplinary cooperation.#2

The economic system is subject to precise and measurable systemic laws.#3

Egmont Kakarot-Handtke

#1 See 'Lawson's fundamental methodological error and the failure of Heterodoxy'

http://axecorg.blogspot.de/2016/03/lawsons-fundamental-methodological.html

#2 See 'Economics and the social science delusion'

http://axecorg.blogspot.de/2016/03/economics-and-social-science-delusion.html

#3 See 'The three fundamental economic laws'

http://axecorg.blogspot.de/2016/03/the-three-fundamental-economic-laws.html

Tom

Hickey said..

February 28, 2017 at 6:19 PM .

But whoever said there WAS a constant relationship? Certainly not the Fed.

Not now. They had to learn this by first the NAIRU model that assumed a natural rate and

cet. par., and then the difficulty of writing a rule that could be applied across time.

Too many confounding factors involved that are not directly related to employment or the

interest rate.

And there are still people calling for a rule.

Noah Way said..

February 28, 2017 at 7:30 PM .

"Economic science" is an oxymoron.

AXEC / E.K-H said..

March 1, 2017 at 5:39 AM .

Noah Way

You say: "'Economic science' is an oxymoron."

It is, first of all, of utmost importance to distinguish between political and theoretical

economics. The main differences are: (i) The goal of political economics is to successfully

push an agenda, the goal of theoretical economics is to successfully explain how the actual

economy works. (ii) In political economics anything goes; in theoretical economics the

scientific standards of material and formal consistency are observed.

Political economics has produced NOTHING of scientific value in the last 200+ years. The

four majors approaches - Walrasianism, Keynesianism, Marxianism, Austrianism - are mutually

contradictory, axiomatically false, and materially/formally inconsistent.

A closer look at the history of economic thought shows that theoretical economics (=

science) had been hijacked from the very beginning by the agenda pushers of political

economics. These folks never rose above the level of vacuous econ-waffle. The whole

discussion from Samuelson/Solow's unemployment-inflation trade-off to Friedman/Phelps's

natural rate to the rational expectation NAIRU is a case in point.

The NAIRU-Phillips curve has zero scientific content. It is a plaything of retarded

political economists. Samuelson, Solow, Friedman, Phelps, and the rest of participants in the

NAIRU discussion up to Wren-Lewis are fake scientists.*

Egmont Kakarot-Handtke

* See also 'Modern macro moronism'

http://axecorg.blogspot.de/2017/02/modern-macro-moronism.html

Matthew Franko said..

March 1, 2017 at 8:13 AM .

"better to say that there is no necessary or constant relationship between employment and

inflation that can be expressed either as a function or a rule,"

Good line here Tom... they don't have a function...

But I would point out that with the employment issue, we have had an unregulated system

interface (open borders) for decades which is ofc going to result in chaos..

Ralph Musgrave said..

March 1, 2017 at 10:20 AM .

EK-H,

I see: so you're saying the "underlying employment theory" of NAIRU "is false": i.e.

you're saying there is no relationship between inflation and unemployment.

Why then don't you advocate a massive increase in demand. Think of the economic benefits

and social problems solved.!!

Reason you don't advocate that is that, like all the other NAIRU deniers, you know

perfectly well that THERE IS a relationship between inflation and unemployment.!!

AXEC / E.K-H said..

March 1, 2017 at 1:43 PM .

Ralph Musgrave

It would be fine if you could first learn to read and to think and to do your economics

homework.

The point at issue is the labor market theory and the remarkable fact of the matter is

that economists have after 200+ years NO valid labor market theory. The proof is in the

NAIRU-Phillips curve. So what these failures are in effect doing is giving policy advice

without sound theoretical foundation. Scientists don't do this.

What is known since the founding fathers about the separation of politics and science is

this: "A scientific observer or reasoner, merely as such, is not an adviser for practice. His

part is only to show that certain consequences follow from certain causes, and that to obtain

certain ends, certain means are the most effectual. Whether the ends themselves are such as

ought to be pursued, and if so, in what cases and to how great a length, it is no part of his

business as a cultivator of science to decide, and science alone will never qualify him for

the decision." (J. S. Mill)

The first point is that economists violate the separation of politics and science on a

daily basis.#1 The second point is that their unwarranted advice is utter rubbish because

they have NO idea how the economy works. The problem society has with economists is that it

would be much better off without these clowns.

You ask me: "Why then don't you advocate a massive increase in demand. Think of the

economic benefits and social problems solved.!!"

Answer: The business of the economist is the true theory about how the economic system

works and NOT the solution of social problems. This is the proper business of politicians. In

addition, an economist who understands how the price and profit mechanism works does not make

such a silly proposal, only brain-dead political agenda pushers do.#2

What I am indeed advocating is that retarded econ-wafflers are thrown out of economics and

that economics gets finally out of what Feynman aptly called cargo cult science.#3

Economists claim since more that 200 years that they are doing science and this is

celebrated each year with the 'Bank of Sweden Prize in Economic Sciences in Memory of Alfred

Nobel'. Time to make this claim come true.

The only thing economist like you can actively do to contribute to the progress of

economics is switching on TV and watching 24/365.

Egmont Kakarot-Handtke

#1 See 'Scientific suicide in the revolving door'

http://axecorg.blogspot.de/2016/11/scientific-suicide-in-revolving-door.html

#2 See 'Rethinking deficit spending'

http://axecorg.blogspot.de/2016/12/rethinking-deficit-spending.html

#3 See 'Economists and the destructive power of stupidity'

http://axecorg.blogspot.de/2017/02/economists-and-destructive-power-of.html

Ralph Musgrave said..

March 1, 2017 at 2:14 PM .

EKH,

"The business of the economist is the true theory about how the economic system works and

NOT the solution of social problems. This is the proper business of politicians."

"The business of the economist" is not just "true theory": it is also to give the best

economic advice they can even where the theory is clearly defective. In the case of the

relationship between inflation and unemployment, the EXACT nature of that relationship is not

known with much accuracy, but governments just have to take a judgement on what level of

unemployment results in too much inflation. Ergo economics have a duty to give the best

advice they can in the circumstances.

Re social problems, your above quote also doesn't alter the fact that economists are in a

position to solve HUGE social problems if they promote an increase in demand where that is

possible. So why are you so reluctant to solve those social problems by advocating a huge

increase in demand. It's blindingly obvious.

Like all the other NAIRU deniers, you know perfectly well there is a relationship between

inflation and unemployment!!

David Swan said..

March 1, 2017 at 3:23 PM .

To say that there is "a" relationship between inflation and unemployment does not even

remotely support the claims inherent in the NAIRU, nor does it justify its use to guide the

macroeconomic framework. NAIRU does not claim that there is "a" relationship between

inflation and unemployment (that lesser claim is covered adequately by the Phillips Curve).

NAIRU claims that low levels of unemployment generate ACCELERATING inflation (i.e.

"hyperinflation"), a claim based on pure sophistry and nothing else. If you would like to

support the NAIRU's utterly fallacious claim that low unemployment generates ACCELERATING

inflation, then please provide data to support that claim.

Furthermore, "a" relationship between unemployment and inflation in no way justifies the

central bank intervention of choking off economic growth to prevent "too many jobs". Is the

inflation harmful or benign? With the historical perspective available to us from nearly 5

decades of NAIRU, all that is required is to look at the chart of hourly wage growth vs

productivity and observe that real wages growth took a sharp right turn at the very time

NAIRU was implemented worldwide. There has not been one iota of real wage growth since the

70's (despite low inflation), whereas the real wage grew steadily prior to that (despite

moderate inflation). If that is the price of "protecting" us from inflation, then in what way

is it beneficial to do so?

Brian Romanchuk said..

March 1, 2017 at 3:38 PM .

I see Ralph Musgrave referred to my article again.

Good Lord, how can I make what I wrote simpler to understand?

The DEFINITION of NAIRU is the level of the unemployment rate at which the price level

starts to accelerate. Sure, there's usually another variable in there mucking up the works,

but it's going to be a second order effect in the current environment.

- - If you hand me a time series of the NAIRU, I could demonstrate how the predicted

acceleration does not match observed data.

- - If you cannot hand me such a time series, that is a strong indication that no such

series exists. In which case, you're wrong, and I'm right.

AXEC / E.K-H said..

March 1, 2017 at 4:42 PM .

Ralph Musgrave

You say: "Ergo economics have a duty to give the best advice they can in the

circumstances."

The only duty of scientifically incompetent economists is to throw themselves under the

bus. Economists are a menace to their fellow citizens as Napoleon already knew: "Late in

life, moreover, he claimed that he had always believed that if an empire were made of granite

the ideas of economists, if listened to, would suffice to reduce it to dust." (Viner)

Economists do NOT solve social problems they ARE a social problem.

You repeat your silly question: "So why are you so reluctant to solve those social

problems by advocating a huge increase in demand. It's blindingly obvious."

Yes it is blindingly obvious that deficit spending does NOT solve social problems but

CREATES the social problem of an insanely unequal distribution (see the references

above).

This follows from the true labor market theory which is given with the systemic employment

equation.#1 "The correct theory of the macroeconomic price mechanism tells us that ―

for purely SYSTEMIC reasons ― the average wage rate has in the current situation to

rise faster than the average price. THIS opens the way out of mass unemployment, deflation,

and stagnation and NOT the blather of scientifically incompetent orthodox and heterodox

agenda pushers."#2

Right policy depends on true theory: "In order to tell the politicians and practitioners

something about causes and best means, the economist needs the true theory or else he has not

much more to offer than educated common sense or his personal opinion." (Stigum)

Economists do not have the true theory. They have NOTHING to offer. The NAIRU-Phillips

curve is provable false. Because of this ALL economic policy conclusions drawn from it are

counterproductive, that is, they WORSEN the situation. So, Samuelson, Solow, Friedman, Phelps

and the other NAIRU-Phillips curve proponents bear the responsibility for mass unemployment

and the social devastation that comes with it.

From the fact that the NAIRU labor market theory is false follows that economists are

incompetent scientists and that ALL their economic policy proposals are scientifically

worthless.

Egmont Kakarot-Handtke

#1 See 'NAIRU: an exhaustive dancing-angels-on-a-pinpoint blather'

http://axecorg.blogspot.de/2017/02/nairu-exhaustive-dancing-angels-on.html

#2 See 'NAIRU and the scientific incompetence of Orthodoxy and Heterodoxy'

http://axecorg.blogspot.de/2017/02/nairu-and-scientific-incompetence-of.html

John said..

March 2, 2017 at 9:53 AM .

I've closely followed this NAIRU argument here and on other threads. I don't have a dog in

this fight, but it seems perfectly obvious from all this that Auburn and Brian have this

exactly right. And for the life of me I cannot fathom how anyone can misunderstand their

argument: there may be a link between employment and inflation, but the NAIRU doesn't capture

it. There may be a link between dogs barking at a full moon, but my theory of a moon made out

of green cheese doesn't capture it.

AXEC / E.K-H said..

March 5, 2017 at 5:29 AM .

NAIRU and economists' lethal swampiness.Comment on David Glasner on 'Richard Lipsey and the Phillips Curve Redux'

David Glasner contributes to the NAIRU discussion#1 by reproducing essential content of

his 2013 paper. Back then he propagated Lipsey's concept of multiple equilibria or band of

unemployment (NAIBU) which is consistent with a stable rate of inflation. The NAIBU concept

is a fine example of the tendency of economists to soften, relativize, qualify, and

semantically dilute every concept until it is senseless and useless.

It is the very characteristic of economics that there are no well-defined concepts and

this begins with the pivotal economic concepts profit and income. The habit of swampification

keeps the discourse safely in the no man's land where "nothing is clear and everything is

possible" (Keynes) and where anything goes.

Swampification is what Popper called an immunizing strategy. The beauty of vagueness and

ambiguity is that it cannot be falsified: "Another thing I must point out is that you cannot

prove a vague theory wrong." (Feynman)#2

David Glasner applies the concept of evolution in order to swampify the NAIRU: "The

current behavior of economies … is consistent with evolutionary theory in which the

economy is constantly evolving in the face of path-dependent, endogenously generated,

technological change, and has a wide range of unemployment and GDP over which the inflation

rate is stable."

In other words, presumably there is a relationship between unemployment and inflation but

nobody knows what it is. While science is known to strive for uniqueness, economics is known

to strive for ambiguity and obfuscation. This swampiness is rationalized as realism. After

all, reality is messy, isn't it?

To recall, the Phillips curve started as a simple and remarkably stable EMPIRICAL

relationship between wage rate changes and the rate of unemployment. The original Phillips

curve was reinterpreted and thereby messed up by Samuelson and Solow who introduced the

economic policy trade-off between inflation and unemployment which was finally thrown out

again with the NAIRU.

A conceptional error/mistake/blunder slipped in with the bastardization of the original

Phillips curve that was never rectified but in effect buried under a huge heap of

inconclusive economic shop talk. This means that until this very day economics has no valid

theory of the labor market.

See part 2

AXEC / E.K-H said..

March 5, 2017 at 5:34 AM .

Part 2

So, the microfounded NAIRU-Phillips curve has first of all to be rectified.#3 The

macrofounded SYSTEM-Phillips curve is shown on Wikimedia

https://commons.wikimedia.org/wiki/File:AXEC62.png

From this correct employment equation follows in the MOST ELEMENTARY case that an increase

of the macro-ratio rhoF=W/PR leads to higher total employment L. The ratio rhoF embodies the

price mechanism. Let the rate of change of productivity R for simplicity be zero, i.e. r=0,

then there are three logical cases, that is, THREE types of inflation.

(i) If the rate of change of the wage rate W is equal to the rate of change of the price P,

i.e. w=p, then employment does NOT change NO MATTER how big or small the rates of change are.

That is, NO amount of inflation or deflation has any effect on employment. Inflation is

neutral, there is no trade-off between unemployment and inflation.

(ii) If the rate of change of the wage rate is greater than the rate of change of the price

then employment INCREASES. There is a POSITIVE effect of inflation on employment.

(iii) If the rate of change of the wage rate is smaller than the rate of change of the price

then employment DECREASES. There is a NEGATIVE effect of inflation on employment.

So, it is the DIFFERENCE in the rates of change of wage rate and price and not the

absolute magnitude of change that is decisive. Every PERFECTLY SYNCHRONOUS

inflation/deflation is employment-neutral, that is, employment remains indefinitely where it

actually is. The neutral inflation can start at ANY point between full and zero employment.

The crucial fact to notice is that there is no such thing as "inflation", there are THREE

types of inflation.

The systemic employment equation defines the causal relationship of "inflation" on

employment. However, there is the inverse causality of employment on "inflation".

Common sense suggests that positive inflation (ii) is more probable the closer actual

employment is at full employment and negative inflation (iii) is more probable the farther

away actual employment is from full employment. In other words: the market economy is

inherently unstable. The feed-back loop between employment and "inflation" is the very

antithesis to the idea of equilibrium. To recall, the NAIRU is DEFINED as an equilibrium.

Standard economics has built equilibrium right into the premises, i.e. into the axiomatic

foundations. All of economics starts with the idea that the market economy is an equilibrium

system. It turns out that this premise is false, just the opposite is the case.

Standard labor market theory as it is incorporated in the NAIRU-Phillips curve is not

vaguely true, or evolutionary true as David Glasner maintains, but provable false.

Egmont Kakarot-Handtke

#1 See 'NAIRU: an exhaustive dancing-angels-on-a-pinpoint blather'

http://axecorg.blogspot.de/2017/02/nairu-exhaustive-dancing-angels-on.html

and 'NAIRU and the scientific incompetence of Orthodoxy and Heterodoxy'

http://axecorg.blogspot.de/2017/02/nairu-and-scientific-incompetence-of.html

#2 "By having a vague theory it is possible to get either result. ... It is usually said when

this is pointed out, 'When you are dealing with psychological matters things can't be defined

so precisely'. Yes, but then you cannot claim to know anything about it."

#3 See 'Keynes' Employment Function and the Gratuitous Phillips Curve Disaster'

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2130421

Jerry Brown -> Poison Pen...

February 17, 2017 at 02:18 PM

What country (or planet) are you referring to when you say Workers are primarily stock holders?

It ain't this country.

cm -> Jerry Brown...

February 17, 2017 at 10:44 PM

It is a commentary on a narrative. Of course part of the point of 401(k) and similar plans

is to "align" workers with the company and companies in general, aside from paying them in stock

rather than cash. I suspect it works more so than it doesn't, overall.

Jerry Brown -> cm...

February 17, 2017 at 10:52 PM

Say What?? Are you saying that Poison Pen was being sarcastic? I hope he was. Or are you saying

that narrative is correct?

cm -> Jerry Brown...

February 18, 2017 at 12:03 AM

Sarcasm or satire, yes. I'm not claiming that the narrative is "correct", but that it exists.

Surely you must have heard of "alignment" between shareholders and employees. Usually used to

justify large stock grants to executives, but also applicable more broadly.

Companies have several programs: ESPP (employees can buy a limited amount of company stock

at a 15% discount), 401(k) retirement accounts that may contain company stock or other investment

funds, stock and stock option grants (employees are not buying the stock but get it as part of

a regular or retention bonus program, usually with vesting - commonly your grant will vest over

4 years).

The idea behind all programs involving company stock is (1) disbursing stock is usually cheaper

to the company than cash, for the same nominal amount - for large programs where administration

overhead is amortized, (2) employees are supposedly "incentivized" to act to increase the stock

price.

The latter is believable at higher management levels, for lower level employees it is supposed

to increase their motivation to put business priorities before their own, how much it works is

anybody's guess.

cm -> cm...

February 18, 2017 at 12:07 AM

And in the case of vesting, (3) employees are supposedly reluctant to "leave money on the

table" by quitting before the stock is vested. This must work in aggregate or companies wouldn't

do this.

If somebody absolutely wants to quit because of a bad situation or a sufficiently compelling

offer, they will. But it raises the bar. Also I have heard about companies sufficiently interested

in hiring somebody with "handcuffs" offering compensation, i.e. effectively buying out your unvested

stock (or replacing it with their own extra grant).

Jerry Brown -> cm...

February 18, 2017 at 12:50 AM

Honestly cm, I have not heard about the alignment between shareholders and employees. That

doesn't mean it doesn't exist, I realize that.

Regardless, I would want to see a bunch of stats that showed that workers were primarily (or

"predominately" was the actual word used) stock holders and that they derive a meaningful part

of their yearly income through that ownership while they are working.

I don't have any stats to cite but I would say that is ridiculous. I would say that almost

all people who are characterized as working class make their income through their labor. Not from

some stock ownership.

cm -> Jerry Brown...

February 18, 2017 at 02:25 PM

I am not claiming that workers are primarily stockholders. I am claiming that companies have

programs to issue, or sell stock at a discount, or match 401(k) contributions up to a limit (in

all applicable cases with our without vesting) to their employees. 401(k) and ESPP probably have

to be offered to everybody, stock grants are usually selective. (Probably restricted by grade

level and job function.)

The primary motivations for companies are that stock is usually cheaper for them than cash,

and the retention effect of vesting. Employee alignment with the stock price is also a narrative,

but it is not clear to me who believes it.

Are you disputing that companies are interested in pushing narratives of their labor relations

that are beyond just "you work here and we pay you", and are in fact doing this?

cm -> Jerry Brown...

February 18, 2017 at 02:33 PM

It is supposedly common for startups to pay below-market (compared to established companies)

to their employees, with the promise of appreciation of stock grants after an IPO/acquisition.

Usually that's a bad deal for most employees, as the IPO may not happen, or when it happens, their

stock has been heavily diluted.

In established companies, stock-based compensation can be more substantial for managerial

or professional staff, but not life-changing - e.g. you may get a 5-20% upgrade on your salary

depending on how important you are considered, which is nice, but it will not change the fact

that you still have to show up for work every day.

Almost three and a half years ago, I published a

post about Richard Lipsey's paper "The Phillips Curve and the Tyranny of an Assumed Unique Macro

Equilibrium." The paper originally presented at the 2013 meeting of the History of Econmics

Society has just been published in the Journal of the History of Economic Thought , with a

slightly revised title "

The Phillips Curve and an Assumed Unique Macroeconomic Equilibrium in Historical Context ." The

abstract of the revised published version of the paper is different from the earlier abstract included

in my 2013 post. Here is the new abstract.

An early post-WWII debate concerned the most desirable demand and inflationary pressures at

which to run the economy. Context was provided by Keynesian theory devoid of a full employment

equilibrium and containing its mainly forgotten, but still relevant, microeconomic underpinnings.

A major input came with the estimates provided by the original Phillips curve. The debate seemed

to be rendered obsolete by the curve's expectations-augmented version with its natural rate of

unemployment, and associated unique equilibrium GDP, as the only values consistent with stable

inflation. The current behavior of economies with the successful inflation targeting is inconsistent

with this natural-rate view, but is consistent with evolutionary theory in which economies have

a wide range of GDP-compatible stable inflation. Now the early post-WWII debates are seen not

to be as misguided as they appeared to be when economists came to accept the assumptions implicit

in the expectations-augmented Phillips curve.

Publication of Lipsey's article nicely coincides with Roger Farmer's new book

Prosperity for All which I discussed in my

previous

post . A key point that Roger makes is that the assumption of a unique equilibrium which underlies

modern macroeconomics and the vertical long-run Phillips Curve is neither theoretically compelling

nor consistent with the empirical evidence. Lipsey's article powerfully reinforces those arguments.

Access to Lipsey's article is gated on the JHET website, so in addition to the abstract, I will quote

the introduction and a couple of paragraphs from the conclusion.

One important early post-WWII debate, which took place particularly in the UK, concerned

the demand and inflationary pressures at which it was best to run the economy. The context for

this debate was provided by early Keynesian theory with its absence of a unique full-employment

equilibrium and its mainly forgotten, but still relevant, microeconomic underpinnings. The original

Phillips Curve was highly relevant to this debate.

All this changed, however, with the introduction of the expectations-augmented version

of the curve with its natural rate of unemployment, and associated unique equilibrium GDP, as

the only values consistent with a stable inflation rate. This new view of the economy found easy

acceptance partly because most economists seem to feel deeply in their guts - and their training

predisposes them to do so - that the economy must have a unique equilibrium to which market forces

inevitably propel it, even if the approach is sometimes, as some believe, painfully slow.

The current behavior of economies with successful inflation targeting is inconsistent with

the existence of a unique non-accelerating-inflation rate of unemployment (NAIRU) but is consistent

with evolutionary theory in which the economy is constantly evolving in the face of path-dependent,

endogenously generated, technological change, and has a wide range of unemployment and GDP over

which the inflation rate is stable. This view explains what otherwise seems mysterious in the

recent experience of many economies and makes the early post-WWII debates not seem as silly as

they appeared to be when economists came to accept the assumption of a perfectly inelastic, long-run

Phillips curve located at the unique equilibrium level of unemployment. One thing that stands

in the way of accepting this view, however, the tyranny of the generally accepted assumption of

a unique, self-sustaining macroeconomic equilibrium.

This paper covers some of the key events in the theory concerning, and the experience of, the

economy's behavior with respect to inflation and unemployment over the post-WWII period. The stage

is set by the pressure-of-demand debate in the 1950s and the place that the simple Phillips curve

came to play in it. The action begins with the introduction of the expectations-augmented Phillips

curve and the acceptance by most Keynesians of its implication of a unique, self-sustaining macro

equilibrium. This view seemed not inconsistent with the facts of inflation and unemployment until

the mid-1990s, when the successful adoption of inflation targeting made it inconsistent with the

facts. An alternative view is proposed, on that is capable of explaining current macro behavior

and reinstates the relevance of the early pressure-of-demand debate. (pp. 415-16).

In reviewing the evidence that stable inflation is consistent with a range of unemployment rates,

Lipsey generalizes the concept of a unique NAIRU to a non-accelerating-inflation band of unemployment

(NAIBU) within which multiple rates of unemployment are consistent with a basically stable expected

rate of inflation. In an interesting footnote, Lipsey addresses a possible argument against the relevance

of the empirical evidence for policy makers based on the Lucas critique.

Some might raise the Lucas critique here, arguing that one finds the NAIBU in the data because

policymakers are credibly concerned only with inflation. As soon as policymakers made use of the

NAIBU, the whole unemployment-inflation relation that has been seen since the mid-1990s might

change or break. For example, unions, particularly in the European Union, where they are typically

more powerful than in North America, might alter their behavior once they became aware that the

central bank was actually targeting employment levels directly and appeared to have the power

to do so. If so, the Bank would have to establish that its priorities were lexicographically ordered

with control of inflation paramount so that any level-of-activity target would be quickly dropped

whenever inflation threatened to go outside of the target bands. (pp. 426-27)

I would just mention in this context that in

this 2013

post about the Lucas critique, I pointed out that in the paper in which Lucas articulated his

critique, he assumed that the only possible source of disequilibrium was a mistake in expected inflation.

If everything else is working well, causing inflation expectations to be incorrect will make things

worse. But if there are other sources of disequilibrium, it is not clear that incorrect inflation

expectations will make things worse; they could make things better. That is a point that Lipsey and

Kelvin Lancaster taught the profession in a

classic

article "The General Theory of Second Best," 20 years before Lucas published his

critique

of econometric policy evaluation.

I conclude by quoting Lipsey's penultimate paragraph (the final paragraph being a quote from Lipsey's

paper on the Phillips Curve from the Blaug and Lloyd volume Famous Figures and Diagrams in Economics

which I quoted in full in my 2013 post.

So we seem to have gone full circle from the early Keynesian view in which there was no unique

level of GDP to which the economy was inevitably drawn, through a simple Phillips curve with its

implied trade-off, to an expectations-augmented Phillips curve (or any of its more modern equivalents)

with its associated unique level of GDP, and finally back to the early Keynesian view in which

policymakers had an option as to the average pressure of aggregate demand at which economic activity

could be sustained.

However, the modern debated about whether to aim for [the high or low range of stable unemployment

rates] is not a debate about inflation versus growth, as it was in the 1950s, but between those

who would risk an occasional rise of inflation above the target band as the price of getting unemployment

as low as possible and those who would risk letting unemployment fall below that indicated by

the lower boundary of the NAIBU as the price of never risking an acceleration of inflation above

the target rate. (p. 427)

Edward Lambert

,

August 26, 2013 at 12:57 am

Great article!!! The drum beat continues Productivity is definitely constrained by tight consumer

liquidity from weak labor compensation.

Economists are going to learn a big lesson, when they see unemployment get stuck above 6.7%. They

will try to explain it by pointing to problems in the economy or government. But the dynamic to

limit employment is already established and it is due to low labor share. My calculations say

the limit is 7.0% but I am allowing some margin of error.

The next two years should certainly be enlightening for many economists, including Krugman,

Delong and Thoma. They do not see the effective demand limit coming.

diptherio

,

August 26, 2013 at 9:22 am

Never underestimate an [neoliberal] economist's ability to ignore reality.

Impishparrot ,

August 26, 2013 at 1:08 am

Hello? All talk of policy and regulations have left-out the workers. They make shit and they

buy shit. Without them, how would multi-national corporations be able to afford the lawyers, lobbyists,

members of Congress – both House and Senate, and it would now appear, members of the US Supreme

Court.

Min ,

August 26, 2013 at 3:21 am

"Higher real wage claims necessarily reduce firms' profitability and hence, if firms want to

protect profits (needed for investment and growth), higher wages must lead to higher prices and

ultimately run-away inflation. The only way to stop this process is to have an increase in "natural

unemployment", which curbs workers' wage claims.

"What is missing from this NAIRU thinking is that wages provide macroeconomic benefits in terms

of higher labour productivity growth and more rapid technological progress."

True. But that aside, the original argument is a non-sequitur. Certainly, a fight between labor

and capital over how to share the economic pie can lead to inflation, but it does not follow that

full employment leads to accelerating inflation instead of converging inflation or fairly constant

inflation. The NAIRU argument takes the behavior of capital as given and puts the onus of responsibility

on labor. It amounts to special pleading.

BTW, it is not unusual in human systems to have conflicts that threaten to become a runaway

feedback cycle. But somehow that rarely happens, for reasons that are not always clear. We still

do not understand human systems all that well.

nonclassical ,

August 26, 2013 at 12:48 pm

..Greenspan's (therefore Rand "goddess") ideological position is based upon equal access and

most especially information to markets this "equality" is undone by secrecy, insider trading,

HFT, etc, etc.

In other words, it's all ideological-never existed, anywhere, any time, in reality..

Hugh ,

August 26, 2013 at 4:20 am

In a kleptocracy, looters are not called looters. That might cause the serfs to rebel.

So they are called "creators" instead, and their stolen loot becomes the just and righteous reward

for their work. Indeed it is the manifestation of natural law without which society and the economy

would fall into darkness, etc., etc.

"Greenspan's stance reflected the conventional wisdom , codified in the theory of

the non-accelerating-inflation rate of unemployment (NAIRU). It must take the blame for unleashing

and at the same time legitimizing a vastly unequal and ultimately unsustainable growth process."

NAIRU is not to blame but the looters who espoused it. They are afterall the crafters of

the conventional wisdom. There were no mistakes. As looting-enabling propaganda, NAIRU functioned

exactly as it was supposed to.

"firms want to protect profits (needed for investment and growth)"

No. Firms are inanimate. They do not want anything. Nor is it the case that their managements

want to protect their profits for the purpose of investment and growth. In a kleptocracy, management

wishes not just to keep but increase profits in order to loot them.

The authors of this article, like those they criticize, leave out the social purposes for why

we have an economy and why we allow corporations to exist. Both look on the economy as a natural

process governed by natural laws (that is what this article is about: which laws best describe

the economy), and not the human enterprise it is. The real measure of the economy is whether it

is producing the society we want to live in. Classical measures, such as growth and productivity,

may be irrelevant or even at odds with this construction.

from Mexico ,

August 26, 2013 at 7:23 am

Hugh said:

NAIRU is not to blame but the looters who espoused it. They are afterall the crafters of

the conventional wisdom. There were no mistakes. As looting-enabling propaganda, NAIRU functioned

exactly as it was supposed to.

Exactly!

NAIRU is the perfect example of purpose-driven science, and Milton Friedman et al and NAIRU

rank right up there with the German racial scientists and eugenics and social Darwinism when it

comes to justifying pure evil.

David Lentini

,

August 26, 2013 at 10:06 am

I isn't fair to call NAIRU "science", since it, like economics, isn't scientific in any way.

Science has enough problems without having to take on charlatans like Friedman.

Friedman's work, as exemplified by NAIRU, is pseudo-science used to justify the demands of

the industrtialists and financiers to remove governmental economic regulation. It's an example

of what I like to call "Laissez-Faire

Lysenkoism ", after the

infamous Soviet agronomist who rigged his experiments and data to demonstrate that communism had

a biological basis.

I agree very much with the article's analysis and conclusions. But I want to add two things:

1. The idea that there really is no "Gault" in a modern economy is not new. J.K. Galbraith

described the inherent interdependence between management and workers in his book The New Industrial

State in which he coined the term "technostructure" to describe how modern industry no longer

could realistically claim to run by a single person. Instead, the rise of scientific and business

specialties made nearly all employees of a business vital. No one, especially the CEO, could really

claim to all the profits.

2. I think the question of economic performance is too narrow. The real issue ultimately is

power. At some point, wealth will become so concentrated that the rich won't care about economic

performance; they'll just make vassals and slaves of the rest of us. At some point money per se

will become obsolete, since everything will be owned by a few anyway.

Massinissa ,

August 26, 2013 at 10:22 am

On number 2, I don't remember Feudalists ever worrying about economic growth, except when it

came to how much grain they could extract from their serfs.

It doesn't matter all that much to the ruling classes how much growth there is or not as long

as they control all that there is.

If low growth means easier control, then they will prefer that. Though I must say im not sure

that low growth does mean easier control.

Doug Terpstra ,

August 26, 2013 at 4:43 pm

Dave's close, but you got it! Neoliberal economics is not interested in a dynamic economy,

in optimum output, or in aggregate wealth-creation, and most certainly not in shared prosperity

(egad!). It is only relative wealth that concerns our neoliberal elite.

Relative wealth is the key to power and concentrated wealth to absolute power, the holy

grail. Thus inequality is not an unintended consequence at all; it's the neolibs' actual goal,

a feature not a bug. Power is their ultimate narcotic. And their pursuit of it is relentless and

violent.

I believe this is the elemental nature of our criminal elite that people must understand,

first and foremost, before change is remotely possible. Unfortunately it's difficult for sane

people to comprehend such madness, and they continue to believe people like Obama have a conscience,

that Congress really seeks the greater good, that our warriors really want to avoid war. They

can no more relate to people like Jamie Dimon, Lloyd Blankfien, or Benjamin Shalom than they can

to a pedophile or a rapist. They have no common reference with the enemies of humanity.

David Lentini

,

August 26, 2013 at 5:16 pm

Feudalism wasn't concerned with economic growth and performance. Those ideas came with

the Enlightenment and the Modern eras, and the end of monarchy. My point was to use "vassal" in

the sense of someone who owe allegiance to a master but is not a slave.

As for the other points you made, I was trying make those too: At some point the inequality

makes modern economics irrelevant.

from Mexico ,

August 26, 2013 at 10:37 am

David Lentini says:

I isn't fair to call NAIRU "science", since it, like economics, isn't scientific in any

way.

No true Scotsman, hun?

I think the indictment of science is far broader than mere economics.

from Mexico ,

August 26, 2013 at 10:46 am

And by the way, who gets to decide what is science and what is pseudo-science? How does the

layman tell the difference?

David Lentini

,

August 26, 2013 at 11:28 am

I'll assume that you're not just baiting me. Or are you taking the side of the climate-change

deniers? Try starting with the basic definitions:

http://en.wikipedia.org/wiki/Science

You can also take the time to read the classics of Bacon, Descartes, Newton, et al.

A succinct definition of "science" is not that easy. But I argue that scientific statements

at the least have to be robust-they have to be capable of reliable confirmation i.e., identical

conditions should lead to the same observations, in other words "predictability" (Popper's "falsification"

is a useful rule of thumb); a new theory should be able to explain or describe all relevant phenomena

described by older theories as well as new phenomena to maintain unified explanation.

As I've argued many times on this 'blog, economics fails both tests. Instead economists offer

statements that ape scientific forms, what I call "pseudo-science". They do this out of ignorance

and a desire to cow the public (including scientists).

And we're all entitled to review the facts and make our judgment in light of the definitions

and uses of the term "science".

I don't see your point in attacking science, which you of course never define. I believe that

humanity needs a view of life that is far broader than provided by science alone. But the scientific

view is still vital to our lives. The problem is that far too many have become mesmerized by the

usefulness of science in addressing certain types of questions, and have been trying to force

their own investigations into a scientific mold rather than admitting that the scientific method

cannot address all questions equally well.

from Mexico ,

August 26, 2013 at 3:52 pm

Well for me, the question is still who gets to decide what is science and what is pseudo-science?

- Is it the guy with the most money?

- The guy with the biggest printing press or soap box?

- The guy with the most political power?

- The Nobel Prize committee?

- University professors?

- The person with the most publications?

- The most prestigious and renowned scientist?

The school of hard knocks has taught us that none of the above are trustworthy or reliable.

The historian of science Naomi Oreskes gives a great talk about this phenomenon here:

http://www.blogtalkradio.com/virtuallyspeaking/2012/04/12/naomi-oreskes-tom-levenson-virtually-speaking-science-1

This means that one is therefore forced back onto their own lights.

Which brings us back to the question: How does the layperson tell the difference between science

and pseudoscience? I don't know many laypersons who have read Bacon, Newton or Descartes.

And what if they've read Hume, Kant or Nietzsche? Then they come away with a very different

idea of what science is. For example:

Thus, though metaphysics is an illusion from the point of view of science, science in turn

becomes but another state of illusion as far as absolute truth is concerned. In The Birth

of Tragedy Nietzche already attacks the scientific optimism of his time under the guise

of "Socratism." The "theoretic man" pursues truth in the delusion that reality can be fathomed,

and even purged of evil, by rational thought and its applications. But faith in the omnipotence

of reason shatters, for the courageously persistent thinker, not only on the fact that science

can never complete its work but chiefly on the positive apprehension that reality is irrational.

As Nietzsche writes later, "We are illogical and therefore unjust beings from the first,

and can know this : that is one of the greatest and most insoluble disharmonies of existence."

–GEORGE A. MORGAN, What Nietzsche Means

David Lentini

,

August 26, 2013 at 5:24 pm

Mexico, I already answered that question. I really don't care what Naiomi Oreskes thinks; I

think for myself. And I don't have much patience for people who won't make the effort to learn

enough about science to answer the question for themselves.

There's a world of difference between Oreskes's writings about the abuse of science to further

partisan political positions, and the meaning of science itself and deciding what qualifies as

science. Just make the effort to learn and stop quoting everyone else.

As for your quote about Nietzsche, all this argument leaves is the usual relativistic confusion.

And that just invites abuse. Science and the scientific method can be defined well enough to distinguish

reliable claims from charaltanism. If you want absolutes, you might just as well accept what the

most powerful tell you to accept.

from Mexico ,

August 26, 2013 at 8:39 pm

Oh I get it!

You get to decide what science is and what pseudo-science is.

It's like Humpty Dumpty said:

'I don't know what you mean by "glory",' Alice said.

Humpty Dumpty smiled contemptuously. 'Of course you don't - till I tell you. I meant "there's

a nice knock-down argument for you!"'

'But "glory" doesn't mean "a nice knock-down argument",' Alice objected.

'When I use a word,' Humpty Dumpty said, in rather a scornful tone, 'it means just what

I choose it to mean - neither more nor less.'

'The question is,' said Alice, 'whether you can make words mean so many different things.'

'The question is,' said Humpty Dumpty, 'which is to be master - that's all.'

–LEWIS CARROL, Through the Looking Glass

OldFatGuy ,

August 27, 2013 at 12:10 pm

Yes, someone does get to decide. Because there ARE universal truths, like it or not.

For example, the world is not flat. Period. All the relativism in the world won't change the

fact that the world is NOT flat.

Arguing against fact doesn't make one some sort of relativist intellectual (is that a term??)

it makes one WRONG. And the only way humanity can ever transcend chaos is to acknowledge those

truths that are universal. We, as a species, are still nowhere near there, and it's like trying

to play a baseball game with no foul lines, basees, umpires, or even a ball. Yes, if life were

like a baseball game there are entire groups of people today that argue it can be played without

a ball. We'll never get beyond this chaos and into a peaceful order until we all get on more or

less the same playing field, and the only way to do that is to acknowledge truths (or rules, like

foul lines, in baseball).

Science is but one avenue to identify those truths. There are others.

David Lentini

,

August 26, 2013 at 11:06 am

Mexico, you made the claim that NAIRU was "purpose-driven science". I countered with the

point that NAIRU was pseudo-science and that economics is not a science. Neither statement has

anything to do with indicting science.

If you argue about flaws in science, whatever that means,n then start a new thread.

Hugh ,

August 26, 2013 at 2:59 pm

Science is a method, but what that method is applied to and how its results are interpreted

are not. Science is also a human activity and so must be viewed through the lens of our humanity,

not as objective truth external to us.

allcoppedout ,

August 26, 2013 at 4:33 am

Lord save us! Humans are biological systems and such systems have all kinds of modularity to

protect various sub-systems and the overall system from collapse.

So where is a modular economics?

Growth? What's that? A sensible, scientific notion of it would be a system that raises everyone

a lot, curtails rich by-products that capture politics and load the many with economic rents,

educates to planet level responsibility, reduces work and squalid energy burning and related wars

We should be seeking stability and incorporating real well-being and a new understanding of

growth. Growth as we have it is a Gucci handbag while others live on a squalid jack tuna boat

earning almost nothing for your fish, eaten with a fancy T-shirt on proclaiming 'save the dolphins',

served with salad picked by migrant workers to keep your figure trim along with the coke you snort.

What growth should be one of the first questions of economics, followed by how we might create

a modular financing of what we should be doing. Without such, no subject.

Aussie F ,

August 26, 2013 at 7:33 am

In reality all the dynamism is in the state sector – from the internet, to superconductors,

pharmaceuticals, biotechnology, containerisation. 'The market' just deals with copyright and marketing.

diptherio

,

August 26, 2013 at 9:30 am

Does this mean it's time to stop wearing my NAIRU jacket?

David Lentini

,

August 26, 2013 at 11:31 am

Only if it's a NAIRU straight jacket. :-)

libezkova -> pgl...,

February 18, 2017 at 05:34 PM

pgl,

This is all about mathiness and corruption of neoliberal economist, which is a real Fifth Column

of financial oligarchy no question about it. With unemployment measures irrevocably corrupted

by political pressures, how one can be talk about validity of derivatives based on them, unless

he/she is drunk ?

In this sense NAIRU is yet another sophisticated neoliberal fake that help to drive the public

policy in the interests of financial oligarchy under mathiness smoke screen and a bunch of corrupt

neoliberal economics serving as a propagandist army of financial oligarchy.

It's time to revamp the old quote changing it to " When I hear the term NAURU...I reach for

my gun!."

If course it would be too cruel to shoot all neoliberal economists, so reeducation camps should

probably be considered.

I think only U6 has some connections to reality. And the discrepancy between official and Gallup

value of U6 is 4%

In other words only the first digit is probably valid and the range is 10 to 20%.

== quote ==

For January 2016 the official Current U-6 unemployment rate was 10.1% up from last month's 9.1%.

On the other hand the independently produced Gallup equivalent called the "Underemployment Rate"

was 14.1% up from 13.7 in December and 13.0% in November. The current differential between Gallup

and BLS on supposedly the same data is 4.0%!

marcus nunes : ,

February 17, 2017 at 12:44 PM

Alternative "NAIRU bashing":

https://thefaintofheart.wordpress.com/2015/02/14/why-insist-on-searching-for-the-holy-grail-aka-nairu/

RGC : ,

February 17, 2017 at 04:11 PM

SWL is becoming aggressively neoliberal. There is no sound theoretical basis for NAIRU and no

empirical reinforcement:

Time to Ditch the NAIRU

James K. Galbraith

The Journal of Economic Perspectives, Vol. 11, No. 1. (Winter, 1997), pp. 93-108

http://tek.bke.hu/files/szovegek/galbraith_time_to_ditch_the_nairu.pdf

pgl -> RGC... ,

February 17, 2017 at 04:37 PM

SWL strikes me as someone who goes well beyond the usual neoliberal laziness. Is that what you

mean by "aggressive"?

RGC -> pgl... ,

February 17, 2017 at 04:45 PM

In reading his blog lately it seemed that he was very defensive about his economics and also angry

at the Corbyn wing of Labour.

marcus nunes : ,

February 17, 2017 at 12:41 PM

"How do we link the real economy to inflation"? NAIRU a waste of time. Try aggregate nominal spending

growth

http://ngdp-advisers.com/2017/02/08/fantasy-world-conventional-central-bankers-money-no-role/

libezkova : ,

February 18, 2017 at 06:17 PM

Sorry Anne, but neoliberal economists are really prostitutes of Financial oligarchy. Well paid,

of course.

That's where NAIRU comes from. Phillips curve is a joke and always was. It's king of sad that

it still mentioned in in non--humorous context:

https://thefaintofheart.wordpress.com/2012/07/20/seven-years-on-things-still-look-the-same/

The NAIRU essentially presupposes the existence of the wage-price spiral. Which can happen

only if wages are either indexed to inflation by law, or there are strong trade unions to defend

workers rights. Under neoliberalism both are those factors are suppressed and can be viewed as

non-existent.

And the statement that the NAIRU myth belongs to the vocabulary of charlatans does not deviate

from the serious character of the discussion. This is just a historical truth.

Hot of the presses: "Debunking the NAIRU myth" January 19, 2017 By Matthew C Klein

https://ftalphaville.ft.com/2017/01/19/2182705/debunking-the-nairu-myth/

== quote ==

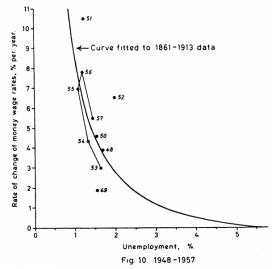

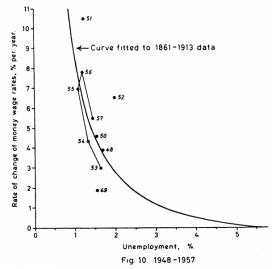

First, some history. In 1926, Irving Fisher found a relationship between the level of unemployment

and the rate of consumer price inflation in the US. In 1958, AW Phillips studied UK data from

1861-1957 and found a relationship between the jobless rate and the growth of nominal wages, although

the relationship seems to have been an artifact of the gold standard given the vertical line he

found in the postwar period:

Some people (wrongly) interpreted Phillips's data to mean that there was a straightforward

trade-off between the inflation rate and the unemployment rate. Policymakers could just pick any

spot on "the Phillips Curve" they want. Among a certain set, the big debates in the 1960s were

about whether the government should target an unemployment rate of 3 per cent or 5 per cent.

This worked out poorly, but the reaction took the form of an equally dubious idea: the Non-Accelerating

Inflation Rate of Unemployment, or NAIRU. In this view, the change in the inflation rate should

be related to the distance between the actual jobless rate and some theoretical level. If the

unemployment rate were above this "neutral" level the inflation rate would slow down and potentially

turn into outright deflation. If the jobless rate were "too low", however, consumer prices would

rise at an accelerating rate.

Suppose you believe NAIRU is a real thing. What would be the argument against pushing the unemployment

rate as close to zero as possible? In theory, the cost of the policy would be ever-accelerating

inflation, eventually perhaps leading to hyperinflation. But the reason to dislike excessive inflation

is that it ultimately makes everyone poorer, which should, among other things, increase unemployment.

(Just look at Venezuela, for a recent example.)

According to the wacky world of NAIRU, however, hyperinflation can coexist just fine with hyper-employment.

Clearly there must be other mechanisms at work, or else we are leaving money on the table by allowing

the jobless rate to ever rise above zero.

== end of quote ==

Some comments are interesting too:

grputland, Jan 22, 2017

To test the NAIRU hypothesis against historical data, shouldn't we plot unemployment vs. change

in inflation? -- instead of CHANGE in unemployment vs. change in inflation?

Be that as it may:

If there is such a thing as a NAIRU, it is still a mistake to treat the NAIRU as a "given"

rather than a function of policy.

If a certain tax feeds into prices, it leaves less room for wages to feed into prices before

(according to NAIRU logic) inflation accelerates. So any tax that feeds into prices will tend

to raise the NAIRU. This is especially the case if the tax causes the cost of labor for employers

to be higher than workers' take-home pay.

Thus the NAIRU, if it exists, is not a counsel of despair, but rather a counsel to get rid

of taxes that feed into prices (especially taxes on labor) and replace them, as far as necessary,

with taxes that DON'T feed into prices -- that is, taxes on economic rents.

marcus nunes , Jan 20, 2017

NAIRU - RIP

https://thefaintofheart.wordpress.com/2015/02/14/why-insist-on-searching-for-the-holy-grail-aka-nairu/

Contrapunctus9, Jan 20, 2017

Many variables contribute to the inflation rate, certainly more than just domestic employment

(and how it is calculated). The Fed's dual mandate is inflation and employment, so it makes sense

that these are a focus of the Fed's communication. But the Fed tends to focus on the result rather

than the cause. It is troubling that there is little discussion from most of the FOMC on inflation

factors which are now more important than unemployment (currency values, foreign labor, technology,

commodity demand and speculation, labor monopsony, underemployment, labor skill demand mismatch,

etc).

Producer and consumer prices are increasing, largely due to China driven commodity prices.

Managerial compensation and production hourly wages are increasing. But weekly wages are stagnant

due to fewer hours. The Fed is ignoring the latter, even though it is what is more important to

sustained core inflation.

Observer, Jan 19, 2017

Looking just at the U3 unemployment rate for the NAIRU without considering the still high U6

rate and lower labour participation rate in the US may be the issue. There's still labour market

slack even though U3 is at its "full" employment level.

grumpy, Jan 19, 2017

Models have to be used with caution (they are only tools) and interpreted with awareness of

the real world - including for example, the varying wage bargaining power of labour, which is

different, post globalisation, to what it was in the '70s.

Who do you think wanted globalisation and liberalisation of trade, and why?

Many economists revere their models excessively.

By: Matthew C

Klein

It's important to try to estimate the unemployment rate that is equivalent to maximum employment

because persistently operating below it pushes inflation higher, which brings me to our price

stability mandate. –Janet Yellen,

January 18, 2017

A little more than half the income generated in America is paid to workers and most of the money

spent in America goes to personal consumption. So it's reasonable to think there is some relationship

between the health of the job market and other important macro variables.

And, in fact, there is a robust connection between the change in the unemployment rate

and the change in the real value of money spent on employee compensation per working-age American

since the mid-1980s:

That chart shows the link between two real variables that have a logical connection to each other.

The question for NAIRU believers is: why should a purely real variable (unemployment) have any bearing

on a purely nominal one (inflation)?

In particular, is it reasonable to think there is an unemployment rate below which inflation necessarily

gets faster and above which the pace of consumer price increases slows down? And even if there were

such an unemployment rate at any point in time, would it be stable enough to be useful for policymakers

concerned with smoothing the business cycle?

Many, including Federal Reserve boss Janet Yellen, seem to think the answer is "yes", but the

evidence points the other way, particularly since the mid-1980s.

First, some history. In 1926, Irving Fisher

found

a relationship between the level of unemployment and the rate of consumer price inflation in

the US. In 1958, AW Phillips studied UK data from 1861-1957 and

found a relationship

between the jobless rate and the growth of nominal wages, although the relationship seems to

have been an artifact of the gold standard given the vertical line he found in the postwar period:

Some people (wrongly) interpreted Phillips's data to mean that there was a straightforward trade-off

between the inflation rate and the unemployment rate. Policymakers could just pick any spot on "the

Phillips Curve" they want. Among a certain set, the big debates in the 1960s were about whether the

government should target an unemployment rate of 3 per cent or 5 per cent.

This worked out poorly, but the reaction took the form of an equally dubious idea: the Non-Accelerating

Inflation Rate of Unemployment, or NAIRU. In this view, the change in the inflation rate

should be related to the distance between the actual jobless rate and some theoretical level. If

the unemployment rate were above this "neutral" level the inflation rate would slow down and potentially

turn into outright

deflation . If the jobless rate were "too low", however, consumer prices would rise at an accelerating

rate.

Suppose you believe NAIRU is a real thing. What would be the argument against pushing the unemployment

rate as close to zero as possible? In theory, the cost of the policy would be ever-accelerating inflation,

eventually perhaps leading to hyperinflation. But the reason to dislike excessive inflation is that

it ultimately makes everyone poorer, which should, among other things, increase unemployment. (Just

look at Venezuela, for a recent example.)

According to the wacky world of NAIRU, however, hyperinflation can coexist just fine with hyper-employment.

Clearly there must be other mechanisms at work, or else we are leaving money on the table by allowing

the jobless rate to ever rise above zero.

In case this argument seems strange, consider the following exchange the Fed had on this very

topic back in

July 1994 (emphasis added):

MR. LINDSEY. If we ran the model out, do we believe that if we applied some social rate of

discount, the losses in output later on would be more than, less than, or equal to the gains in

output in the short run [from letting inflation accelerate]?

MR. KOHN. The model itself doesn't have, I don't believe, losses in output from higher inflation

rates.

MR. LINDSEY. Ever? We never have a net loss in output resulting from a choice to go for inflation?

MR. PRELL. It does not take, in terms of a normal simple cost of capital calculation, a very

big inflation differential to get you a net loss in the present value in the long run.

CHAIRMAN GREENSPAN. The argument as to why we get a net loss is "the Federal Reserve will react–do

something." But the question is, we are the Federal Reserve and why should we react if that's

true?

MR. LINDSEY. If we don't believe that the present value of output in this economy will be lower

by letting inflation alone, then we should let inflation go up. It's as simple as that Do we believe

that printing money will increase the present value of output?

MR. BLINDER. Yes, I think we would. I believe that printing money will give the economy a temporary

high that will not last and therefore in the integral sense that you said, yes, you get a larger

integral of output over an historical period, if you never decided to end it–if you never said,

when you got to 10 percent inflation, whoops, that wasn't very good, and you went back to lower

inflation.

CHAIRMAN GREENSPAN. Yes, but why would you conclude that at that point when, because as Ed

Boehne says, 11 percent is still better?

MR. BLINDER. If 11 percent is better than 10 percent, if there's no cost to inflation–I am

a little bit surprised at the tenor of this conversation around here! [Laughter] There is some

academic content that is–

CHAIRMAN GREENSPAN. In all seriousness, the question really gets to the models. Why would you

believe that there is a cost of increased inflation from the models?

Greenspan never got a straight answer to his question but the consensus was that models based

on NAIRU are basically wrong. Tellingly, it was

none other than Janet Yellen who wrongly worried the unemployment rate was "too low" in the mid-to-late

1990s and would cause inflation to accelerate.

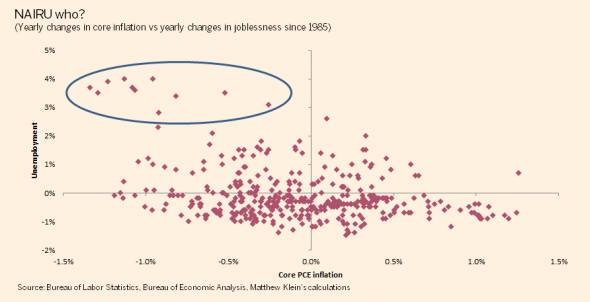

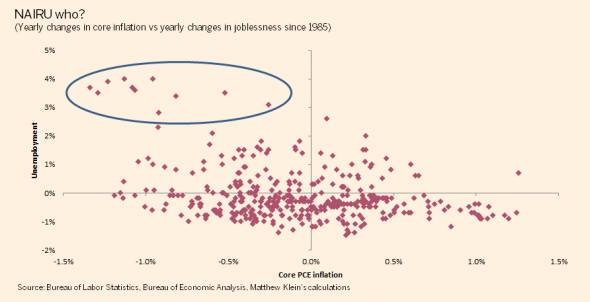

As it happens, the data don't support the idea of NAIRU either, at least not since the mid-1980s.

The test would be to compare changes in the unemployment rate against changes in the inflation rate.

If NAIRU made sense, there should be a strong inverse relationship between the changes in the two

series. And yet:

Regressing changes in core inflation against changes in the jobless rate gets you an r-squared

of 0.11, which is basically meaningless. Moreover, that result is purely a product of the data points

in the blue circle, which all occurred during the teeth of the financial crisis and could be blamed

on the co-movement of employment and commodity prices. Take those out, and you end up with two perfectly

unrelated series:

You get similar results if you use headline inflation rather than core inflation.

The intellectual confusion over the relationship between unemployment and inflation was especially

salient during the Fed's own policy debates in the aftermath of the crisis. The unemployment rate

rose by 5 percentage points between mid-1979 and late 1982. It also rose by 5 percentage points between

early 2008 and late 2009. Moreover, the jobless rate stayed above 9 per cent through first nine months

of 2011.

The Fed staff expected this would produce massive disinflation, or even deflation, yet it never

happened.

By the

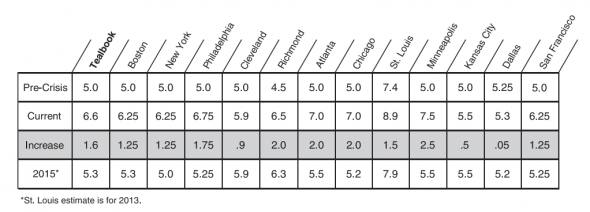

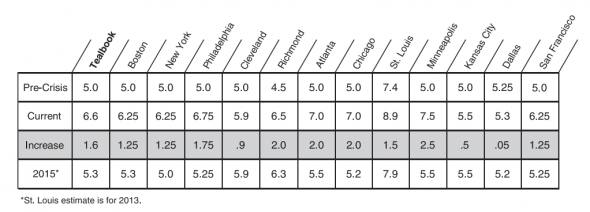

January 2011 FOMC meeting , it should have been clear the old models weren't sufficient. Instead

of ditching the NAIRU concept, however, the Fed's staff and many of the regional presidents tried

to rehabilitate it by arguing the NAIRU had changed. (There were lots of reasons provided, including

the extension of unemployment insurance benefits and skill mismatches.)

With the admirable exception of Richard Fisher at the Federal Reserve Bank of Dallas, the overwhelming

consensus was that the crisis had raised the "non-accelerating inflation rate of unemployment" by

about

1.5 percentage points :

Moreover, everyone except Fisher and the New York Fed's Bill Dudley thought the crisis produced

such long-lasting damage that the NAIRU would still be higher by 2015 (!) than it was before 2007.

In reality, of course, the Fed has been forced to steadily revise its NAIRU estimates lower as the

unemployment rate gradually normalises and inflation remains quiescent. The net effect was this rather

ridiculous chart:

NAIRU isn't just a useless concept, it's a counterproductive one that encourages policymakers

to focus on the jobless rate as a means to an end (price stability) even though there is zero connection

between the two variables. The sooner NAIRU is buried and forgotten, the better.

Policy Tensor, 17 hours ago

Matthew, there's strong evidence that what drives US inflation (and more generally DE inflation)

is not domestic slack but global slack. See

https://policytensor.com/2016/12/17/global-slack-us-inflation-and-the-feds-policy-error/

grputland, Jan 22, 2017

To test the NAIRU hypothesis against historical data, shouldn't we plot unemployment vs. change

in inflation? -- instead of CHANGE in unemployment vs. change in inflation?

Be that as it may:

If there is such a thing as a NAIRU, it is still a mistake to treat the NAIRU as a "given"

rather than a function of policy. If a certain tax feeds into prices, it leaves less room

for wages to feed into prices before (according to NAIRU logic) inflation accelerates. So any

tax that feeds into prices will tend to raise the NAIRU. This is especially the case if the tax

causes the cost of labor for employers to be higher than workers' take-home pay.

Thus the NAIRU, if it exists, is not a counsel of despair, but rather a counsel to get rid

of taxes that feed into prices (especially taxes on labor) and replace them, as far as necessary,

with taxes that DON'T feed into prices -- that is, taxes on economic rents.

Drago Jan 21, 2017

@ Ralph Musgrave So according to Galileo Galilei the earth is a perfect sphere. Great news.

So presumably he believes there's some magical force of nature that keeps us all from falling

into space, and apparently one can travel in a straight line and end up exactly where he departed.

Never read such twaddle.

Ralph Musgrave, Jan 21, 2017

@ Drago

@ Ralph Musgrave Totally daft response to my points - but what I'd expect from the anti-NAIRU

brigade. But for the benefit of the latter cerebrally challenged brigade, I'll spell out what

I mean in more detail. I'd honestly appreciate a detailed and intelligent answer.

NAIRU is the idea that there is a relationship between inflation and unemployment: specifically,

when demand rises and unemployment falls, inflation will at some point also rise (assuming the

rise in demand continues).

Klein & Co claim that NAIRU relationship does not exist. That means, unless I've missed something,

that if unemployment falls and continues to fall, inflation WILL NOT RISE, (because, to repeat,

according to Klein & Co there is no relationship between inflation and unemployment).

Ergo it should be possible to implement a very large rise in demand plus a very large fall

in unemployment, and according to Klein & Co there will be no automatic rise in inflation. Now

what have I missed?

Drago Jan 21, 2017 ;

@ Ralph Musgrave

@ Drago MCK perhaps went too far in saying that there is zero connection between inflation

and unemployment, but the rest of his points stand.

And regarding my previous reply, I was merely alluding to the fact that what is intuitive is

not always what is true.

NeilW@MMT Jan 22, 2017

@ Ralph Musgrave "So presumably he favors bumping up demand to the point where unemployment

almost vanishes"

There won't if you hold the level of competition high and using buying power to stop price

rises taking hold. The key is for a significant purchaser to refuse to trade at any suggested

higher prices which then starves the system of aggregate demand forcing either innovation or failure.

And you do that directly rather than trying to do it indirectly by trying, and failing, to price

loans higher.

In a tight labour market the capital/labour ratio gets better which forces replacement of jobs

with machinery and improved methods. If you can't get the staff you have to get cleverer with

the ones you have.